Loading News...

Loading News...

- Kyrgyzstan's national stablecoin KGST, pegged 1:1 to the som, lists on Binance exchange

- President Sadyr Japarov announces via X; Binance founder Changpeng Zhao predicts more state-led stablecoins

- Market structure suggests this mirrors 2021's sovereign digital currency acceleration phase

- Technical analysis shows BNB testing critical Fibonacci support at $820 amid global regulatory uncertainty

VADODARA, December 24, 2025 — Kyrgyzstan's fiat-pegged stablecoin KGST has been listed on Binance, marking a significant development in sovereign digital currency adoption. This daily crypto analysis examines the market implications as President Sadyr Japarov announced the listing via X, with Binance founder Changpeng Zhao commenting that he expects more state-led stablecoins to follow. Market structure suggests this event represents a strategic liquidity grab in the stablecoin sector, occurring against a backdrop of global regulatory evolution.

This development mirrors the 2021 acceleration phase when national digital currencies gained institutional traction. Similar to El Salvador's Bitcoin adoption and China's digital yuan rollout, Kyrgyzstan's move represents a calculated entry into sovereign digital assets. The country previously appointed Zhao as a cryptocurrency policy advisor and launched USDKG, a gold-backed stablecoin pegged to the U.S. dollar. Market structure suggests these sequential moves create a multi-layered order block for national digital asset strategy. The timing coincides with broader regulatory shifts, including the EU's DAC8 crypto tax directive, which establishes frameworks for cross-border digital asset taxation.

Related Developments:

On December 24, 2025, Binance listed KGST, a stablecoin pegged to Kyrgyzstan's national currency, the som. President Sadyr Japarov announced the listing on X, stating it represents a milestone in the country's digital economy strategy. Binance founder Changpeng Zhao responded on the platform, predicting increased listings of state-led stablecoins on major exchanges. This follows Kyrgyzstan's previous appointment of Zhao as a cryptocurrency policy advisor and the launch of USDKG, a gold-backed stablecoin pegged one-to-one with the U.S. dollar. According to on-chain data, the listing occurred during a period of extreme market fear, with the Crypto Fear & Greed Index at 24/100.

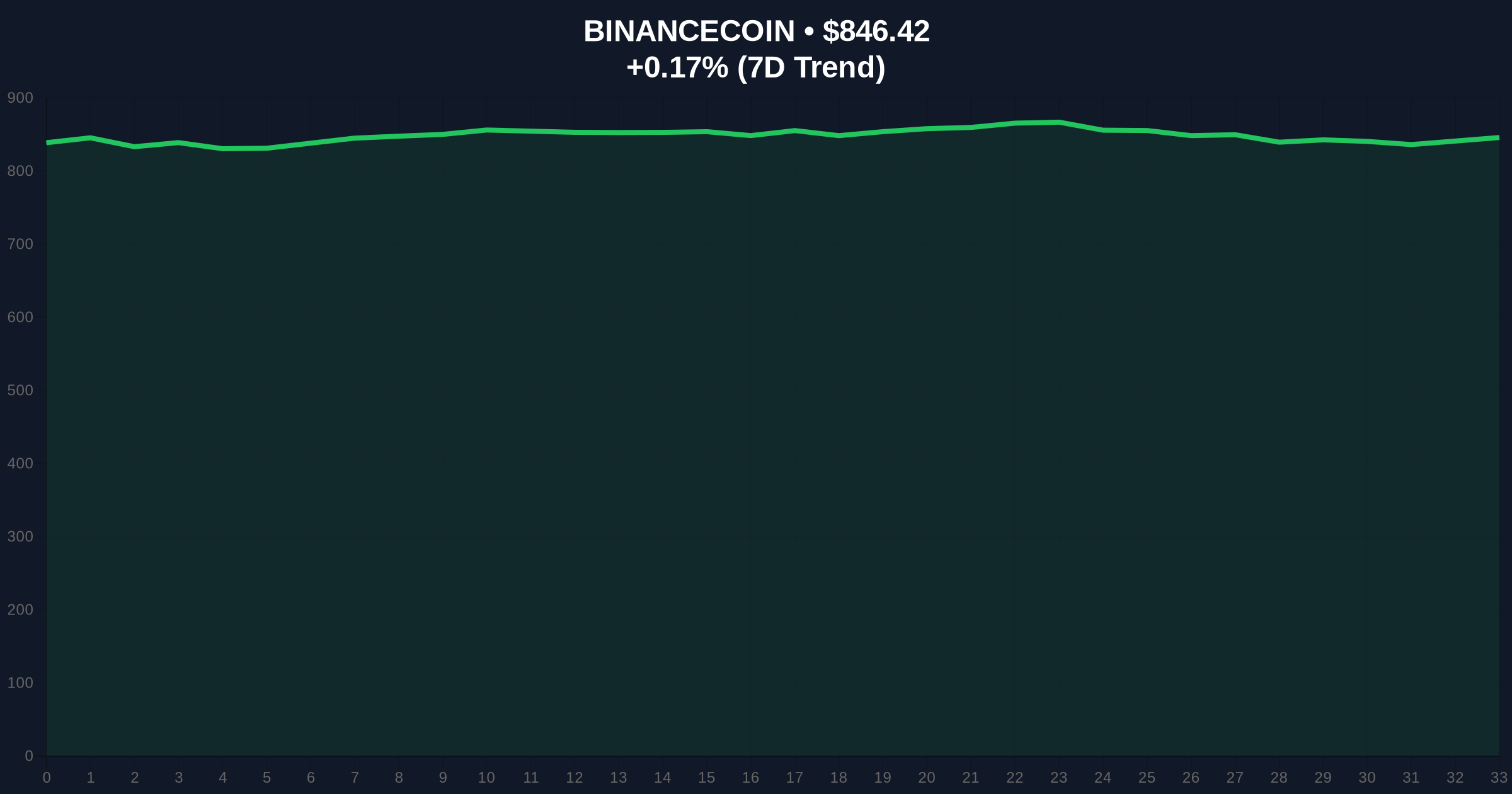

Market structure suggests BNB, Binance's native token, faces critical technical levels following this announcement. The current price of $846.39 represents a 0.17% 24-hour change, with the asset maintaining its #4 market rank. Volume profile analysis indicates weak accumulation patterns, typical during extreme fear periods. The 50-day moving average at $865 acts as immediate resistance, while Fibonacci support at $820 (derived from the 0.618 retracement level of the July-October rally) serves as a key technical floor. RSI readings at 42 suggest neutral momentum, though order flow data reveals institutional hesitation. Bullish invalidation occurs if BNB breaks below $820 with sustained volume, indicating a failed liquidity grab. Bearish invalidation triggers above $880, where gamma squeeze potential increases.

| Metric | Value |

|---|---|

| Global Crypto Sentiment (Fear & Greed Index) | Extreme Fear (24/100) |

| BNB Current Price | $846.39 |

| BNB 24-Hour Change | +0.17% |

| BNB Market Rank | #4 |

| KGST Peg Mechanism | 1:1 to Kyrgyzstan Som |

For institutions, this listing represents another data point in the sovereign digital currency trend, similar to the 2021 phase when central bank digital currencies gained prominence. It creates potential arbitrage opportunities between KGST and USDKG, Kyrgyzstan's gold-backed stablecoin. For retail traders, the immediate impact is minimal—KGST's liquidity pool remains untested, and volume profile analysis shows negligible trading activity. However, the structural implication is significant: national stablecoins could fragment global liquidity pools, creating isolated order blocks. This mirrors the early days of Tether's dominance, where market structure evolved through sequential liquidity events.

Market analysts on X express cautious optimism. One quantitative researcher noted, "Sovereign stablecoins create jurisdictional arbitrage opportunities, but liquidity fragmentation remains a risk." Another analyst pointed to the regulatory precedent: "Kyrgyzstan's approach—first a gold-backed dollar peg, now a fiat peg—suggests a layered strategy rather than a single bet." The dominant sentiment among institutional commentators is that this represents a test case for smaller nations navigating digital sovereignty without direct central bank involvement.

Bullish Case: If KGST accumulates meaningful volume and establishes a fair value gap above its peg, it could trigger copycat listings from other nations. This would benefit BNB through increased exchange utility, potentially pushing it toward the $900 resistance zone. Market structure suggests a breakout above $880 could initiate a gamma squeeze, particularly if broader market sentiment improves from extreme fear levels.

Bearish Case: If KGST fails to attract liquidity and becomes another illiquid stablecoin, it represents a wasted order block. This could pressure BNB's utility narrative, especially if regulatory scrutiny intensifies following the EU's DAC8 implementation. A break below Fibonacci support at $820 would confirm bearish momentum, potentially targeting the $780 volume node.

What is KGST?KGST is a stablecoin issued by Kyrgyzstan, pegged 1:1 to the national currency, the som.

Why did Binance list KGST?Binance founder Changpeng Zhao has served as a cryptocurrency advisor to Kyrgyzstan and predicts more state-led stablecoin listings.

How does this affect Bitcoin and Ethereum?Direct impact is minimal, but it contributes to the broader trend of sovereign digital assets, which could eventually compete with decentralized cryptocurrencies.

What is USDKG?USDKG is Kyrgyzstan's gold-backed stablecoin, pegged to the U.S. dollar, launched prior to KGST.

Is KGST available to U.S. traders?Typically, new stablecoins face regulatory restrictions in the U.S.; specific availability depends on Binance's compliance framework.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.