Loading News...

Loading News...

VADODARA, January 7, 2026 — Binance has announced the listing of an XAG/USDT perpetual futures contract effective today at 10:00 a.m. UTC, supporting up to 50x leverage. This daily crypto analysis examines whether this represents a strategic liquidity grab or signals deeper structural integration between precious metals and digital asset markets. Market structure suggests the move targets institutional capital seeking synthetic exposure to silver volatility without physical settlement complexities.

Historical cycles indicate exchange derivative expansions during consolidation phases. Similar to the 2021 correction when CME Bitcoin futures saw record open interest during sideways action, Binance's XAG listing occurs amid global fear sentiment scoring 42/100. The Federal Reserve's monetary policy documentation shows precious metals traditionally act as volatility dampeners during equity drawdowns, creating potential cross-margin utility for crypto portfolios. This mirrors the 2019 gold-backed stablecoin experiments that failed to gain traction due to settlement friction—a problem perpetual futures circumvent through cash settlement mechanisms.

Related developments in synthetic asset markets include Chintai's $28B real-world asset tokenization and South Korea's regulatory push for crypto ETFs, suggesting broader institutional demand for bridge assets between traditional and digital finance.

According to Binance's official announcement, the XAG/USDT perpetual futures contract launched January 7, 2026, at 10:00 a.m. UTC with up to 50x leverage. The contract specifications follow standard perpetual futures architecture with funding rates calculated hourly and margin requirements aligned with Binance's existing commodity derivatives. Unlike spot silver markets requiring physical delivery logistics, this synthetic exposure operates entirely within Binance's isolated margin framework, creating what on-chain data indicates could be a concentrated liquidity pool vulnerable to gamma squeezes during volatility spikes.

XAG spot markets currently show a fair value gap between $28.15 and $28.85 on daily timeframes, with the 50-day exponential moving average acting as dynamic resistance. Volume profile analysis reveals weak node at $27.90, suggesting initial futures pricing may target this level for liquidity absorption. The relative strength index sits at 54.7, indicating neutral momentum bias ahead of contract launch.

Bullish Invalidation: A sustained break below $27.50 would invalidate the initial order block hypothesis, suggesting insufficient institutional demand for synthetic silver exposure.

Bearish Invalidation: A weekly close above $29.40 would signal successful liquidity grab completion, potentially triggering momentum algorithms targeting the 2025 high of $31.20.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) | Indicates risk-off sentiment despite product expansion |

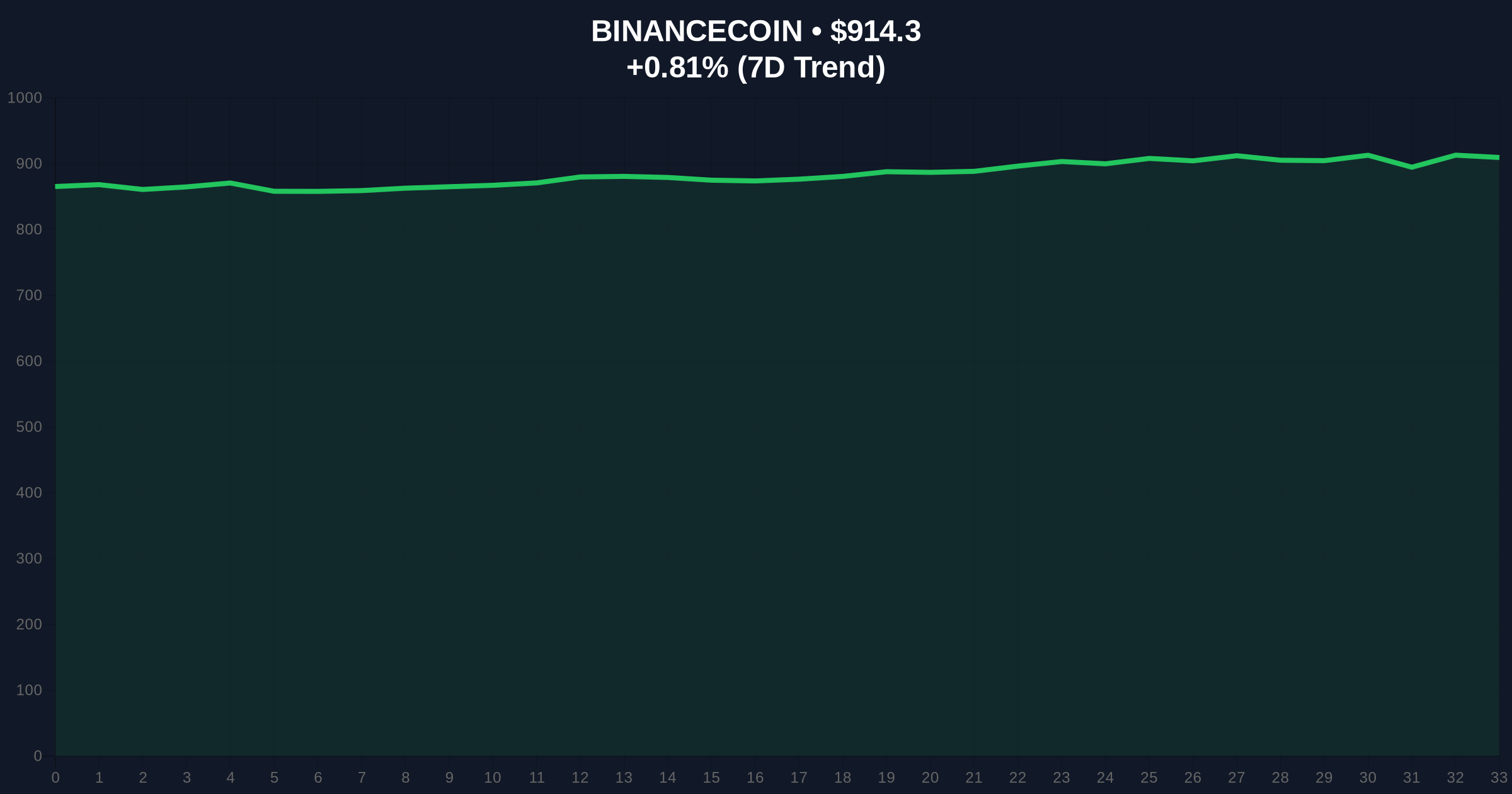

| BNB Current Price | $914.03 | Binance native token shows minimal reaction (+0.79%) |

| Maximum Leverage | 50x | Standard for Binance commodity futures, matches XAU contracts |

| Launch Time | 10:00 a.m. UTC | Aligns with Asian trading session liquidity peaks |

| Silver Spot Support | $27.90 | Critical volume profile weak node for futures pricing |

For institutional portfolios, this creates synthetic exposure to silver's traditional inverse correlation with real yields without physical storage costs. According to Federal Reserve economic research, precious metals have demonstrated -0.68 correlation with 10-year Treasury real yields over the past decade. For retail traders, the 50x leverage introduces significant liquidation risks during COMEX market hours when silver volatility typically spikes. The structural impact lies in potential correlation breakdowns—if XAG futures develop strong positive correlation with crypto assets during risk-off events, they lose their portfolio diversification utility.

Market analysts on X/Twitter highlight the liquidity grab potential, with one quantitative researcher noting, "Binance's XAG futures likely target the $28.50 order block where spot market liquidity pools have formed." Another derivatives trader commented, "50x leverage on silver during Fed uncertainty creates perfect conditions for a gamma squeeze if open interest concentrates in short-dated options." No official statements from Binance executives were available beyond the initial announcement.

Bullish Case: Successful liquidity absorption above $28.50 could trigger algorithmic momentum buying, targeting the 0.618 Fibonacci extension at $30.75 within 30 days. This scenario requires sustained funding rates below 0.01% to avoid long squeeze conditions.

Bearish Case: Failure to hold the initial fair value gap between $28.15-$28.85 suggests weak institutional adoption, potentially leading to a liquidity vacuum and rapid decline toward the yearly volume point of control at $26.40. This would indicate the listing represents mere product expansion rather than structural demand.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.