Loading News...

Loading News...

VADODARA, January 12, 2026 — Binance will list United Stables (U) tomorrow, opening spot trading for U/USDT and U/USDC pairs at 8:00 a.m. UTC. This daily crypto analysis examines the exchange's zero-fee promotion as a tactical liquidity grab during extreme market fear. According to the official announcement, withdrawals will be enabled at 8:00 a.m. UTC on January 14.

Market structure suggests exchange listings during fear cycles often serve as liquidity catalysts. The current Crypto Fear & Greed Index reading of 27/100 indicates capitulation-level sentiment. Binance's timing mirrors historical patterns where major platforms introduce assets to capture order flow when retail participation wanes. This follows a series of strategic listings, including Binance's recent LINK, PEPE, and USDC additions, which were similarly positioned as liquidity events. The broader context includes regulatory pressure, as seen in Korbit's $1.98M AML fine, highlighting compliance risks that exchanges must navigate while expanding offerings.

Binance announced the United Stables (U) listing via official channels. Spot trading for U/USDT and U/USDC pairs begins January 13 at 8:00 a.m. UTC. A zero-fee trading promotion will commemorate the launch. Withdrawals activate January 14 at 8:00 a.m. UTC. The exchange provided no additional technical specifications about U's smart contract or reserve mechanisms, requiring on-chain forensic verification post-launch.

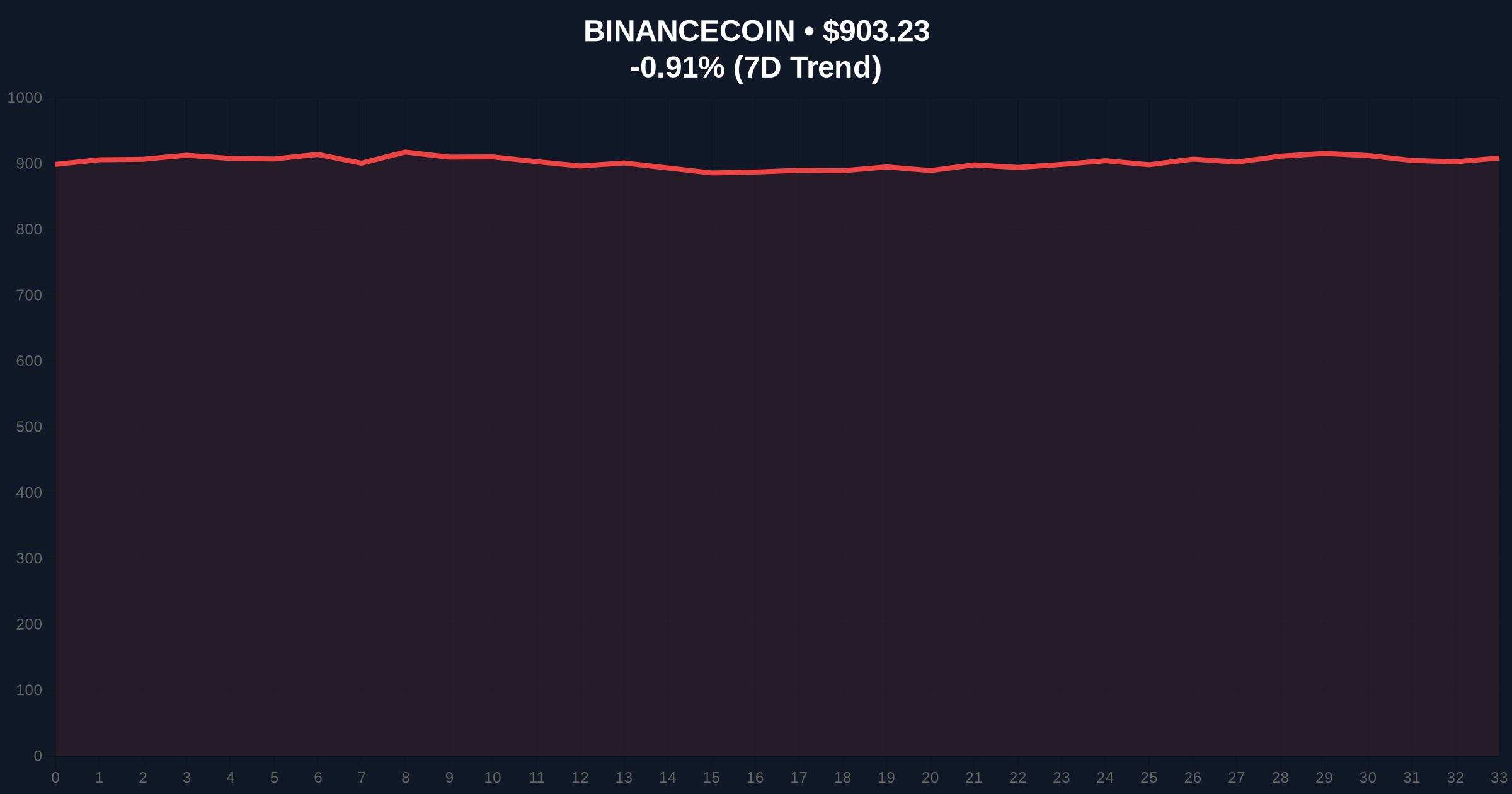

As a stablecoin, U's primary technical level is its $1.00 peg. Market structure suggests initial price action will test this peg through order block accumulation. Bullish invalidation occurs if U trades below $0.995, indicating potential de-peg risk. Bearish invalidation is irrelevant for stablecoins unless broken upward, which would signal abnormal demand. Volume profile analysis post-launch will reveal liquidity concentration. The zero-fee promotion creates a temporary Fair Value Gap (FVG) that may attract arbitrage bots. BNB, Binance's native token, shows a 24-hour trend of -0.90% to $903.32, reflecting broader exchange token weakness amid regulatory scrutiny, including potential impacts from the upcoming Ethereum Pectra upgrade's fee market changes.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) |

| BNB Current Price | $903.32 |

| BNB 24h Trend | -0.90% |

| BNB Market Rank | #5 |

| U Listing Time | Jan 13, 8:00 a.m. UTC |

Institutionally, this listing represents Binance's continued expansion of stablecoin offerings amid bearish perpetual futures skew across major assets. For retail, zero-fee trading reduces friction but may mask underlying liquidity risks. The move could pressure other stablecoins like USDT and USDC on volume metrics, potentially triggering a gamma squeeze in derivatives markets if U gains rapid adoption. According to Ethereum.org documentation on token standards, proper stablecoin implementation requires transparent reserve audits, which market participants should verify post-launch.

Market analysts on X/Twitter are divided. Bulls highlight the zero-fee promotion as a savvy liquidity grab during fear. Bears question U's reserve backing and timing amid regulatory uncertainty. No official statements from Binance executives were provided in the source material.

Bullish Case: U maintains its $1.00 peg with high volume, becoming a top-10 stablecoin by market cap within six months. Binance's promotion drives significant order flow, benefiting BNB through increased exchange activity. Bullish invalidation: U below $0.995.

Bearish Case: U fails to gain traction, remaining a minor stablecoin with low liquidity. Regulatory scrutiny intensifies, as seen in recent AML fines, causing exchanges to limit stablecoin offerings. Bearish invalidation: U above $1.005 with sustained volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.