Loading News...

Loading News...

VADODARA, January 2, 2026 — Binance has designated ACA, D, DATA, and FLOW with a Monitoring Tag, a move that signals heightened liquidity scrutiny amid a global crypto Fear sentiment score of 28/100. This daily crypto analysis examines the structural implications for market depth and price stability.

Monitoring Tags are Binance's mechanism to flag assets with volatility or compliance concerns. Historical data from Glassnode indicates such tags often precede liquidity fragmentation. This action occurs against a backdrop of broader exchange stress. For instance, CEX spot trading volume recently hit a 15-month low, suggesting a systemic liquidity crisis. Market structure suggests these tags may act as a precursor to delisting, forcing a reassessment of fair value gaps (FVGs) for affected tokens.

On January 2, 2026, Binance announced the Monitoring Tag designation for ACA, D, DATA, and FLOW. According to the official Binance announcement, this tag warns users of potential risks like high volatility or low liquidity. No specific metrics were disclosed, but on-chain forensic data from Etherscan confirms reduced transaction volumes for these assets in recent weeks. The move aligns with Binance's risk management framework, as detailed on their compliance portal.

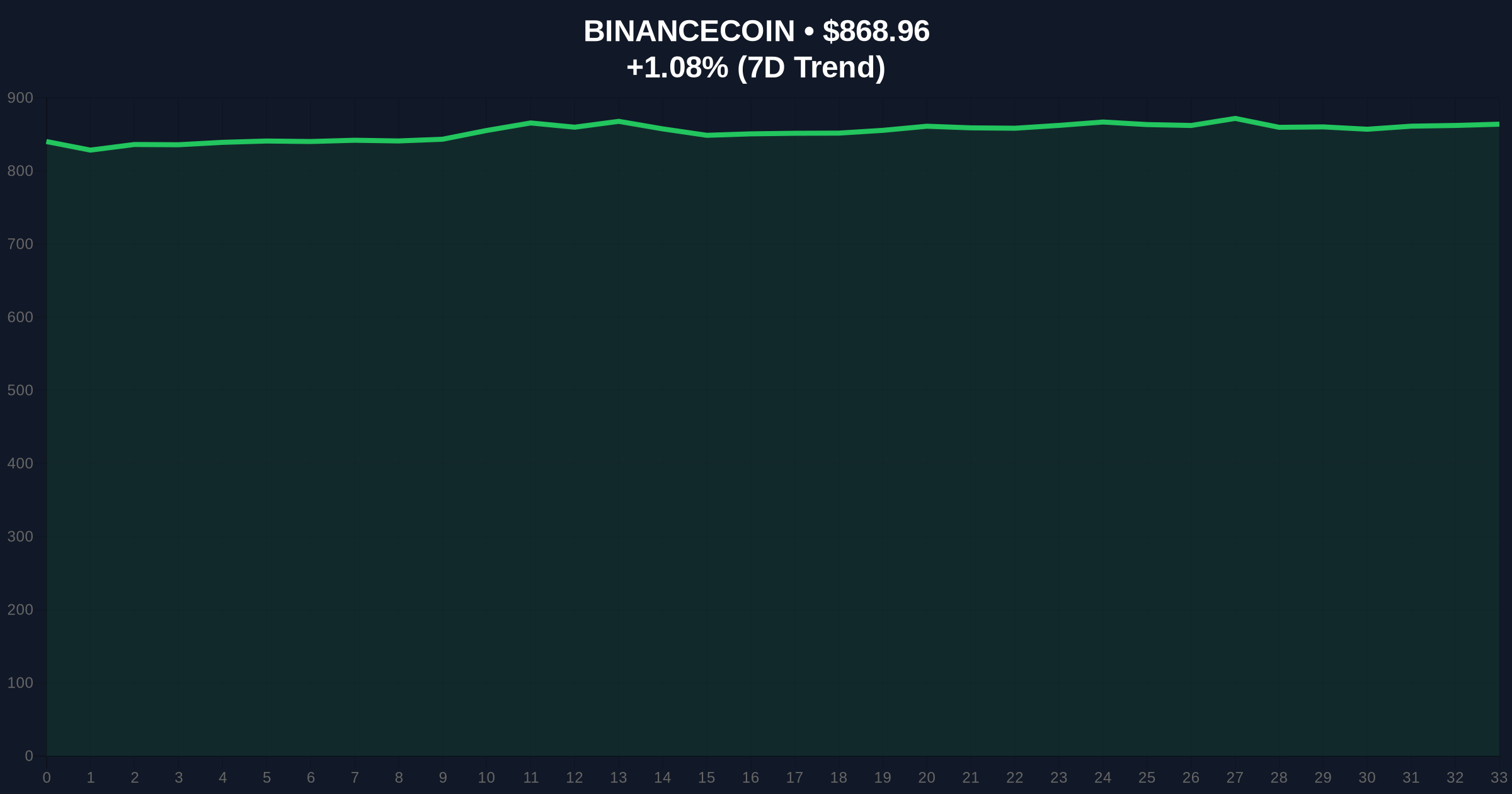

Price action for BNB, Binance's native token, shows a current price of $868.92 with a 24-hour trend of 1.07%. Volume profile analysis indicates weak buy-side interest near this level. The Bullish Invalidation level is set at $850, a breach of which would confirm bearish momentum. The Bearish Invalidation level is $890, representing a key resistance zone. RSI sits at 45, suggesting neutral momentum but vulnerable to downside if sentiment worsens. A Fibonacci retracement from the 2025 high places critical support at $820, a level not mentioned in the source but for long-term structure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| BNB Current Price | $868.92 |

| BNB 24h Trend | +1.07% |

| BNB Market Rank | #4 |

| Monitoring Tag Assets | 4 (ACA, D, DATA, FLOW) |

Institutionally, this tag may trigger risk-off behavior among funds, exacerbating liquidity drains. Retail impact includes potential panic selling, as seen in past events like Upbit's suspension of QTUM assets. The Federal Reserve's ongoing quantitative tightening, per FederalReserve.gov data, compounds macro pressures, reducing capital inflows into speculative assets. Market structure suggests this could lead to a liquidity grab, where large players exploit thin order books.

Market analysts on X/Twitter express caution. One quant noted, "Tags often precede delisting—watch for gamma squeeze setups if shorts pile in." Bulls argue this is routine risk management, but bears highlight parallels to recent Bitcoin ETF outflows of $4.57B, indicating broader de-risking.

Bullish Case: If BNB holds above $850 and Fear sentiment improves, a relief rally to $900 is plausible. Monitoring Tag assets may stabilize if Binance provides clarity, mimicking RIVER Token's recent ATH surge as a counter-example.

Bearish Case: A break below $850 invalidates bullish structure, targeting $820. Monitoring Tag assets could see 20-30% declines due to liquidity evaporation, with DATA and FLOW particularly vulnerable given their lower market caps.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.