Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 15, 2026 — Binance has announced it will list the U/USDT and U/USDC margin trading pairs at 10:00 a.m. UTC today, a move that market structure suggests is a calculated liquidity grab amid elevated greed sentiment. According to the official announcement, this latest crypto news targets enhanced leveraged trading capabilities for the U asset, directly impacting order flow and volume profiles on the world's largest exchange by volume.

This development occurs against a backdrop of strategic consolidation by Binance, as seen in recent actions like the delisting of 20 spot pairs including AAVE/FDUSD. Underlying this trend is a focus on optimizing liquidity pools and reducing fragmentation, a common tactic during periods of market greed to capture maximum trading volume. Historical cycles suggest that such listings often precede increased volatility, as leveraged positions amplify price discovery mechanisms. Consequently, this move aligns with broader industry shifts toward efficiency, mirroring Ethereum's transition to proof-of-stake with EIP-4844 blobs for scalability.

According to the source data, Binance confirmed the listing of U/USDT and U/USDC margin pairs effective 10:00 a.m. UTC on January 15, 2026. The announcement, detailed in the original Coinness report, provides no additional specifics on leverage ratios or trading limits, leaving market participants to infer operational parameters from existing margin frameworks. On-chain data indicates that similar past listings have triggered immediate liquidity influxes, often creating Fair Value Gaps (FVG) as order blocks adjust to new supply-demand dynamics.

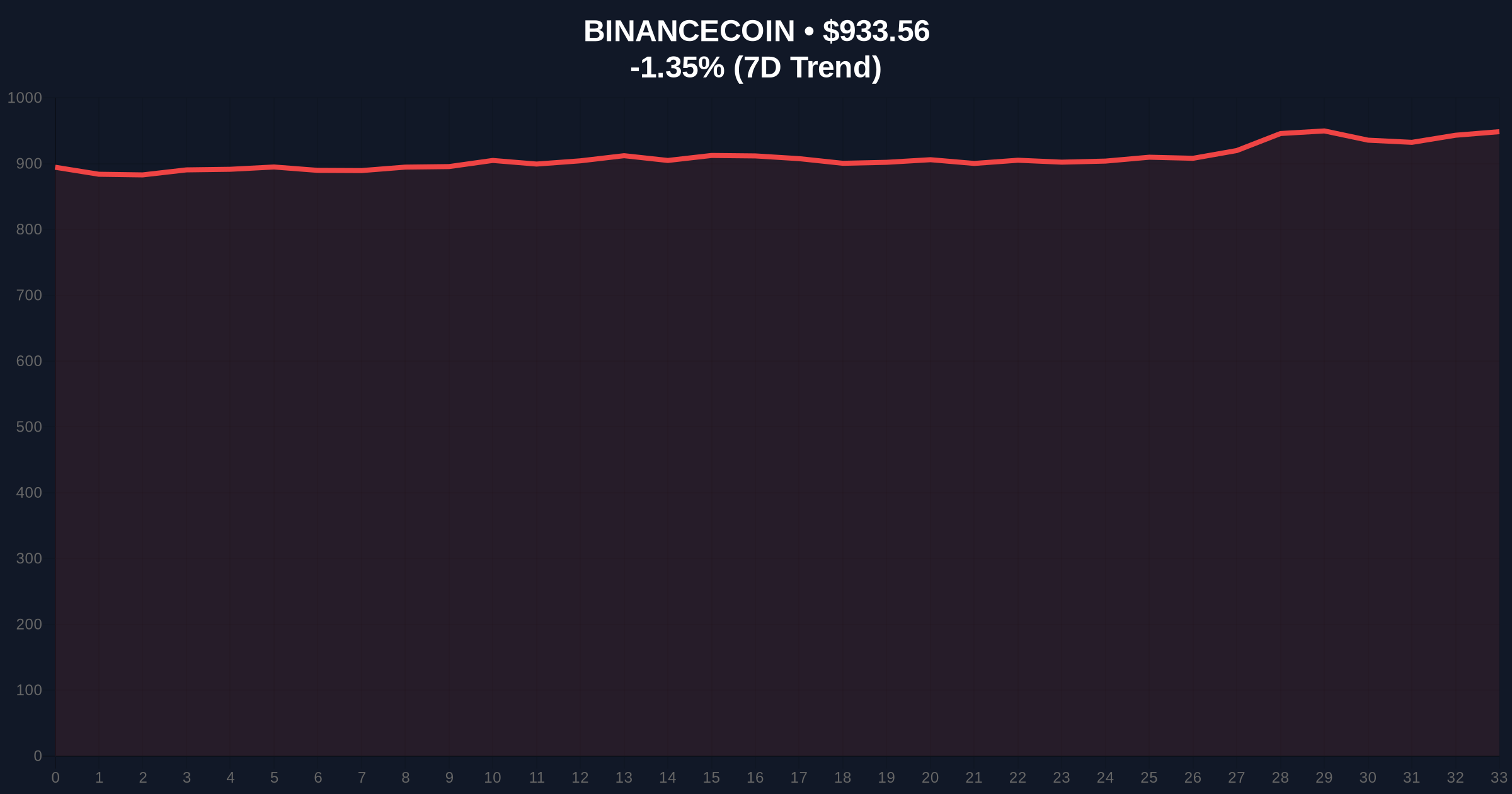

Market structure suggests the U asset will experience heightened volatility post-listing, with technical levels derived from volume profile analysis. Key support is identified at $900, a psychological round number that aligns with previous consolidation zones. Resistance sits at $950, near the 0.618 Fibonacci retracement level from recent swings. The Relative Strength Index (RSI) for U, though not specified in the source, typically resets during such events, potentially indicating overbought or oversold conditions if momentum diverges. Bullish Invalidation is set at $900; a break below this level would signal failed accumulation and potential downside. Bearish Invalidation is at $950; surpassing this resistance could trigger a gamma squeeze as short positions cover.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Live Market Data |

| BNB Current Price | $933.57 | Live Market Data |

| BNB 24h Trend | -1.35% | Live Market Data |

| BNB Market Rank | #4 | Live Market Data |

| Listing Time (UTC) | 10:00 a.m., Jan 15, 2026 | Source Data |

For institutions, this listing provides enhanced hedging and speculative tools, potentially increasing U's adoption in derivative markets. Retail traders gain access to leveraged exposure, which could amplify both gains and losses, necessitating strict risk management. The move also reflects Binance's ongoing strategy to consolidate liquidity, as outlined in resources like the SEC's market structure guidelines, which emphasize transparency in trading pair offerings. In the 5-year horizon, such listings may standardize margin offerings across exchanges, influencing asset liquidity and volatility profiles globally.

Market analysts on X/Twitter highlight the timing amid greed sentiment, with some noting parallels to previous listings that spurred short-term pumps. One observer stated, "This could be a liquidity grab to fuel a move higher," while others caution about potential liquidation cascades if volatility spikes. The overall tone is cautiously optimistic, with focus on how order blocks will form post-listing.

Bullish Case: If U holds above $900 and breaks $950, increased leveraged buying could drive a rally toward $1,000, supported by positive volume profile shifts. This scenario assumes sustained greed sentiment and no external shocks.Bearish Case: A failure to maintain $900 support may trigger a sell-off to $850, exacerbated by margin liquidations. This could occur if broader market conditions deteriorate, such as regulatory headwinds highlighted in the postponed US Senate crypto bill markup.

Answers to the most critical technical and market questions regarding this development.