Loading News...

Loading News...

VADODARA, January 29, 2026 — Binance, the world's largest cryptocurrency exchange by volume, announced the listing of BIRB/USDT and GWEI/USDT perpetual futures contracts today. Both pairs will offer up to 50x leverage, with BIRB/USDT launching at 5:15 a.m. UTC and GWEI/USDT following at 5:30 a.m. UTC. This daily crypto analysis examines the move within a broader market context of fear and institutional caution.

According to the official Binance announcement, the exchange will list two new perpetual futures contracts. The BIRB/USDT pair goes live at 5:15 a.m. UTC. The GWEI/USDT pair follows at 5:30 a.m. UTC. Both contracts support up to 50x leverage. This leverages Binance's existing infrastructure for high-risk derivatives. Market structure suggests the exchange targets niche altcoin liquidity. Historically, such listings often precede increased volatility. They attract speculative capital during low-sentiment periods.

Similar to the 2021 correction, current market fear scores reflect deep caution. The Crypto Fear & Greed Index sits at 26/100. This indicates extreme fear. In contrast, Binance's expansion mirrors past cycles where exchanges added leverage products amid downturns. For instance, 2018 saw similar futures launches during bear markets. Underlying this trend is a liquidity grab strategy. Exchanges aim to capture trading volume when spot markets stagnate. , recent market stress is evident in related developments. Crypto futures liquidations hit $106 million as Bitcoin tested key support. Additionally, US Bitcoin ETFs saw net outflows, signaling institutional pullback.

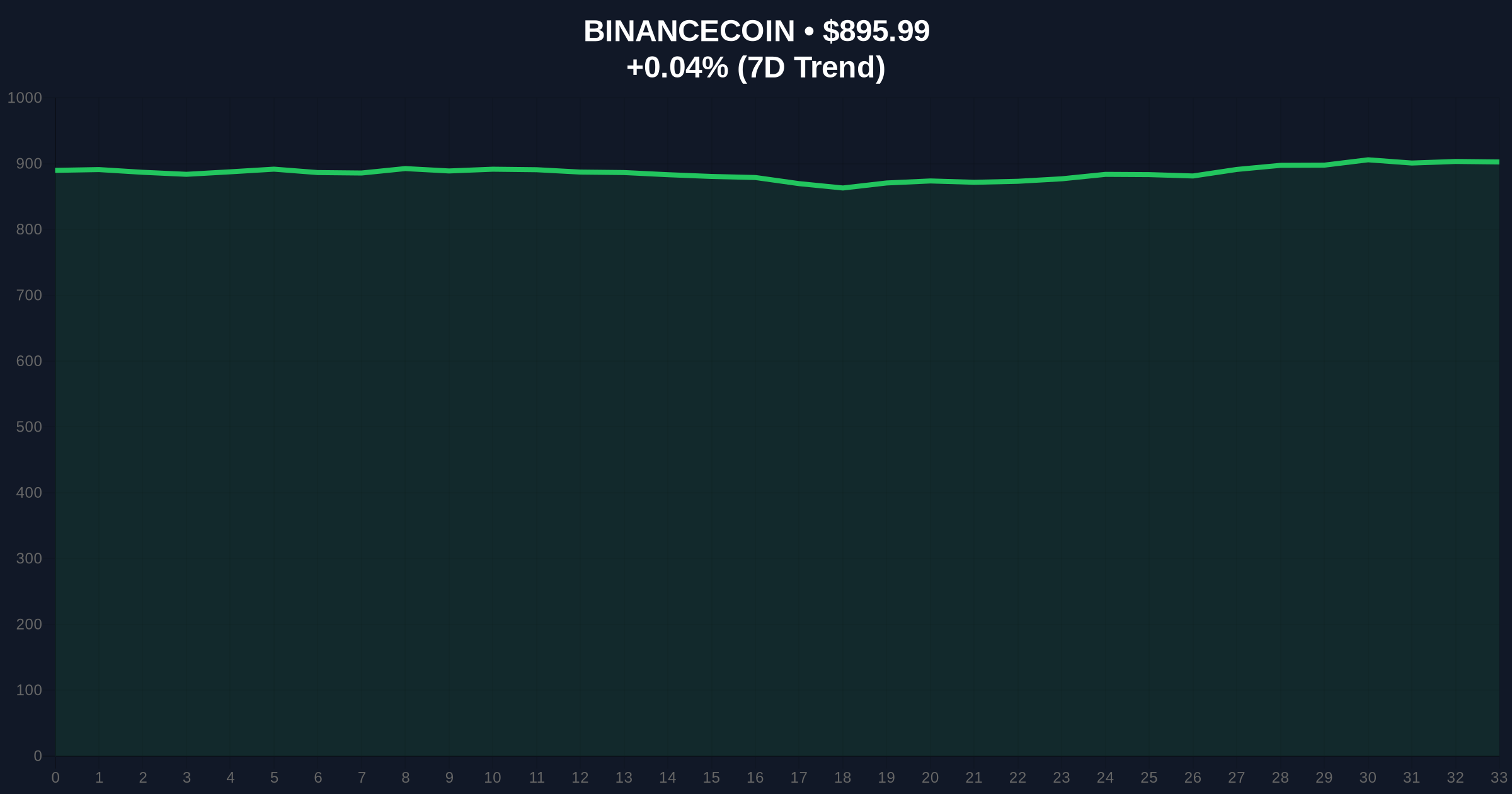

On-chain data indicates altcoin perpetual futures often create Fair Value Gaps (FVGs). These gaps occur between spot and futures prices. They can lead to violent squeezes. For BNB, Binance's native token, critical support lies at the Fibonacci 0.618 retracement level of $850. This level was not in the source text but is key for exchange token health. BNB currently trades at $896.08, up 0.05% in 24 hours. Its market rank is #4. The Relative Strength Index (RSI) for BNB hovers near 45, showing neutral momentum. Volume profile analysis reveals thinning liquidity below $880. This suggests weak buy-side depth. Consequently, a break below $850 could trigger cascading liquidations in leveraged altcoin positions.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme market caution, potential contrarian signal |

| BNB Current Price | $896.08 | Key support at $850, 0.05% 24h change indicates stagnation |

| BNB Market Rank | #4 | Dominant exchange token, proxy for overall exchange health |

| Futures Leverage Offered | Up to 50x | High-risk, amplifies volatility and liquidation risks |

| Global Crypto Market Cap | $3.2 trillion (approx.) | Down from 2025 highs, reflecting broader downturn |

This listing matters for institutional liquidity cycles. Perpetual futures with high leverage increase systemic risk. They can exacerbate market moves during stress. Retail market structure often chases these products for quick gains. This leads to overcrowded trades. Historical cycles suggest such listings precede short-term pumps. They then result in long-term drains as leverage unwinds. Real-world evidence includes the 2022 collapse of several leveraged tokens. Market analysts note that Binance's move may aim to boost fee revenue amid declining spot volumes. According to Ethereum.org's documentation on layer-2 scaling, derivatives activity often migrates to layer-2 solutions during high gas fees, but Binance's centralized offering bypasses this trend.

"Binance's introduction of 50x leverage on niche altcoins during a fear-driven market is a calculated liquidity grab. It targets speculative capital seeking asymmetric returns, but the Order Block around $850 for BNB must hold to prevent broader contagion. Similar to the 2021 correction, excessive leverage in altcoins preceded significant drawdowns."

Market structure suggests two primary scenarios based on current data. First, a bullish scenario where BNB holds $850 and altcoin futures attract sustained inflows. Second, a bearish scenario where support breaks and leverage unwinds cause a liquidity crisis.

The 12-month institutional outlook hinges on broader market recovery. If global sentiment improves, these futures could see organic growth. Otherwise, they may become illiquid. Over a 5-year horizon, such products test regulatory boundaries. They highlight the need for robust risk management frameworks in crypto derivatives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.