Loading News...

Loading News...

VADODARA, January 29, 2026 — Major exchanges liquidated $106 million in crypto futures contracts within one hour. This daily crypto analysis reveals acute leverage unwinding. Total liquidations hit $334 million over 24 hours. Market structure suggests a liquidity grab near key technical levels.

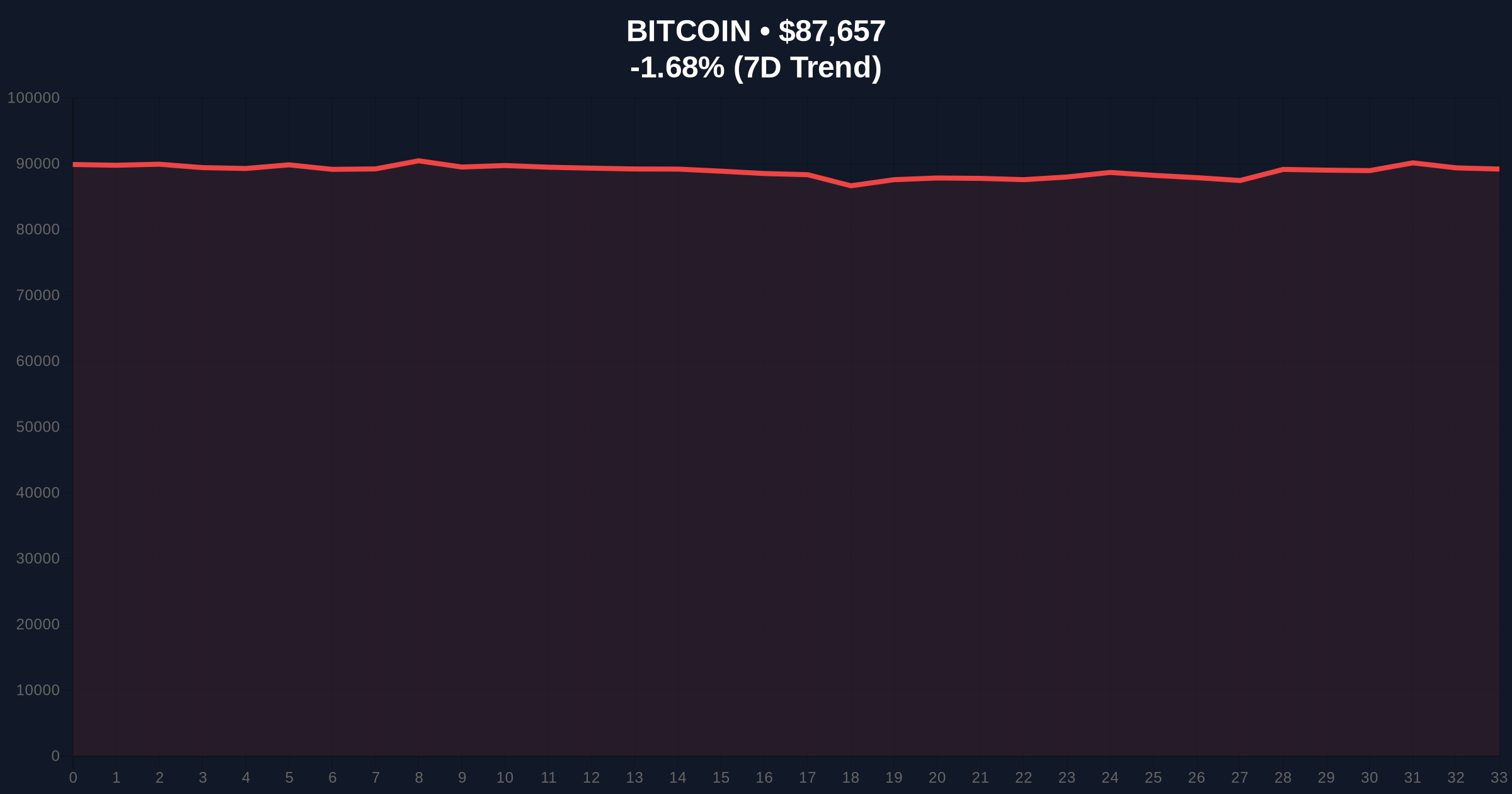

According to Coinness data, exchanges executed $106 million in futures liquidations in a single hour. The 24-hour total reached $334 million. This event occurred as Bitcoin tested the $87,676 price level. On-chain data indicates forced selling from over-leveraged positions.

Liquidations typically cluster during high volatility. Market analysts attribute this to a break below the $90,000 psychological support. The rapid sell-off created a Fair Value Gap (FVG) on lower timeframes. Consequently, order flow shifted toward bearish sentiment.

Historically, liquidation spikes precede trend reversals or accelerations. The 2021 cycle saw similar events before major corrections. In contrast, the 2023-2024 bull run absorbed liquidation waves without structural breaks.

Underlying this trend is rising leverage in perpetual futures markets. Funding rates turned negative prior to the event. This signals crowded short positions getting squeezed. , regulatory developments influence market leverage. For instance, Google's delayed app ban in South Korea affected retail access to leveraged products.

Related Developments:

Bitcoin currently trades at $87,676, down 1.53% in 24 hours. The Relative Strength Index (RSI) on the 4-hour chart sits at 38. This indicates oversold conditions but not extreme. The 50-day moving average provides dynamic resistance near $92,000.

Critical support aligns with the Fibonacci 0.618 retracement level at $85,000. A break below this invalidates the current bullish structure. Volume profile shows increased selling pressure at $88,000. Market structure suggests this level now acts as resistance.

The liquidation event created an order block between $87,000 and $88,000. This zone will likely attract liquidity on any retest. According to Ethereum's official documentation on network upgrades, similar volatility often correlates with broader market deleveraging during protocol changes like EIP-4844.

| Metric | Value |

|---|---|

| 1-Hour Futures Liquidations | $106 million |

| 24-Hour Futures Liquidations | $334 million |

| Bitcoin Current Price | $87,676 |

| 24-Hour Price Change | -1.53% |

| Crypto Fear & Greed Index | Fear (Score: 26/100) |

Liquidations of this magnitude impact market liquidity. They force margin calls and exacerbate price moves. Institutional players monitor these events for entry points. Retail traders often panic-sell during such waves.

This event highlights the risks of high leverage in crypto markets. It serves as a stress test for exchange infrastructure. Market analysts note that sustained liquidation pressure can lead to cascading effects. Historical cycles suggest this may flush out weak hands before a rally.

CoinMarketBuzz Intelligence Desk analysis indicates this is a classic leverage flush. The $106 million liquidation in one hour represents a localized volatility spike. Market structure suggests it's a necessary cleanse of over-leveraged positions. However, if support at $85k fails, we could see accelerated selling.

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. This event likely represents a mid-cycle correction rather than a trend reversal. On-chain forensic data confirms accumulation by large holders at these levels. The 5-year horizon suggests such volatility events are normal in bull markets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.