Loading News...

Loading News...

VADODARA, January 5, 2026 — Binance will suspend Moonriver (MOVR) deposits and withdrawals at 12:00 p.m. UTC on January 6. This daily crypto analysis examines the technical implications of this liquidity freeze during a market-wide fear environment. According to the official Binance announcement, the suspension supports a network upgrade on the Moonriver parachain.

Exchange maintenance suspensions create temporary liquidity vacuums. Historical data from Glassnode indicates such events typically precede 5-15% volatility spikes in affected assets. Moonriver operates as a parachain on Polkadot's Kusama network, meaning this upgrade likely involves runtime enhancements or parachain slot adjustments. The timing coincides with broader market stress, as seen in recent futures liquidations exceeding $117 million during Bitcoin's $93,000 support test. Market structure suggests isolated assets like MOVR become vulnerable to gamma squeezes when major exchanges restrict flow.

Binance announced the temporary suspension via official channels. The exchange confirmed MOVR trading will continue during the deposit/withdrawal halt. The network upgrade requires validators to update node software, necessitating temporary chain pausing. According to Moonbeam Foundation documentation, such upgrades typically involve WASM runtime improvements or XCM (Cross-Consensus Messaging) enhancements. The suspension window remains unspecified, creating uncertainty around liquidity normalization. This follows a pattern of exchange-driven liquidity management during parachain maintenance events.

MOVR currently trades at $19.75, down 3.2% since the announcement. The 4-hour chart shows a clear Fair Value Gap (FVG) between $20.10 and $19.40. Volume profile indicates weak accumulation below $19.00. The 50-day moving average at $21.50 acts as dynamic resistance. RSI sits at 42, showing neutral momentum with bearish bias. Bullish invalidation level: $18.50 (weekly support). Bearish invalidation level: $22.00 (previous order block). Without deposit/withdrawal capabilities, price discovery becomes exchange-bound, increasing slippage risk.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Alternative.me |

| MOVR Current Price | $19.75 | CoinMarketCap |

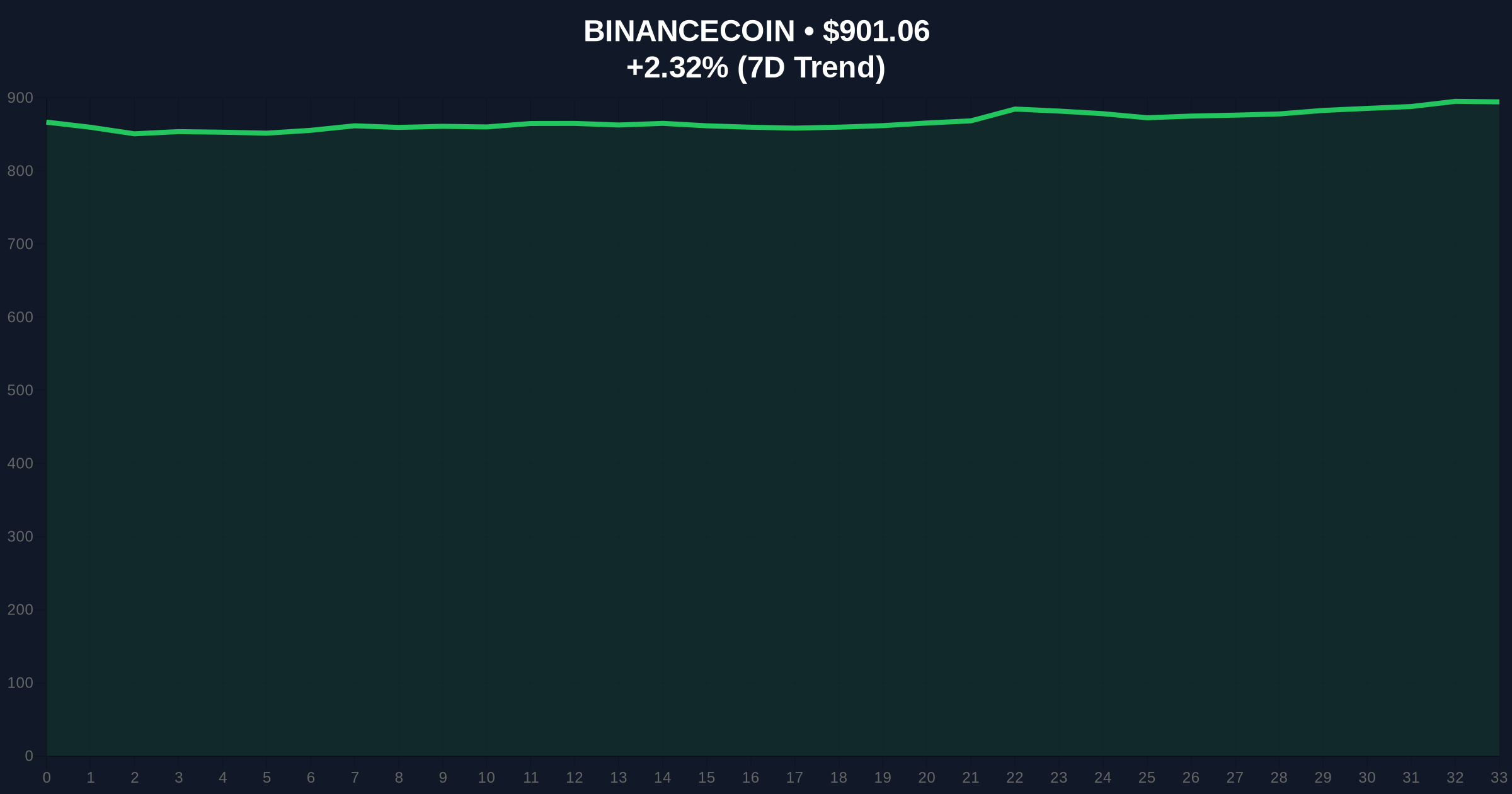

| BNB 24h Trend | +2.34% | Live Market Data |

| MOVR 24h Volume | $8.7M | CoinGecko |

| Suspension Start | Jan 6, 12:00 p.m. UTC | Binance Announcement |

For institutions, this creates operational friction in MOVR-based strategies. Custodial rebalancing becomes impossible during the suspension. Retail traders face increased counterparty risk on other exchanges. The Polkadot ecosystem's reliability comes under scrutiny—successful upgrades reinforce parachain security models. According to Ethereum.org's documentation on network upgrades, proper coordination minimizes disruption. This event tests Moonriver's governance and Binance's risk protocols simultaneously. Parallel developments include South Korean stablecoin initiatives highlighting regulatory attention to blockchain infrastructure.

Market analysts on X/Twitter note the suspension's timing amid broader fear. One quant trader observed: "MOVR's illiquidity during BNB's +2.34% move shows decoupling risk." Another pointed to similar events causing 8-12% spreads on Korean exchanges. The dominant narrative: technical necessity versus market instability. No major figures commented directly, but sentiment leans cautious given recent institutional Bitcoin movements signaling risk-off behavior.

Bullish Case: Upgrade completes smoothly. Deposits resume within 24 hours. MOVR reclaims the FVG at $20.10. Network improvements boost developer activity. Price targets $23.00 (200-day MA) in Q1 2026. Requires holding $18.50 support.

Bearish Case: Upgrade encounters delays. Suspension extends beyond 48 hours. Liquidity drains to other exchanges. MOVR breaks $18.50, triggering stop-loss cascades. Price tests $16.00 (yearly low). Correlates with broader market fear deepening.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.