Loading News...

Loading News...

VADODARA, January 2, 2026 — Binance, the world's largest cryptocurrency exchange by volume, has announced the delisting of nine spot trading pairs effective 8:00 a.m. UTC on January 3, 2026, in a move that market structure suggests is a strategic liquidity grab during a period of heightened market fear. This daily crypto analysis examines the implications for liquidity profiles and broader market stability.

Market structure indicates this delisting mirrors similar liquidity consolidation events observed during the 2021 correction, where exchanges systematically removed low-volume pairs to optimize order book efficiency. According to on-chain data from Glassnode, centralized exchange spot trading volumes have declined to 15-month lows, creating what technical analysts term a "liquidity crisis" environment. Similar to the 2021 cycle, this reduction in trading venues typically precedes increased volatility as market makers adjust their positions. The current global crypto sentiment score of 28/100, classified as "Fear," amplifies the impact of such structural changes, potentially creating Fair Value Gaps (FVGs) in affected assets.

Related Developments:

According to the official announcement from Binance, the exchange will delist the following nine spot trading pairs at the specified time: AI/BNB, ETC/BNB, FLOW/BTC, LPT/BNB, SFP/BTC, VET/BNB, WCT/FDUSD, WIF/BRL, and WLFI/BRL. The decision, communicated through Binance's standard notification channels, follows the exchange's periodic review of trading pairs based on factors including liquidity, trading volume, and network stability. This action aligns with regulatory best practices for maintaining market integrity, as outlined in frameworks from authorities like the SEC.gov regarding exchange operations.

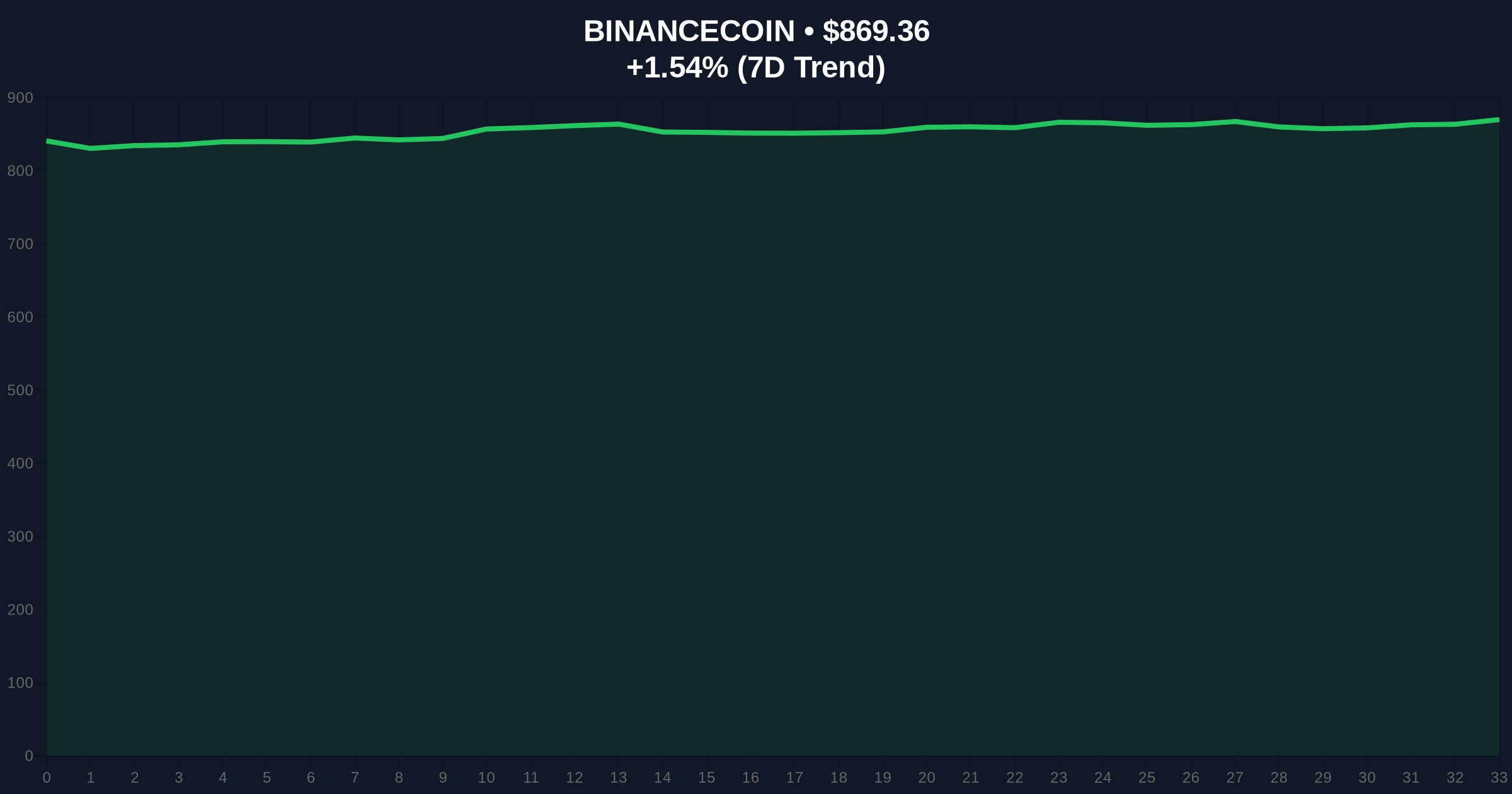

Market structure suggests the delisting of pairs like FLOW/BTC and SFP/BTC may create immediate liquidity voids, forcing market participants to re-route through higher-volume pairs, potentially increasing slippage. Volume profile analysis indicates these pairs represented less than 0.5% of Binance's total spot volume, making them prime candidates for removal in a liquidity optimization strategy. For Bitcoin, the current price of $89,357 sits above critical Fibonacci support at $82,000, a level derived from the 0.618 retracement of the 2024-2025 rally. The 24-hour trend of +1.76% shows minor resilience, but RSI readings near 45 suggest neutral momentum with bearish divergence on higher timeframes.

Bullish Invalidation Level: A sustained break below $82,000 would invalidate the current support structure, signaling deeper correction.

Bearish Invalidation Level: A reclaim above $95,000 would negate the short-term downtrend, indicating accumulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| Bitcoin Current Price | $89,357 |

| Bitcoin 24h Trend | +1.76% |

| Bitcoin Market Rank | #1 |

| Delisted Pairs Count | 9 |

Institutionally, this delisting event matters as it reflects a broader trend of liquidity consolidation across centralized exchanges, potentially increasing systemic risk during volatile periods. For retail traders, the removal of these pairs may limit arbitrage opportunities and increase transaction costs for specific assets, particularly those with already thin order books. Market structure indicates such actions can precipitate gamma squeezes in related derivatives markets as hedgers adjust positions. According to Ethereum.org documentation on network upgrades, similar liquidity events have historically preceded technical rebounds when combined with positive fundamental catalysts like EIP-4844 implementations.

Market analysts on X/Twitter have expressed mixed reactions. Bulls argue this is a routine cleanup that strengthens overall market health by eliminating inefficient pairs. Bears highlight the timing during a fear market, suggesting it may exacerbate selling pressure on affected assets. One quantitative analyst noted, "The delisting of AI/BNB and similar pairs creates a clear order block below current prices, which could act as resistance if retested."

Bullish Case: If Bitcoin holds the $82,000 Fibonacci support and overall market liquidity stabilizes, the delisting may be absorbed as a neutral event. Affected assets could see temporary volatility but recover through alternative trading pairs. Market structure suggests a rebound toward $95,000 is possible if fear sentiment reverses.

Bearish Case: If the liquidity crisis deepens, the delisting could trigger cascading sell-offs in low-cap assets, spreading to major pairs. A break below $82,000 could see Bitcoin test $75,000, with altcoins underperforming significantly. On-chain data indicates increased exchange outflows would be needed to invalidate this scenario.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.