Loading News...

Loading News...

VADODARA, January 8, 2026 — The Crypto Fear & Greed Index collapsed 14 points to 28, signaling extreme fear as Bitcoin tests critical support. This daily crypto analysis examines the structural implications of sentiment degradation amid elevated volatility. According to data provider Alternative, the index now sits deep in “Fear” territory, a level historically associated with contrarian buying opportunities or further downside acceleration.

Market structure suggests this sentiment plunge mirrors late-2023 conditions preceding the Q1 2024 rally. The index uses a weighted model: volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), Bitcoin dominance (10%), and Google search volume (10%). A reading below 30 typically coincides with local bottoms or distribution phases. Current conditions echo the post-FTX collapse period when the index bottomed at 20. Related developments include pending U.S. Senate crypto legislation and institutional accumulation signals, both adding macro uncertainty.

On January 8, 2026, Alternative’s Fear & Greed Index printed 28. This represents a 14-point single-day drop from the previous reading. The metric aggregates six data streams into a 0-100 scale. Extreme Fear territory begins at 25. The sharp decline correlates with Bitcoin’s rejection at the $95,000 psychological resistance and subsequent slide toward $91,000. Historical cycles suggest such rapid sentiment deterioration often precedes volatile price discovery.

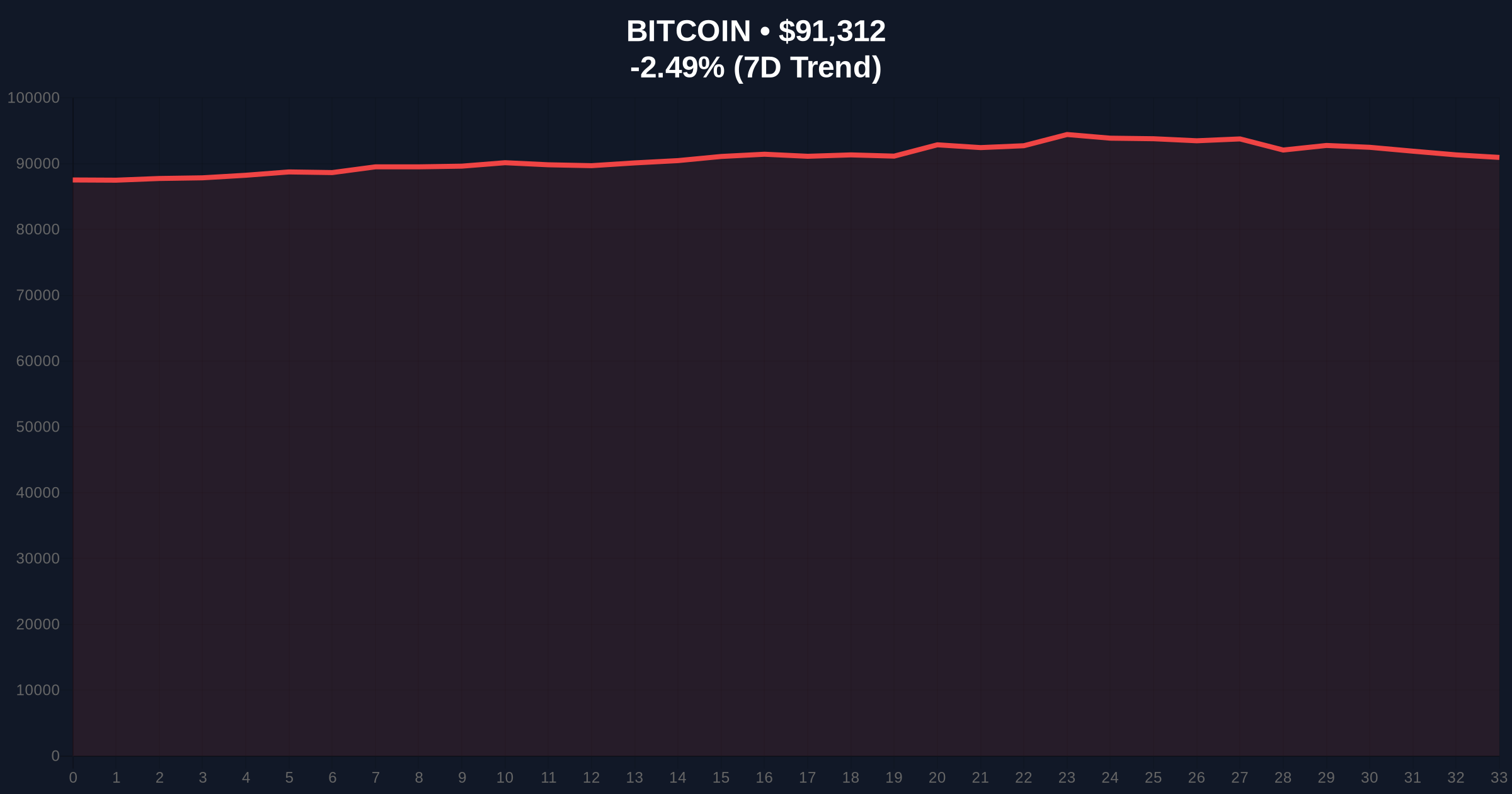

Bitcoin currently trades at $91,336, down 2.47% over 24 hours. The 4-hour chart shows a clear Fair Value Gap (FVG) between $92,800 and $93,500 that requires filling. The daily RSI sits at 42, indicating neutral momentum with bearish bias. The 50-day EMA at $89,200 provides dynamic support. A Bullish Invalidation level is established at $88,500—a break below would invalidate any near-term recovery thesis. The Bearish Invalidation level is $94,000; a close above suggests fear is overcooked. Volume Profile indicates high-density nodes around $90,500, making it critical support.

| Metric | Value | Change |

|---|---|---|

| Crypto Fear & Greed Index | 28/100 | -14 points |

| Bitcoin Price | $91,336 | -2.47% (24h) |

| Index Category | Fear | Extreme Fear threshold: 25 |

| Key Support (BTC) | $90,500 | Volume Profile Node |

| Key Resistance (BTC) | $93,200 | FVG Upper Bound |

For institutions, extreme fear readings often signal accumulation zones. The 28 print suggests retail capitulation, potentially creating a Liquidity Grab below $90,000. Retail traders face amplified volatility risk as sentiment metrics diverge from on-chain fundamentals. According to Ethereum.org’s analytics, network activity remains robust despite price weakness, indicating underlying strength. This divergence between price and utility metrics is critical for the 5-year horizon, as it highlights structural maturation versus cyclical sentiment swings.

Market analysts on X/Twitter highlight the historical significance of sub-30 readings. One quant noted, “Fear at 28 with Bitcoin above $90k is statistically anomalous—typically we see these levels at much lower prices.” Bulls argue this is a classic sentiment washout before a rally. Bears point to deteriorating macro conditions and potential regulatory overhangs from ETF options market developments.

Bullish Case: Index reversal above 40 triggers short covering. Bitcoin fills the FVG to $93,500 and challenges $95,000. This scenario requires holding the $90,500 support and seeing a surge in stablecoin inflow metrics. Historical data from FederalReserve.gov on liquidity conditions supports potential risk-asset rebounds when fear is extreme.Bearish Case: Fear deepens below 25. Bitcoin breaks $90,500 support, targeting the $88,500 invalidation level. This would confirm a larger corrective structure, potentially toward the 200-day MA near $85,000. Elevated volatility persists as the market prices in regulatory uncertainty.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.