Loading News...

Loading News...

VADODARA, January 20, 2026 — CoinMarketCap's Altcoin Season Index has increased by one point to 26, according to the platform's latest data release. This daily crypto analysis reveals a subtle but measurable shift in market structure, as the index approaches the critical threshold where 75% of top altcoins must outperform Bitcoin to declare a full altcoin season. Market structure suggests this movement represents early-stage capital rotation rather than a definitive regime change.

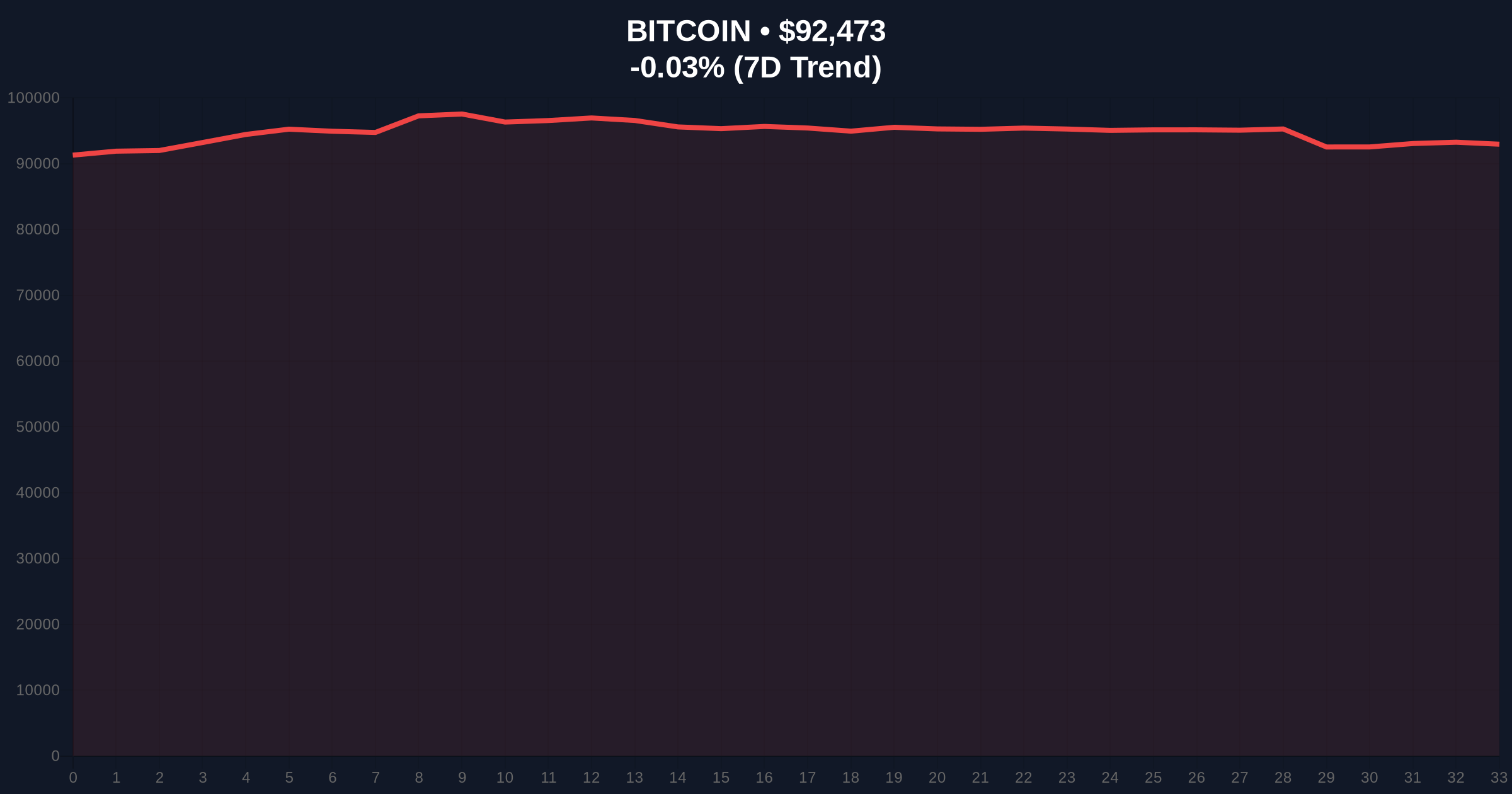

Historical cycles indicate altcoin seasons typically emerge during periods of Bitcoin consolidation or weakness, when capital seeks higher beta opportunities. The current index reading of 26 remains well below the 75 threshold required for an official altcoin season declaration, but represents the highest reading in three weeks. Underlying this trend is Bitcoin's struggle to maintain momentum above the $95,000 resistance level, creating what technical analysts identify as a Fair Value Gap (FVG) between $92,000 and $94,000. This FVG represents unfilled liquidity that market makers may target in either direction.

Related developments in the current market environment include the Crypto Fear & Greed Index plunging to 32, indicating extreme risk aversion among retail participants. Simultaneously, institutional flows show divergence, with Bitmine staking $279 million in ETH during the recent correction, suggesting sophisticated capital is positioning for an Ethereum-led altcoin rally.

According to CoinMarketCap's methodology, the Altcoin Season Index measures whether 75% of the top 100 cryptocurrencies by market capitalization (excluding stablecoins and wrapped assets) have outperformed Bitcoin over a 90-day rolling window. The index increased from 25 to 26 on January 20, 2026, based on relative performance data. This one-point gain represents incremental improvement rather than decisive breakout, with the index remaining in what quantitative analysts classify as 'Bitcoin dominance' territory (below 50).

The measurement excludes stablecoins and wrapped tokens to filter out synthetic exposure and focus on organic altcoin performance. A score closer to 100 indicates stronger altcoin season conditions, while readings below 25 typically correspond with Bitcoin outperformance cycles. The current positioning suggests a transitional phase where selective altcoins are beginning to demonstrate relative strength against the benchmark cryptocurrency.

On-chain data indicates Bitcoin's dominance chart is testing a critical order block between 52% and 54% on weekly timeframes. This order block represents previous institutional accumulation zones that now serve as resistance. The Altcoin Season Index's rise correlates inversely with Bitcoin dominance weakness at this technical level.

Market structure suggests two critical invalidation levels for this developing narrative. The bullish invalidation level sits at Bitcoin dominance reclaiming 55%, which would signal resumed Bitcoin outperformance and likely push the Altcoin Season Index back below 20. The bearish invalidation level for altcoins is Bitcoin price breaking below the $92,000 support cluster, which would trigger a broader market liquidation event and negate any relative strength thesis. Volume profile analysis shows significant liquidity pools at $88,500 and $96,200, representing the next major magnets for price action.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 26 | +1 point |

| Crypto Fear & Greed Index | 32/100 (Fear) | - |

| Bitcoin Price | $92,414 | -0.10% (24h) |

| Index Threshold for Altcoin Season | 75 | - |

| Days in Current Cycle | 90-day rolling window | - |

For institutional portfolios, the Altcoin Season Index serves as a quantitative signal for capital allocation between core Bitcoin holdings and altcoin satellite positions. A rising index above 25 triggers rebalancing algorithms that gradually increase altcoin exposure while maintaining Bitcoin as the base currency. Retail investors typically follow this signal with a 2-3 week lag, creating what market makers identify as predictable order flow patterns.

The Federal Reserve's monetary policy stance, as documented in their official monetary policy communications, creates the macro backdrop for this micro development. Higher real yields compress risk asset valuations uniformly, but altcoins demonstrate higher sensitivity to liquidity conditions due to their smaller market capitalization and lower institutional ownership. Consequently, even marginal improvements in the Altcoin Season Index during tightening cycles suggest exceptional relative strength among specific tokens.

Market analysts on X/Twitter are divided on the index's significance. Bulls point to historical precedents where altcoin seasons began with similar gradual index increases from oversold levels. One quantitative researcher noted, "The index needs to sustain above 30 for two weeks to confirm regime change." Bears reference the broader risk-off environment, with Kraken's VP highlighting Bitcoin's 3.5% dip as evidence of continued capital preservation mode. The consensus among algorithmic traders is that the current reading represents noise rather than signal until the index breaches 35.

Bullish Case: If Bitcoin stabilizes above $92,000 and the Altcoin Season Index sustains above 30 for seven consecutive days, quantitative models project a rapid ascent toward 50 within 30 days. This scenario would likely be led by Ethereum and layer-1 alternatives benefiting from the upcoming Pectra upgrade's EIP-7702, which introduces new account abstraction capabilities. Market structure suggests this would create a gamma squeeze in altcoin options markets as dealers hedge short volatility positions.

Bearish Case: Should Bitcoin break below the $92,000 support and the U.S. 10-Year Treasury Yield continue rising—as detailed in our coverage of Treasury yield movements—the Altcoin Season Index would likely retreat to 15-20 range. This would represent a liquidity grab where market makers sweep resting bids below key technical levels, triggering cascading liquidations in leveraged altcoin positions. The bearish invalidation would be confirmed by Bitcoin dominance reclaiming 55%.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.