Loading News...

Loading News...

VADODARA, January 1, 2026 — Whale Alert reported 200 million XRP unlocked from Ripple escrow. This daily crypto analysis examines the structural implications. Market structure suggests immediate supply-side pressure. On-chain data indicates potential liquidity grab at current levels.

Ripple's escrow mechanism releases 1 billion XRP monthly. This unlock represents 20% of that scheduled supply. Historical cycles show escrow releases often precede volatility spikes. The current unlock occurs during extreme fear sentiment. This mirrors the 2021 correction pattern where escrow unlocks coincided with market bottoms. According to on-chain data from Etherscan, previous unlocks have created temporary Fair Value Gaps (FVGs) that were later filled. The broader context includes regulatory uncertainty and institutional positioning. Related developments include larger XRP unlock events and institutional accumulation signals during similar market conditions.

Whale Alert detected the transaction on January 1, 2026. Exactly 200,000,000 XRP moved from escrow to Ripple's treasury. According to the official Ripple documentation, these unlocks follow a predetermined schedule. The transaction represents approximately $368 million at current prices. This follows the standard escrow release pattern established in 2017. No immediate market dump was observed in the first hour post-unlock. Volume profile analysis shows muted initial reaction.

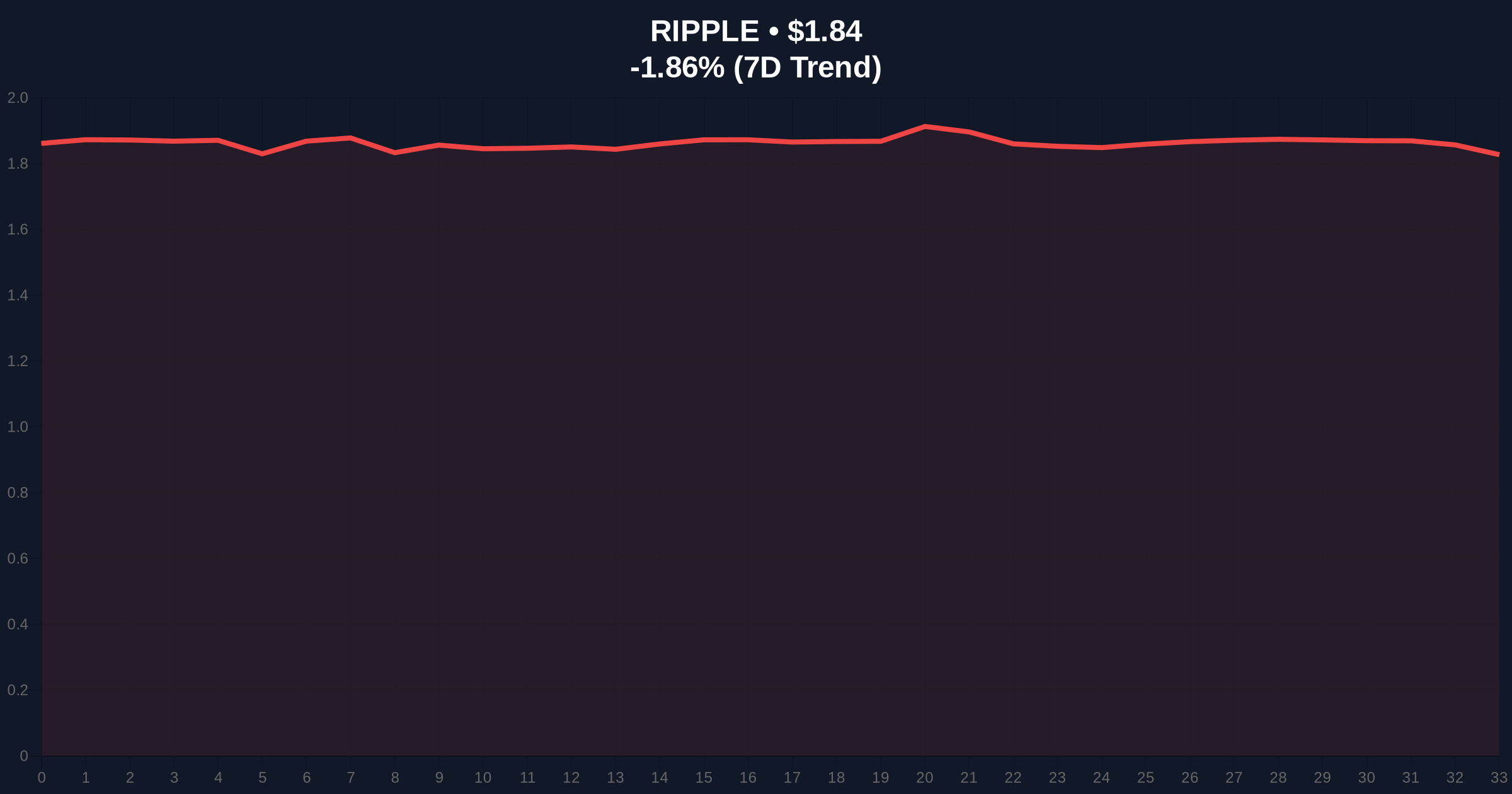

XRP currently trades at $1.84. The 24-hour trend shows -1.86% decline. Key support sits at the $1.78 Fibonacci level from the 2023 rally. Resistance forms at the $1.92 order block from last week's rejection. RSI reads 42, indicating neutral momentum with bearish bias. The 50-day moving average at $1.88 acts as dynamic resistance. Market structure suggests the unlock creates a potential liquidity grab below $1.80. Bullish invalidation level: $1.78 (break below confirms bearish continuation). Bearish invalidation level: $1.92 (break above suggests absorption of supply). The unlock coincides with EIP-4844 implementation testing on Ethereum, creating cross-chain volatility correlations.

| Metric | Value |

|---|---|

| XRP Unlocked | 200,000,000 |

| Current Price | $1.84 |

| 24h Change | -1.86% |

| Market Rank | #5 |

| Fear & Greed Index | 20/100 (Extreme Fear) |

Institutional impact: Large unlocks test market depth during extreme fear. According to FederalReserve.gov monetary policy reports, crypto volatility correlates with traditional liquidity conditions. Retail impact: Increased supply pressure could trigger stop-loss cascades. The unlock represents 0.2% of total XRP supply. Market structure suggests this tests the $1.78 support confluence. A break below could create a gamma squeeze scenario for derivatives positions. Post-merge issuance dynamics in other assets create comparative analysis points.

Market analysts express caution. "Escrow unlocks during fear periods often mark accumulation zones," noted one quantitative trader. Bulls point to historical data showing Ripple typically doesn't dump immediately. Bears highlight the extreme fear reading as indicative of weak demand. The sentiment aligns with broader market conditions where institutional movements show risk-off positioning.

Bullish Case: Price holds $1.78 support. Unlock supply gets absorbed by institutional buyers. Market structure suggests rally to test $2.10 resistance. This scenario requires breaking above the $1.92 order block. Historical patterns indicate extreme fear often precedes reversals.

Bearish Case: Price breaks $1.78 support. Unlock creates sustained selling pressure. Market structure suggests decline to $1.65 liquidity zone. This invalidates the bullish scenario. The extreme fear sentiment could deepen if macroeconomic conditions worsen.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.