Loading News...

Loading News...

VADODARA, January 29, 2026 — Crypto ETP issuer 21Shares has launched an exchange-traded product tracking JitoSOL, a Solana-based liquid staking token, according to a report by The Block. This daily crypto analysis examines the product's structure and its implications for Solana's market dynamics. The ETP trades under the ticker JSOL on Euronext exchanges in Paris and Amsterdam. It provides exposure to SOL's price while offering staking rewards and transaction revenue from Jito's infrastructure.

21Shares, a prominent crypto ETP issuer, launched the JitoSOL ETP on January 29, 2026. The product tracks JitoSOL, a liquid staking token on the Solana blockchain. According to The Block, JSOL combines price exposure to SOL with staking rewards and infrastructure revenue. It lists on Euronext's Paris and Amsterdam exchanges. This move targets European institutional investors seeking regulated crypto exposure. The launch occurs amid a broader trend of tokenization and ETP expansion in traditional finance.

Historically, liquid staking token launches have boosted underlying blockchain activity. For Solana, JitoSOL's growth mirrors Ethereum's Lido stETH model. In contrast, Solana's proof-of-history consensus requires different staking mechanics. Underlying this trend is increasing institutional demand for yield-generating crypto assets. Consequently, 21Shares' entry follows similar products from competitors like CoinShares and VanEck. This development aligns with a surge in tokenization initiatives across financial markets, as seen in recent hires by firms like Securitize.

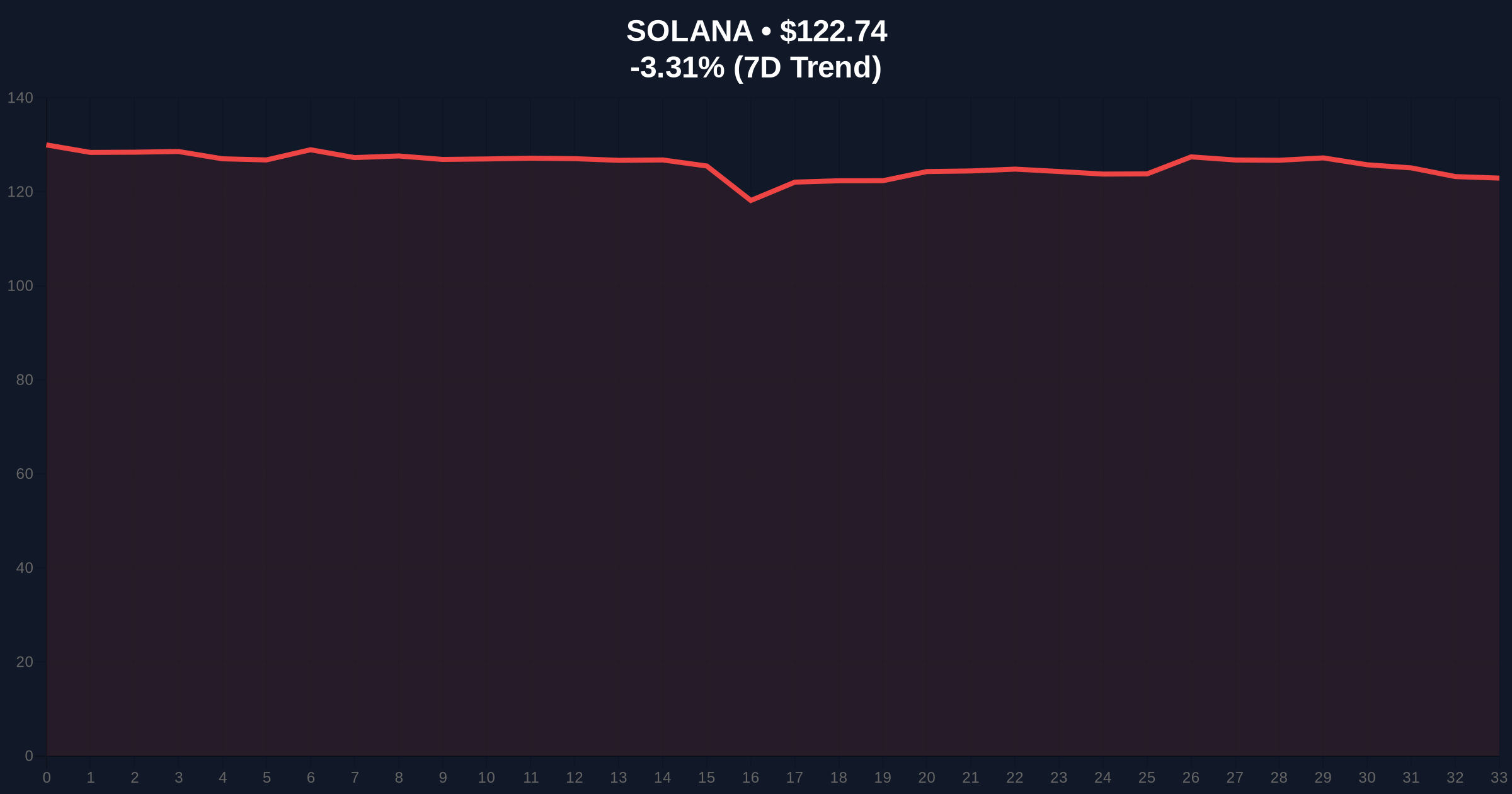

Market structure suggests Solana faces headwinds despite the ETP launch. SOL currently trades at $122.73, down 3.31% in 24 hours. The Relative Strength Index (RSI) sits near 40, indicating neutral momentum. A critical Fibonacci retracement level at $118.50 (0.618 from recent highs) acts as support. If broken, it could trigger a deeper correction. On-chain data from Solscan shows increased staking activity, but network congestion remains a concern. The JitoSOL ETP may alleviate this by bundling staking operations.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Alternative.me |

| Solana (SOL) Price | $122.73 | CoinMarketCap |

| SOL 24h Change | -3.31% | CoinMarketCap |

| SOL Market Rank | #7 | CoinMarketCap |

| JitoSOL TVL (Approx.) | $1.2B | DeFiLlama |

This launch matters for Solana's institutional adoption. It provides a regulated vehicle for staking rewards, attracting conservative capital. , it enhances liquidity for JitoSOL, potentially reducing slippage in DeFi markets. On-chain data indicates that increased staking could improve network security. However, it also concentrates staking power among fewer validators. Market analysts note that similar ETPs for Bitcoin and Ethereum have driven price appreciation in past cycles. This product could mirror that effect for Solana.

The JitoSOL ETP represents a maturation of Solana's staking economy. By offering combined exposure to price and yield, 21Shares taps into growing demand for structured crypto products. This could stabilize SOL's volatility over time, as institutional flows provide a liquidity buffer.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish scenario where SOL holds $118.50 and rallies toward $140. Second, a bearish scenario where breaking support leads to a test of $110. The 12-month outlook depends on ETP inflows and broader crypto sentiment. Institutional adoption of Solana-based products may accelerate, especially if regulatory clarity improves. Historical cycles suggest that new financial instruments often precede price rallies after initial volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.