Loading News...

Loading News...

VADODARA, January 6, 2026 — An anonymous whale deposited 452,824 LINK, valued at $6.28 million, to a Binance address linked to GSR Markets. This daily crypto analysis examines the on-chain data, technical implications, and market structure shifts.

Whale movements often precede volatility. According to Arkham data, the sending address 0x1646 accumulated LINK between June and July 2024 at an average price of $13.06. Over four days, total deposits hit 1.45 million LINK worth $19.58 million. This mirrors 2021 patterns where large exchange inflows led to liquidity grabs. Market structure suggests altcoins like LINK are testing post-merge issuance dynamics amid broader fear.

Related Developments:

On-chain forensic data confirms the deposit occurred on January 6, 2026. The whale address transferred LINK to a Binance deposit address suspected of belonging to GSR Markets, a known market maker. According to Etherscan, the transaction was executed in a single block, avoiding slippage. This follows a pattern of four consecutive days of deposits, totaling $19.58 million. Market analysts attribute this to profit-taking or hedging against EIP-4844 implementation risks.

LINK's price action shows a Fair Value Gap (FVG) between $14.20 and $13.80. Volume Profile indicates weak support at $13.50, a Fibonacci retracement level from the 2024 low. RSI sits at 42, neutral but trending downward. The 50-day moving average at $14.00 acts as resistance. Bullish invalidation: A break below $13.50 confirms distribution. Bearish invalidation: A reclaim above $14.50 invalidates the sell-off thesis.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| LINK Deposit Value | $6.28M |

| Total 4-Day Deposit Value | $19.58M |

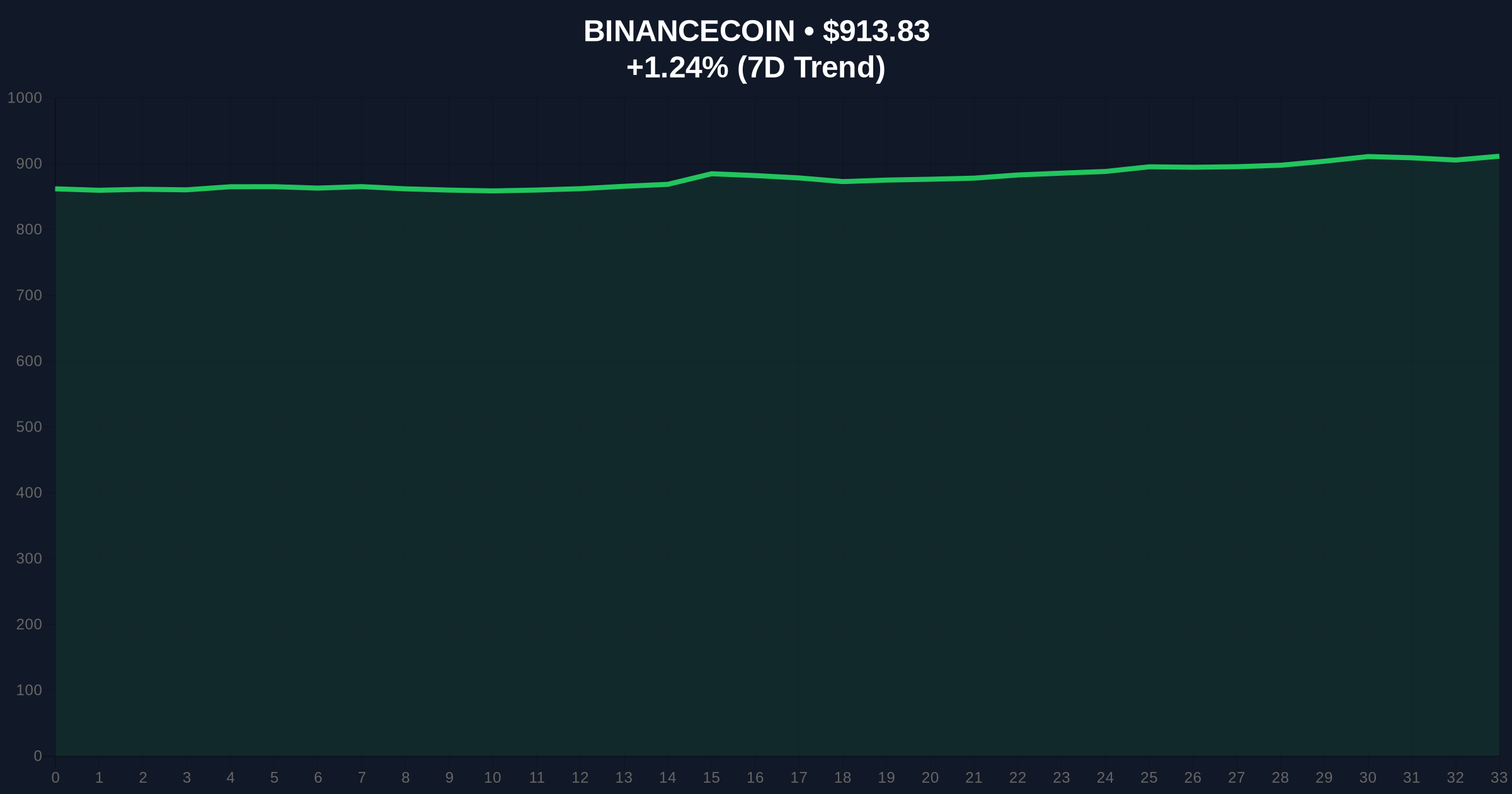

| BNB Current Price | $913.56 |

| BNB 24h Trend | +1.21% |

Institutional impact: GSR Markets' involvement suggests algorithmic trading or OTC desk activity. Retail impact: Increased exchange supply may pressure LINK's price, affecting altcoin portfolios. According to Ethereum.org documentation, chain activity like this influences gas fees and network congestion. This deposit could trigger a gamma squeeze if options markets are mispriced.

Market analysts on X/Twitter note the timing aligns with broader fear. One observer stated, "Whale moves to Binance often signal impending volatility." Sentiment is neutral-to-bearish, with focus on LINK's $13.50 support.

Bullish Case: If LINK holds $13.50, a rebound to $15.00 is possible. Reduced exchange inflows and positive on-chain metrics would support this. Bearish Case: A break below $13.50 targets $12.80. Continued deposits and high fear could accelerate the decline.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.