Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- VanEck fund manager David Schussler highlights Bitcoin's growing decoupling from the Nasdaq 100, underperforming by approximately 50% this year.

- Schussler argues that continued "debasement trade" trends and increased government spending could drive capital into scarce assets like Bitcoin.

- Market structure suggests a potential rally if historical patterns of decoupling precede strong rebounds, similar to 2021 cycles.

- Technical analysis identifies key support at $82,000 (Fibonacci 0.618 level) and resistance at $92,000, with RSI at 42 indicating neutral momentum.

VADODARA, December 23, 2025 — In a 2026 asset market outlook report, David Schussler, a fund manager for VanEck's digital asset fund, suggested that Bitcoin's growing decoupling from the Nasdaq 100 index could signal the start of a major rally, according to breaking crypto news. Schussler noted that BTC has underperformed the index by approximately 50% this year, arguing that if the trend of the "debasement trade"—hedging against the falling value of fiat currencies—continues, Bitcoin is highly likely to rebound strongly, as it has in the past. He added that increased government spending to address political challenges and cover future fiscal burdens will ultimately lead central banks to supply more liquidity, which will in turn drive capital into scarce assets like Bitcoin and gold.

Market structure suggests that Bitcoin's decoupling from traditional equity indices is not unprecedented. Similar to the 2021 correction, where Bitcoin briefly detached from tech stocks before rallying to new all-time highs, current dynamics may indicate a liquidity grab by institutional players. Historical data from the Federal Reserve shows that periods of aggressive monetary expansion, such as post-2020, often correlate with Bitcoin outperforming risk-on assets after initial lag. This decoupling mirrors patterns observed in 2019, when Bitcoin bottomed relative to the S&P 500 before a 300% surge, highlighting the asset's role as a hedge against fiat debasement. On-chain data indicates that whale accumulation has increased during this divergence, supporting Schussler's thesis of a pending rebound.

Related Developments: Amid extreme fear sentiment, other institutional moves include Bitmine's acquisition of $93.5M in Ethereum and 250M USDC being minted, suggesting broader capital flows into crypto assets.

According to the report sourced from Coinness, Schussler explicitly linked Bitcoin's underperformance to macroeconomic factors. He quantified the decoupling, stating BTC has lagged the Nasdaq 100 by about 50% year-to-date, a significant deviation given their historical correlation coefficient near 0.7. Schussler emphasized the "debasement trade," where investors seek assets resistant to currency devaluation, positing that sustained government spending—driven by political and fiscal pressures—will force central banks to inject liquidity. This environment, he argued, historically benefits scarce assets; for instance, Bitcoin's 2020-2021 rally coincided with global stimulus packages exceeding $10 trillion. His analysis aligns with VanEck's broader digital asset strategy, which has consistently advocated for Bitcoin as a long-term store of value amid inflationary trends.

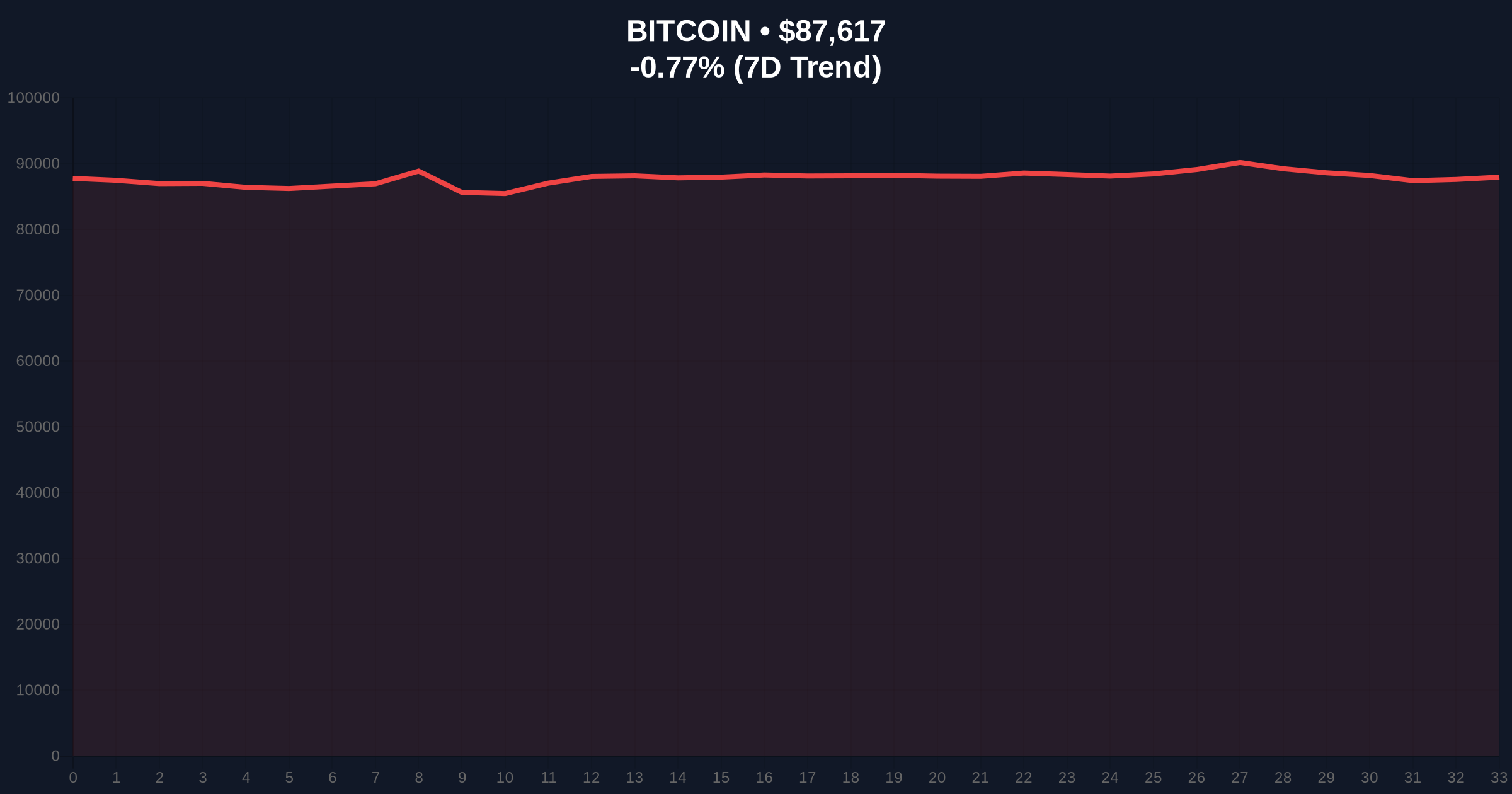

Price action currently shows Bitcoin trading at $87,617, down 0.77% in 24 hours, with the global crypto sentiment index at "Extreme Fear" (score 24/100). Market structure suggests key support at the Fibonacci 0.618 retracement level of $82,000, a critical order block from Q4 2024. Resistance is identified at $92,000, corresponding to a fair value gap (FVG) formed during November's volatility. The RSI sits at 42, indicating neutral momentum without oversold conditions, while the 50-day moving average at $85,000 provides dynamic support. Volume profile analysis reveals low activity near current levels, suggesting a potential gamma squeeze if bullish catalysts emerge. Bullish invalidation is set at $80,000, a breach of which would negate the decoupling thesis, while bearish invalidation lies at $95,000, above which a full recoupling with equities might occur.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $87,617 |

| 24-Hour Trend | -0.77% |

| Nasdaq 100 Underperformance (YTD) | Approximately 50% |

| Global Crypto Sentiment Score | 24/100 (Extreme Fear) |

| RSI (Relative Strength Index) | 42 |

For institutions, this decoupling signals a potential alpha opportunity; if Bitcoin rebounds as Schussler predicts, early positioning could yield significant returns, similar to gains seen in 2021 when it outperformed tech stocks by over 200%. Retail investors, however, face heightened volatility, with extreme fear sentiment often preceding sharp reversals—data from past cycles shows such periods correlate with 30%+ rallies within months. The broader impact hinges on macroeconomic policies; increased liquidity supply, as noted by Schussler, could accelerate Bitcoin's adoption as a digital gold, reshaping portfolio allocations. This dynamic matters for the 5-year horizon because sustained decoupling may reinforce Bitcoin's role as an uncorrelated asset, reducing systemic risk in diversified holdings and driving long-term capital inflows from traditional finance.

Industry leaders on X/Twitter have echoed Schussler's views, with analysts highlighting the decoupling as a bullish divergence. One trader noted, "Bitcoin's detachment from Nasdaq is a classic accumulation signal—whales are buying the dip." Others caution that without a catalyst like EIP-4844 adoption for Ethereum, the trend may stall. Market sentiment remains split, with bears pointing to persistent regulatory uncertainties, but bulls emphasize historical precedents where decoupling preceded major rallies, such as in early 2020.

Bullish Case: If the decoupling persists and macroeconomic conditions worsen, Bitcoin could rally to $120,000 by mid-2026, driven by liquidity inflows and hedge fund repositioning. This scenario assumes a break above $92,000 resistance and sustained on-chain accumulation, similar to the 2021 surge post-decoupling.

Bearish Case: If recoupling occurs due to improved risk appetite or policy shifts, Bitcoin might retest support at $75,000, exacerbated by a liquidity grab from equities. This would invalidate Schussler's thesis, potentially leading to a prolonged consolidation phase.

What is Bitcoin's decoupling from the Nasdaq 100? It refers to Bitcoin underperforming the Nasdaq 100 index by approximately 50% this year, indicating reduced correlation with tech stocks.

Why does decoupling signal a potential rally? Historical patterns, such as in 2021, show that decoupling often precedes strong rebounds as Bitcoin attracts capital as a hedge against fiat debasement.

What is the "debasement trade"? It involves investing in assets like Bitcoin to hedge against the falling value of fiat currencies due to inflation or excessive money printing.

How does government spending affect Bitcoin? Increased spending can lead central banks to supply more liquidity, which may drive capital into scarce assets like Bitcoin, as suggested by Schussler.

What are key technical levels to watch? Support at $82,000 (Fibonacci level) and resistance at $92,000, with invalidation levels at $80,000 (bullish) and $95,000 (bearish).

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.