Loading News...

Loading News...

VADODARA, January 28, 2026 — Solana's validator network has collapsed to levels not seen since 2021. Daily crypto analysis reveals a critical drop below 800 active validators. This marks a 65% decline from its early 2023 peak of approximately 2,500. The Block reported this data, attributing the plunge to fading subsidies for smaller operators.

On-chain forensic data confirms the validator count now sits under 800. This level last occurred in 2021. The decline accelerated over the past year. According to The Block, diminished incentives drove the exodus. Subsidies like voting cost support and staking matching policies have decreased. Consequently, smaller validators found operations economically unviable. Market structure suggests a liquidity grab from larger entities. This consolidation risks centralizing the network's proof-of-stake security model.

Historically, validator count correlates with network health. A high count disperses stake and enhances security. In contrast, Solana's drop mirrors past blockchain stress events. For example, Ethereum faced similar issues pre-merge with high gas costs pushing out smaller validators. Underlying this trend is a broader market fear. The Global Crypto Fear & Greed Index hit 29, indicating extreme caution. This sentiment aligns with other market stresses, such as the recent Bitcoin break below $89,000 amid similar fear levels.

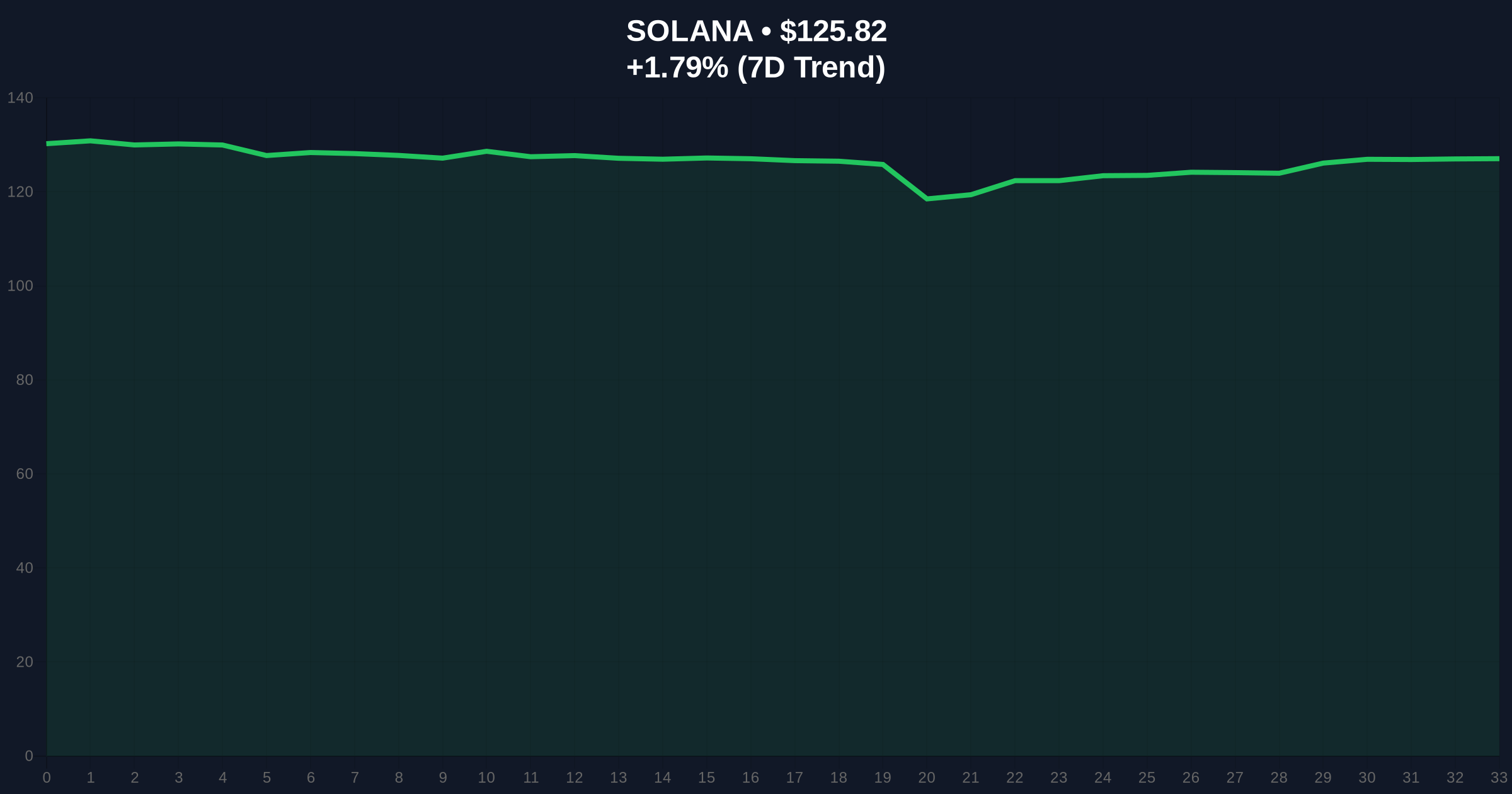

Solana's current price is $125.82, up 1.79% in 24 hours. However, technical indicators flash warning signs. The Relative Strength Index (RSI) sits at 45, showing neutral momentum. A critical Fibonacci 0.618 support level rests at $115. This level must hold to prevent a deeper correction. , the 50-day moving average at $130 acts as resistance. Order block analysis reveals a fair value gap between $120 and $135. Invalidating this gap requires sustained buying pressure. On-chain data indicates weakening network security metrics. This could pressure SOL's valuation long-term.

| Metric | Value | Context |

|---|---|---|

| Current Validator Count | <800 | Down 65% from 2023 peak |

| SOL Price | $125.82 | +1.79% (24h) |

| Market Rank | #6 | By market capitalization |

| Crypto Fear & Greed Index | 29/100 (Fear) | Global sentiment indicator |

| Key Support Level | $115 | Fibonacci 0.618 level |

Validator count directly impacts network security. A lower count increases risk of 51% attacks. According to Ethereum's official documentation on proof-of-stake, decentralization is critical for attack resistance. Solana's drop threatens this principle. Institutional liquidity cycles favor robust networks. Retail market structure may react negatively. This event could trigger a reevaluation of Solana's long-term viability. , it highlights the fragility of subsidy-dependent validator ecosystems.

"The validator decline is a structural red flag. Market structure suggests security degradation. Without intervention, Solana's network could face increased centralization risks. This mirrors past cycles where shrinking validator sets preceded security incidents."

Two data-backed scenarios emerge from current market structure.

Historical cycles suggest a 12-month outlook hinges on network fixes. If subsidies return or protocol changes reduce costs, validator count could stabilize. Otherwise, continued decline may erode Solana's market position. This aligns with a 5-year horizon where security and decentralization dominate institutional criteria.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.