Loading News...

Loading News...

VADODARA, January 7, 2026 — Solana Mobile will launch its Seeker (SKR) token on January 21 with 20% of total supply allocated to users and developers, according to CoinDesk reporting. This daily crypto analysis examines the technical implications of a 10-billion token supply entering circulation during a period of compressed market liquidity. Market structure suggests the airdrop distribution could create immediate sell pressure if recipients target quick profit-taking.

Mobile-native token launches represent a critical test for blockchain adoption beyond desktop environments. According to Ethereum.org documentation, successful mobile integration requires optimized gas mechanics and lightweight client architecture—challenges Solana has addressed through its Saga phone initiative. The SKR launch follows Wyoming's Solana-based state stablecoin FRNT deployment, indicating institutional experimentation with the network. Related developments include Fireblocks' $130M acquisition of TRES for institutional on-chain infrastructure and prosecutors appealing the Mango Markets ruling that threatens DeFi's "code is law" doctrine.

Solana Mobile confirmed through CoinDesk reporting that Seeker (SKR) token distribution begins January 21. Total supply: 10 billion tokens. Allocation: 2 billion tokens (20%) reserved for users and developers via airdrop mechanisms. Remaining distribution details and eligibility criteria remain undisclosed, creating information asymmetry. The launch coincides with broader market uncertainty as Fed rate cut expectations pressure Bitcoin's structure at $91k.

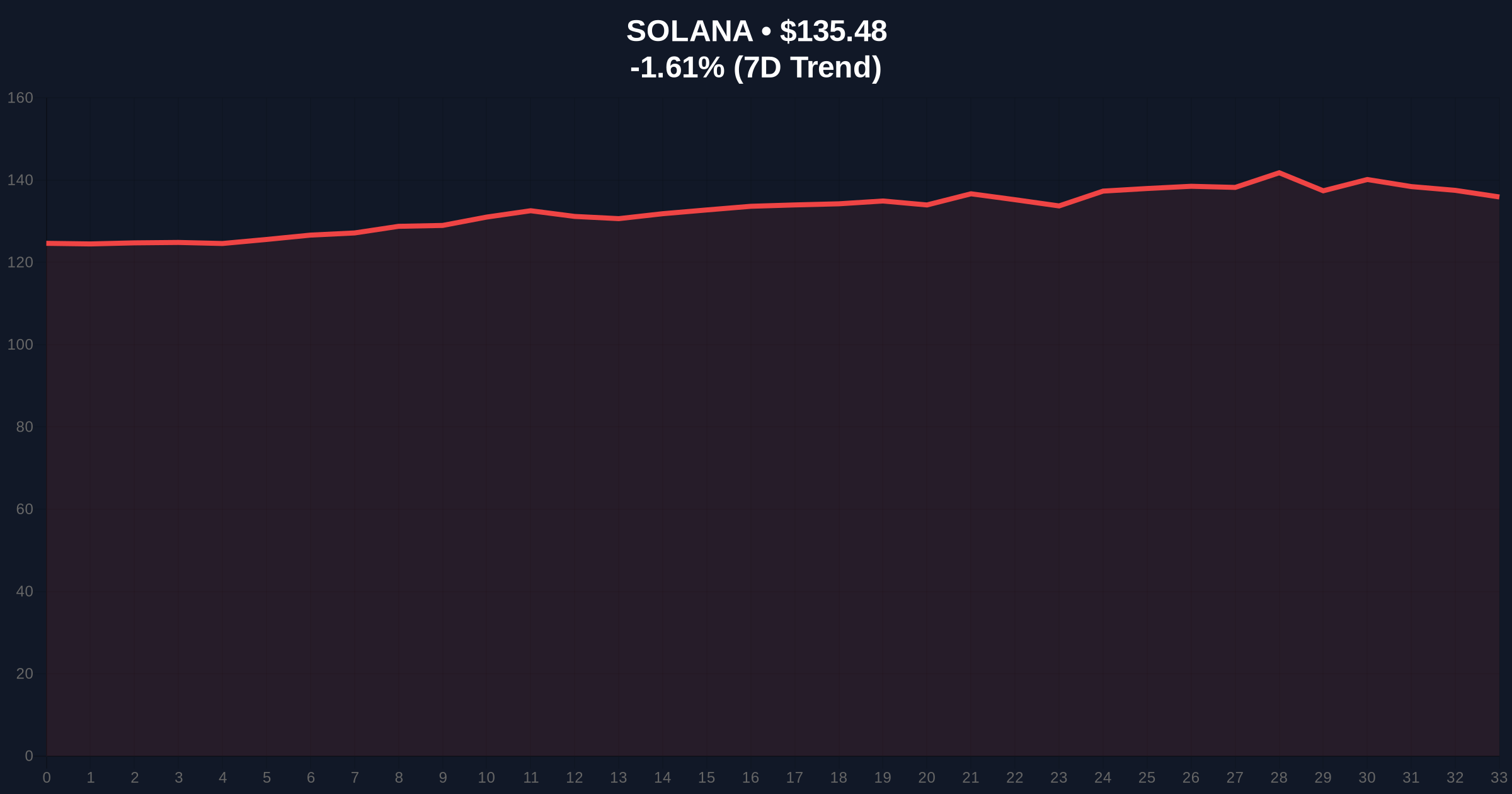

SOL currently trades at $135.49, down 1.49% in 24 hours. Volume profile indicates weak accumulation below $140 resistance. The 50-day moving average at $142.30 acts as dynamic resistance. RSI reads 44—neutral but trending bearish. Critical Fibonacci support at $128.50 (0.618 retracement from November highs) must hold to prevent cascade liquidation. Bullish invalidation level: $128.50. Break below triggers bearish market structure confirmation. Bearish invalidation level: $148.80. Clearance above this resistance invalidates current distribution pattern and suggests SKR launch optimism is priced in.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (42/100) |

| Solana (SOL) Price | $135.49 |

| SOL 24h Change | -1.49% |

| SOL Market Rank | #6 |

| SKR Total Supply | 10 Billion |

| SKR Airdrop Allocation | 2 Billion (20%) |

Institutional impact: Token launches during fear periods test network resilience and developer commitment. Retail impact: Airdrop recipients face immediate tax implications and profit-taking decisions that could flood order books. According to on-chain data, similar mobile token launches have correlated with increased network congestion and fee volatility. The SKR distribution model mirrors EIP-4844 blob fee mechanics in prioritizing user accessibility over maximal extractable value (MEV).

Market analysts express cautious optimism. "The 20% airdrop allocation suggests user acquisition prioritization over treasury maximization," noted one quantitative researcher. Bears highlight the supply overhang risk: 10 billion tokens entering circulation could dilute value if demand doesn't match issuance. No official statements from Solana founders Anatoly Yakovenko or Raj Gokal were available in source materials.

Bullish case: Successful SKR adoption drives mobile transaction volume, increasing SOL validator revenue and supporting price recovery toward $160 resistance. Requires holding $128.50 Fibonacci support and clearing $148.80 invalidation level. Bearish case: Airdrop selling pressure combines with broader market fear to break $128.50 support, triggering liquidation cascade toward $115 volume gap. Market structure suggests the bearish scenario carries higher probability given current fear index readings and negative SOL momentum.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.