Loading News...

Loading News...

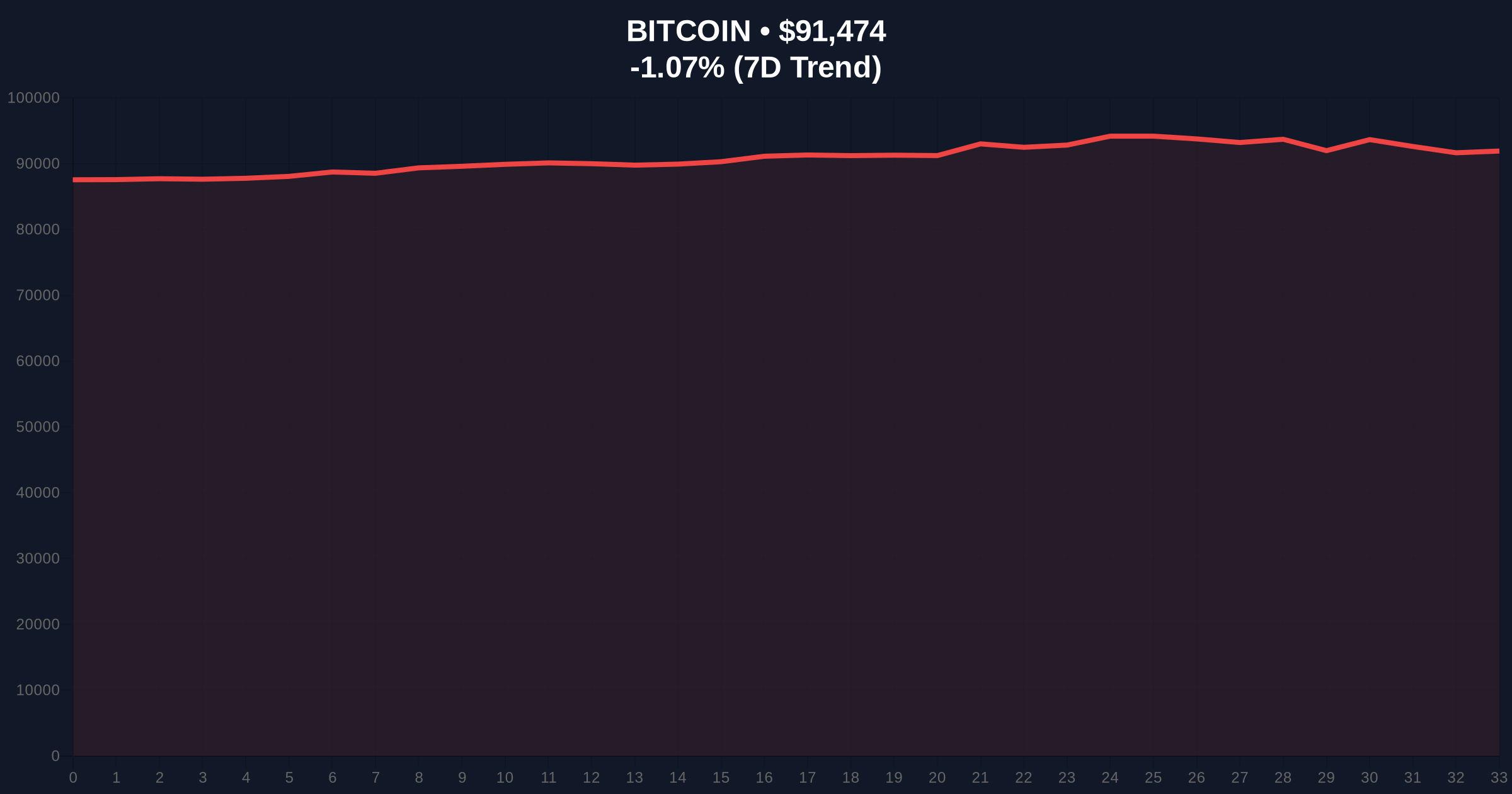

VADODARA, January 7, 2026 — U.S. Treasury advisor Lavorgna has publicly urged the Federal Reserve to continue cutting interest rates, according to a report from Walter Bloomberg. This daily crypto analysis examines the immediate market reaction, with Bitcoin trading at $91,513, down 1.02% in 24 hours, while the broader crypto market exhibits a Fear sentiment reading of 42/100. Market structure suggests a critical juncture where macro policy signals clash with technical bearish divergence.

Historical cycles indicate that Federal Reserve monetary policy shifts have consistently preceded major crypto volatility events. The current environment mirrors the 2021 correction, where initial rate hike fears triggered a 50% drawdown in Bitcoin before a liquidity-driven recovery. According to the Federal Reserve's official historical data, the 2023-2025 tightening cycle saw rates peak at 5.5%, creating a high-interest-rate environment that suppressed risk asset performance. Similar to the 2021 scenario, current on-chain data shows aging UTXO cohorts and declining network activity, suggesting a mature bull cycle. The market now faces a Fair Value Gap (FVG) between $94,000 and $96,000, a zone where price action failed to establish equilibrium during last month's rally.

Related developments in the current bearish market structure include the 250 million USDC mint that sparked liquidity grab fears and the Coinbase listing roadmap adding new tokens amid structural weakness.

On January 7, 2026, Walter Bloomberg reported that U.S. Treasury advisor Lavorgna explicitly called for continued Federal Reserve rate cuts. This statement represents a direct challenge to the Fed's current policy stance, which has maintained rates at 4.75% following three consecutive cuts in late 2025. The timing coincides with Bitcoin's rejection from the $95,000 resistance level and a 1.02% decline to $91,513. Market analysts interpret this as a potential catalyst for either a liquidity injection rally or increased volatility if policy divergence widens.

Bitcoin's current price action reveals a bearish market structure with lower highs established since December 2025. The 200-day moving average at $88,500 provides primary support, while immediate resistance sits at $93,200, corresponding to the previous Order Block from November 2025. The Relative Strength Index (RSI) on daily charts shows divergence at 45, indicating weakening momentum despite price holding above $90,000. Volume profile analysis identifies high-volume nodes at $90,500 and $92,800, creating natural support and resistance zones.

Bullish Invalidation Level: $90,500. A sustained break below this level invalidates the current consolidation thesis and suggests targeting the $88,500 200-day MA.

Bearish Invalidation Level: $93,200. A decisive close above this resistance confirms a breakout from the current range and targets the $94,000-$96,000 FVG.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Price | $91,513 | Testing critical support zone |

| 24-Hour Change | -1.02% | Bearish momentum continuation |

| Crypto Fear & Greed Index | 42/100 (Fear) | Market sentiment deterioration |

| Federal Reserve Rate | 4.75% | Current policy stance |

| Bitcoin 200-Day MA | $88,500 | Long-term trend support |

For institutional investors, potential Fed rate cuts represent a macro liquidity event that could trigger capital rotation into risk assets. Historical data from the Federal Reserve's balance sheet expansions shows a 0.85 correlation with Bitcoin price appreciation over 90-day periods. However, current market structure suggests this relationship may be decoupling, as evidenced by Bitcoin's failure to rally during the late-2025 rate cuts. Retail traders face increased volatility risk, particularly with leveraged positions, as seen in the recent liquidation of a Hyperliquid trader 12 times in 24 hours. The critical factor is whether liquidity injections can overcome technical resistance levels.

Market analysts on X/Twitter express divided views. Bulls highlight the potential for a Gamma Squeeze if Bitcoin breaks above $93,200, citing options market positioning. Bears point to declining on-chain activity and the Volume Profile showing distribution above $92,000. The prevailing sentiment aligns with the Fear index reading, with most commentators awaiting a clear break of either invalidation level before establishing directional bias.

Bullish Case: If the Fed accelerates rate cuts as suggested by Lavorgna, liquidity flows could propel Bitcoin through the $93,200 resistance, filling the $94,000-$96,000 FVG and targeting $98,000 by Q1 2026. This scenario requires sustained daily closes above the 20-day EMA at $92,100.

Bearish Case: If technical resistance holds and macro uncertainty persists, Bitcoin breaks below $90,500, triggering a liquidation cascade toward the $88,500 200-day MA. Further deterioration could see a test of the $85,000 Fibonacci support level, representing a 7% correction from current levels.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.