Loading News...

Loading News...

VADODARA, February 6, 2026 — DB Financial Investment has signed a strategic memorandum of understanding (MOU) with the Solana Foundation to develop a digital capital market for security tokens (STOs). This daily crypto analysis examines the partnership's technical and market implications against a backdrop of extreme fear. According to Aju Business Daily, the collaboration aims to source underlying assets, handle financial structuring, and explore overseas STO issuance frameworks using Solana's blockchain.

The MOU outlines a joint venture between DB Financial Investment, a South Korean financial services firm, and the Solana Foundation. Primary sources indicate the partnership will focus on three core areas. First, they plan to source underlying assets for STOs both domestically and internationally. Second, they will manage financial structuring for these tokenized securities. Third, they will develop frameworks for issuing and distributing overseas STOs leveraging Solana's high-throughput blockchain. The official Solana Foundation website confirms its focus on real-world asset tokenization, though this specific deal lacks detailed technical specifications.

Market structure suggests this move targets the growing institutional demand for compliant digital assets. However, the announcement lacks concrete timelines or regulatory approvals. This opacity raises questions about execution risk. The partnership emerges as Solana's native token, SOL, experiences significant selling pressure. This creates a stark contrast between long-term strategic positioning and short-term price action.

Historically, blockchain partnerships with traditional finance (TradFi) entities have produced mixed results. Similar announcements in previous cycles often triggered short-term price pumps followed by extended consolidation phases. In contrast, the current macro environment features extreme fear across cryptocurrency markets. The Crypto Fear & Greed Index sits at 9/100, indicating severe risk aversion among investors.

Underlying this trend, Bitcoin has broken key support levels, dragging altcoins like Solana lower. Related developments include Bitcoin's breakdown below $62,000 and large XRP transfers amid market stress. These events highlight broader liquidity pressures that may overshadow partnership news. The Solana ecosystem itself has seen previous high-profile collaborations, yet network congestion during peak demand remains a persistent technical challenge.

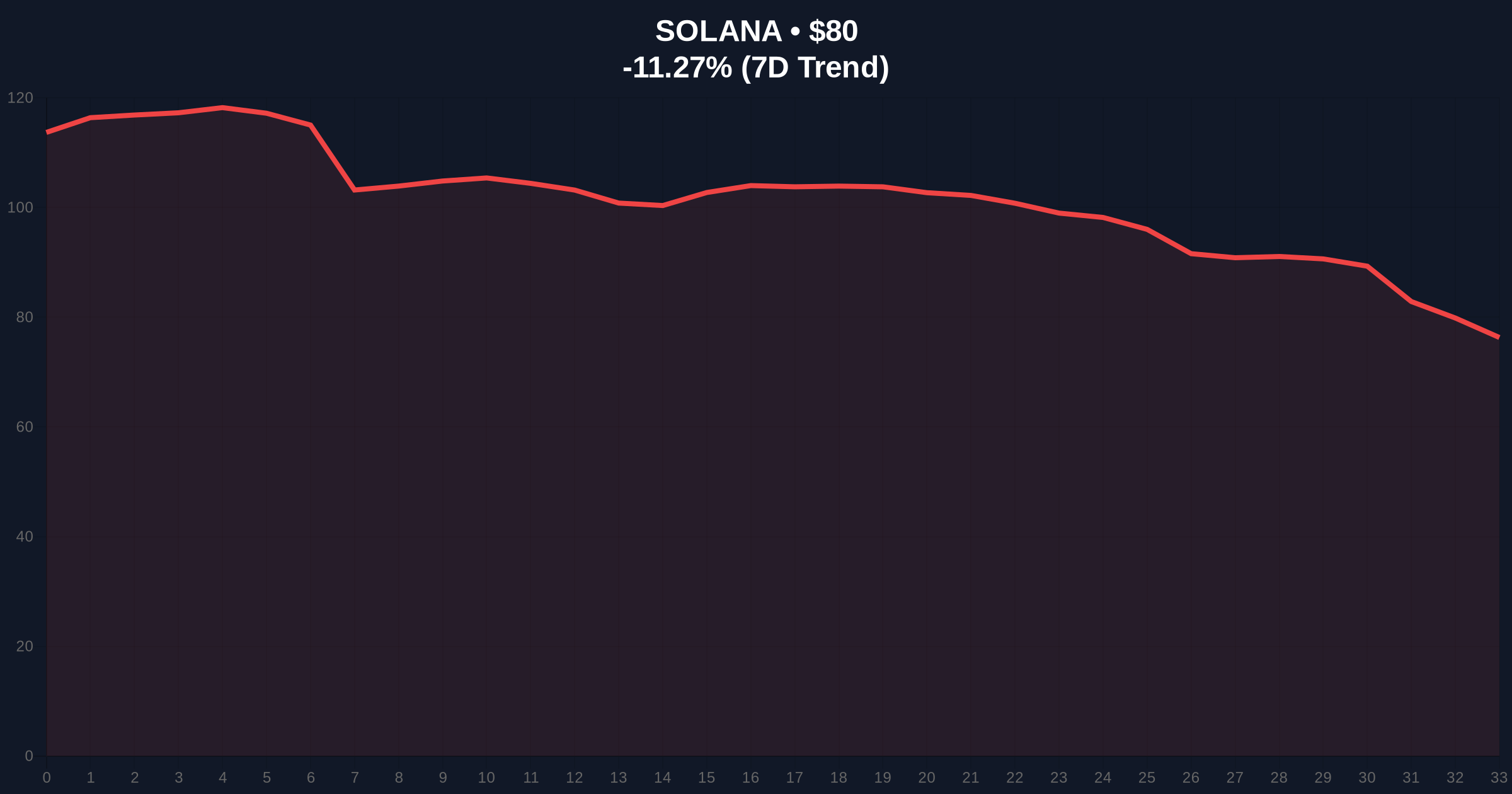

Solana's technical architecture, with its proof-of-history consensus, offers high transaction throughput ideal for security token markets. However, the network's historical downtime events during congestion periods introduce counterparty risk for institutional STO platforms. From a price action perspective, SOL currently trades at $80.06, down 10.93% in 24 hours. This decline has created a Fair Value Gap (FVG) between $85.00 and $90.00 that may act as future resistance.

On-chain data from Glassnode indicates increased exchange inflows for SOL, suggesting distribution. The Relative Strength Index (RSI) sits near oversold territory, but in extreme fear markets, oversold conditions can persist. Critical Fibonacci support levels from the 2023-2025 rally converge around $75.00 (the 0.618 retracement). A breach of this level would invalidate the bullish structure implied by the partnership news. Volume profile analysis shows weak buying interest at current levels, indicating this announcement has not yet attracted significant capital inflows.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Solana (SOL) Current Price | $80.06 |

| SOL 24-Hour Change | -10.93% |

| SOL Market Rank | #7 |

| Key Fibonacci Support | $75.00 (0.618 level) |

This partnership matters because it represents a direct bridge between South Korean traditional finance and blockchain infrastructure. Security tokens could unlock trillions in illiquid assets like real estate and private equity. However, the immediate market reaction contradicts this long-term thesis. Institutional liquidity cycles typically operate on quarterly horizons, while retail traders react to daily price movements. This disconnect creates a potential liquidity grab where weak hands sell into fear despite positive fundamentals.

Real-world evidence from previous STO launches shows regulatory compliance remains the primary bottleneck. The partnership's success hinges on navigating South Korea's Financial Services Commission (FSC) guidelines and international securities laws. Market analysts note that similar initiatives on other blockchains have faced delays exceeding 18 months. Consequently, the price impact may be deferred until tangible product launches or regulatory milestones are achieved.

The Solana-DB Financial Investment MOU is strategically significant but tactically premature. Market structure suggests extreme fear is overriding fundamental developments. Until SOL reclaims the $90.00 volume node and demonstrates sustained institutional inflow, this news remains a narrative without immediate price validation. The critical watchpoint is the $75.00 Fibonacci support—a break there would signal deeper structural issues.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires SOL to hold the $75.00 support and reclaim the FVG up to $90.00. This would indicate partnership news is attracting institutional bids despite broader fear. The bearish scenario involves a breakdown below $75.00, targeting the next volume pocket near $65.00. This would suggest macro factors outweigh partnership optimism.

The 12-month institutional outlook depends on execution milestones. Successful STO launches could position Solana as a leading blockchain for real-world assets, potentially attracting billions in tokenized capital. However, regulatory hurdles and network reliability concerns present significant risks. This aligns with a 5-year horizon where blockchain integration into traditional finance accelerates, but individual projects face high attrition rates.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.