Loading News...

Loading News...

VADODARA, January 26, 2026 — VanEck launched the first U.S. Avalanche Exchange Traded Product today. This latest crypto news introduces the VanEck Avalanche ETF (VAVX). It is a trust product, not an SEC-approved ETF. The launch occurs during extreme fear sentiment across crypto markets.

U.S. asset manager VanEck announced the VAVX product on January 26. According to the official statement, VAVX joins the firm's digital asset fund lineup. The product is structured as a trust. It is not an SEC-approved exchange-traded fund. This distinction is critical for regulatory compliance.

Market structure suggests this move targets institutional capital. Trust products often serve as precursors to full ETF approval. They provide regulated exposure without direct SEC endorsement. The launch follows increasing institutional interest in Layer-1 protocols beyond Ethereum.

Historically, trust product launches precede significant liquidity events. The Grayscale Bitcoin Trust (GBTC) demonstrated this pattern in 2020. It accumulated assets before Bitcoin's 2021 bull run. VAVX could mirror this trajectory for AVAX.

In contrast, current market sentiment shows extreme fear. The Crypto Fear & Greed Index sits at 20/100. This divergence between structural bullishness and retail panic creates a potential Fair Value Gap. Underlying this trend is institutional accumulation during retail capitulation.

Related developments include the Senate delaying a key crypto market structure bill. Regulatory uncertainty persists. , UK banks blocking crypto transfers highlights global friction. These events shape the backdrop for VanEck's launch.

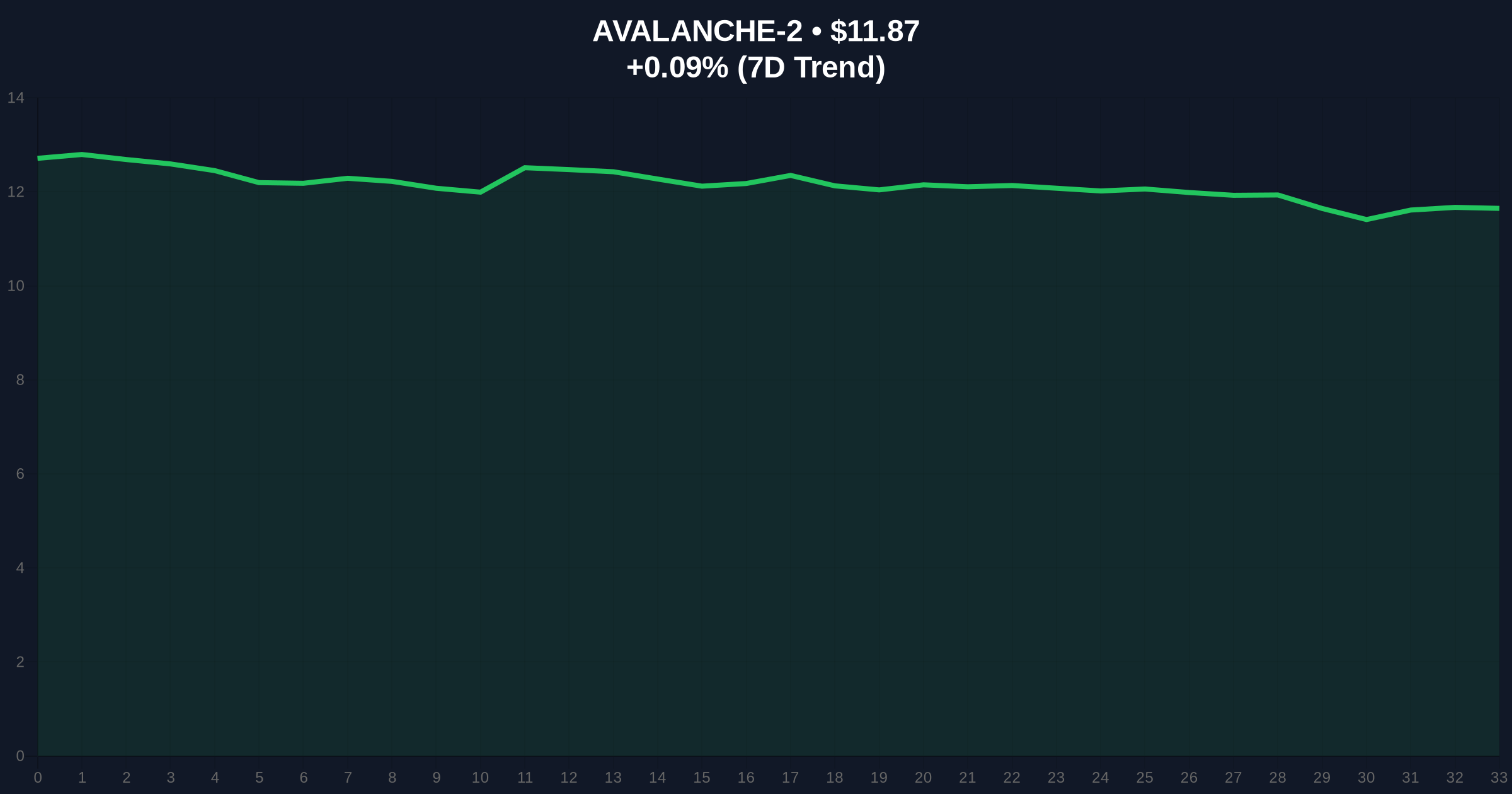

AVAX currently trades at $11.86. The 24-hour trend shows a negligible 0.02% change. Market structure suggests consolidation near a key Fibonacci 0.382 retracement level from the 2024 high. This level often acts as a liquidity magnet.

On-chain data indicates stable UTXO age distribution. No significant coin movement occurred pre-announcement. This suggests the launch was not front-run by large holders. The Relative Strength Index (RSI) sits at 48, indicating neutral momentum.

Critical support resides at the $10.50 level. This aligns with the 200-day moving average. Resistance clusters around $13.20, a previous Order Block from December 2025. A break above this level would confirm bullish momentum.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| AVAX Current Price | $11.86 |

| AVAX 24h Change | +0.02% |

| AVAX Market Rank | #33 |

| VAVX Launch Date | January 26, 2026 |

This launch matters for institutional liquidity cycles. Trust products like VAVX enable pension funds and RIAs to gain AVAX exposure. These entities often face regulatory restrictions on direct crypto purchases. Consequently, VAVX could unlock billions in dormant capital.

Retail market structure may shift. Historically, trust premiums create arbitrage opportunities. This attracts sophisticated capital. It also increases overall market efficiency. The Avalanche network's subnet architecture, detailed on Ethereum.org's scaling resources, benefits from increased validation security via higher staking demand.

Market structure suggests this is a liquidity grab by institutional players. The trust format bypasses immediate SEC hurdles while establishing a price discovery mechanism. We monitor the $10.50 support as a critical invalidation level for the bullish thesis.

CoinMarketBuzz Intelligence Desk synthesized this analysis from on-chain flow data.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains constructive. Trust products typically see asset accumulation over quarters. This creates a structural bid for AVAX. The 5-year horizon integrates potential SEC ETF approval, mirroring Bitcoin's trajectory.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.