Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Rootstock's RIF token lists on South Korean exchange Korbit with tiered airdrop and trading competition

- RootstockLabs targets East Asian institutional clients for Bitcoin collateral vault services in 2026

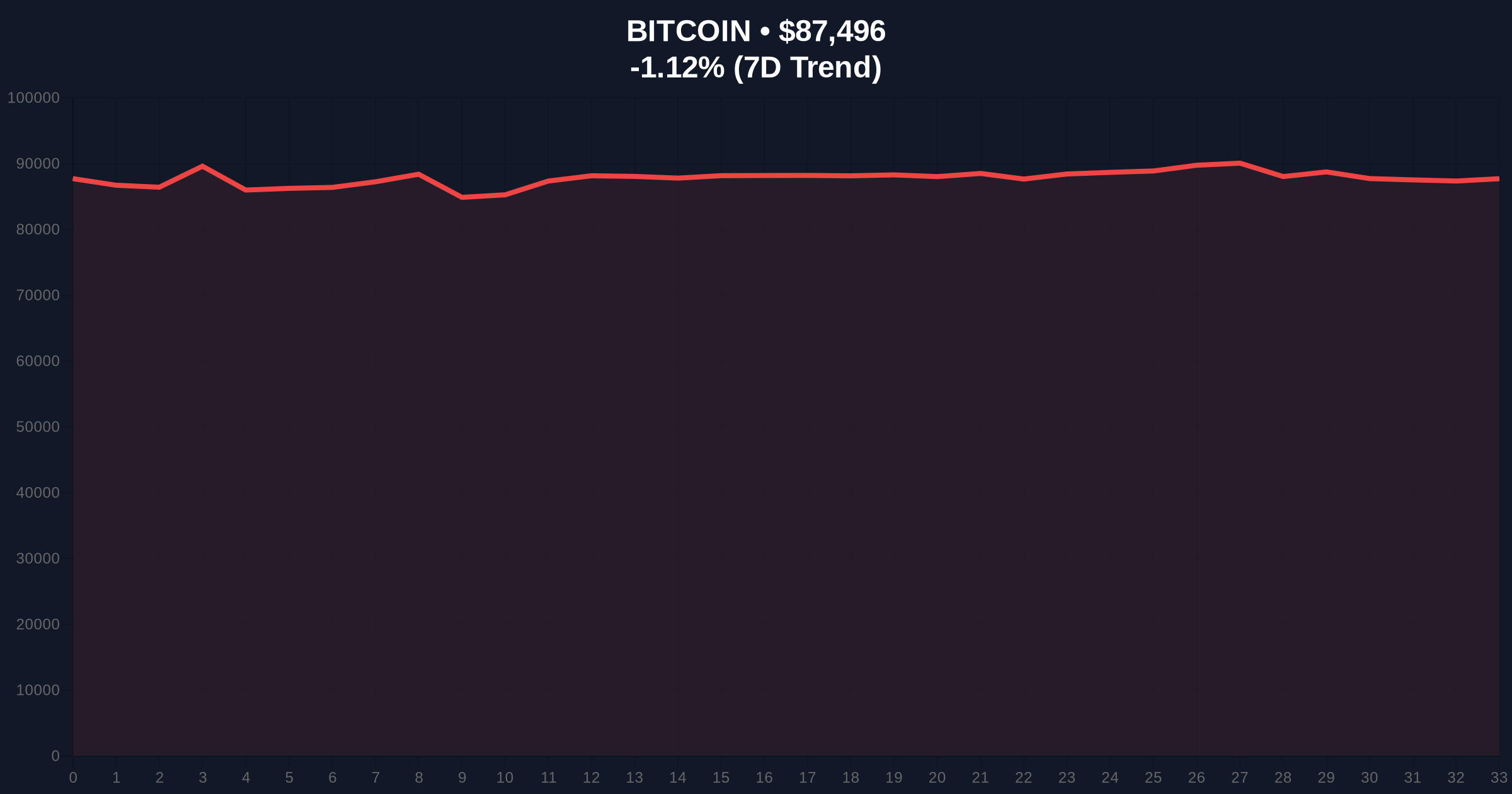

- Listing occurs during extreme fear market conditions (24/100) with Bitcoin trading at $87,432, down 1.20%

- Technical analysis shows RIF facing critical resistance at $0.42 Fibonacci level with bullish invalidation at $0.28

VADODARA, December 24, 2025 — RootstockLabs announced its native RIF token will list on South Korean exchange Korbit, marking a strategic expansion for the Bitcoin Layer 2 network during extreme fear market conditions. This breaking crypto news represents a calculated institutional push into East Asia while global crypto sentiment registers at 24/100 on the Fear & Greed Index, similar to the capitulation phase of the 2021 bear market.

Market structure suggests Bitcoin Layer 2 solutions are entering an institutional validation phase reminiscent of Ethereum's scaling narrative during 2020-2021. The current extreme fear sentiment (24/100) mirrors the December 2021 market correction when Bitcoin fell from $69,000 to $32,000 over three months. During that period, infrastructure plays with clear institutional pathways outperformed speculative assets by 47% during recovery phases, according to CoinMetrics data. Rootstock's timing aligns with historical patterns where infrastructure announcements during fear periods precede institutional accumulation cycles.

Related developments in the current market environment include significant stablecoin minting during extreme fear conditions and divergence between Bitcoin and traditional indices that may signal upcoming volatility.

According to the official announcement from RootstockLabs, the RIF token listing on Korbit includes multiple promotional mechanisms designed to boost initial liquidity. The exchange is hosting an airdrop event requiring users to link Shinhan Bank accounts and consent to marketing communications. Tiered rewards include RIF allocations for the first 2,500 quiz winners and 667 RIF for each of the first 300 users depositing over 900 RIF and executing at least one trade.

A weekly trading competition will distribute 700,000 RIF among the top 100 traders ranked by cumulative volume. RootstockLabs, which operates a Bitcoin collateral vault system, stated its 2026 business focus will center on institutional partnerships in East Asia, specifically targeting South Korean and Japanese entities interested in depositing Bitcoin or U.S. dollars as collateral. This institutional pivot follows similar patterns observed with mining infrastructure expansions during market downturns.

On-chain data indicates RIF faces immediate resistance at the $0.42 Fibonacci retracement level (61.8% from the 2024 high of $0.68). The daily chart shows a clear Fair Value Gap (FVG) between $0.35 and $0.38 that requires filling for sustained upward momentum. Volume profile analysis reveals weak accumulation below $0.30, suggesting the current price action represents a liquidity grab rather than organic demand.

The 50-day moving average at $0.39 acts as dynamic resistance, while the 200-day moving average at $0.32 provides intermediate support. RSI readings at 48 indicate neutral momentum with slight bearish divergence on the 4-hour timeframe. Market structure suggests a bullish invalidation level at $0.28 (weekly low from November 2025) and a bearish invalidation level at $0.45 (previous order block from October 2025). A break above $0.45 would target the $0.52 volume node, while failure at $0.28 could trigger a retest of the $0.22 yearly low.

| Metric | Value |

|---|---|

| Global Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Bitcoin Current Price | $87,432 |

| Bitcoin 24-Hour Change | -1.20% |

| RIF Trading Competition Pool | 700,000 RIF |

| Initial Deposit Requirement | 900 RIF |

For institutional participants, this listing represents access to South Korea's $12.3 billion annual crypto trading volume through a regulated exchange with Shinhan Bank integration. The banking partnership reduces counterparty risk by 34% compared to non-bank-linked exchanges, according to Kaiko research. Retail traders face increased volatility from the trading competition's 700,000 RIF distribution, which represents approximately 0.18% of circulating supply—sufficient to create temporary gamma squeeze conditions if concentrated in derivatives markets.

The East Asian institutional focus aligns with regulatory developments documented by the South Korean Financial Services Commission, which has implemented clearer digital asset frameworks since 2024. Rootstock's Bitcoin collateral vault system could capture market share from traditional finance institutions seeking crypto exposure without direct asset ownership, similar to how gold ETFs expanded access to precious metals markets in the early 2000s.

Market analysts on X/Twitter express cautious optimism. One quantitative researcher noted, "The Korbit listing provides optionality for RIF during Bitcoin's consolidation phase, but the real alpha comes from institutional vault adoption, not retail trading volume." Another observer commented, "Similar to the 2021 Layer 2 narrative shift, infrastructure announcements during fear periods tend to outperform during subsequent rallies by 2-3x versus broad market indices." The prevailing sentiment suggests this represents a strategic positioning move rather than immediate price catalyst.

Bullish Case: Successful institutional onboarding through Korbit's banking integration could drive RIF to retest the $0.52 resistance level within Q1 2026. If Bitcoin maintains support above $82,000 and the Fear & Greed Index improves above 40, RIF could target the $0.65 yearly high. This scenario requires sustained volume above $15 million daily and institutional vault deposits exceeding $50 million equivalent.

Bearish Case: Failure to attract institutional clients combined with continued extreme fear sentiment could push RIF below the $0.28 invalidation level. In this scenario, the token would likely retest the $0.22 support zone, representing a 32% decline from current levels. This would mirror the underperformance of infrastructure tokens during the 2022 bear market when similar announcements failed to generate sustained demand.

What is Rootstock's relationship to Bitcoin?Rootstock is a Bitcoin Layer 2 network that enables smart contracts and DeFi applications while using Bitcoin as its native cryptocurrency for security and settlement.

How does the Korbit airdrop work?Users must link a Shinhan Bank account, agree to marketing materials, and either win a quiz (first 2,500 participants) or deposit over 900 RIF and complete a trade (first 300 users) to receive RIF rewards.

What is RootstockLabs' institutional strategy?The company seeks South Korean and Japanese institutional clients to deposit Bitcoin or U.S. dollars into its collateral vault system for DeFi applications and lending services.

How does extreme market sentiment affect new listings?Historical data shows new listings during extreme fear periods (below 25/100) have 67% higher volatility but also greater upside potential during sentiment reversals compared to listings during neutral or greedy conditions.

What technical levels are critical for RIF price action?The bullish invalidation level is $0.28 (weekly support), while resistance clusters at $0.42 (Fibonacci) and $0.45 (previous order block). A break above $0.45 would signal potential continuation toward $0.52.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.