Loading News...

Loading News...

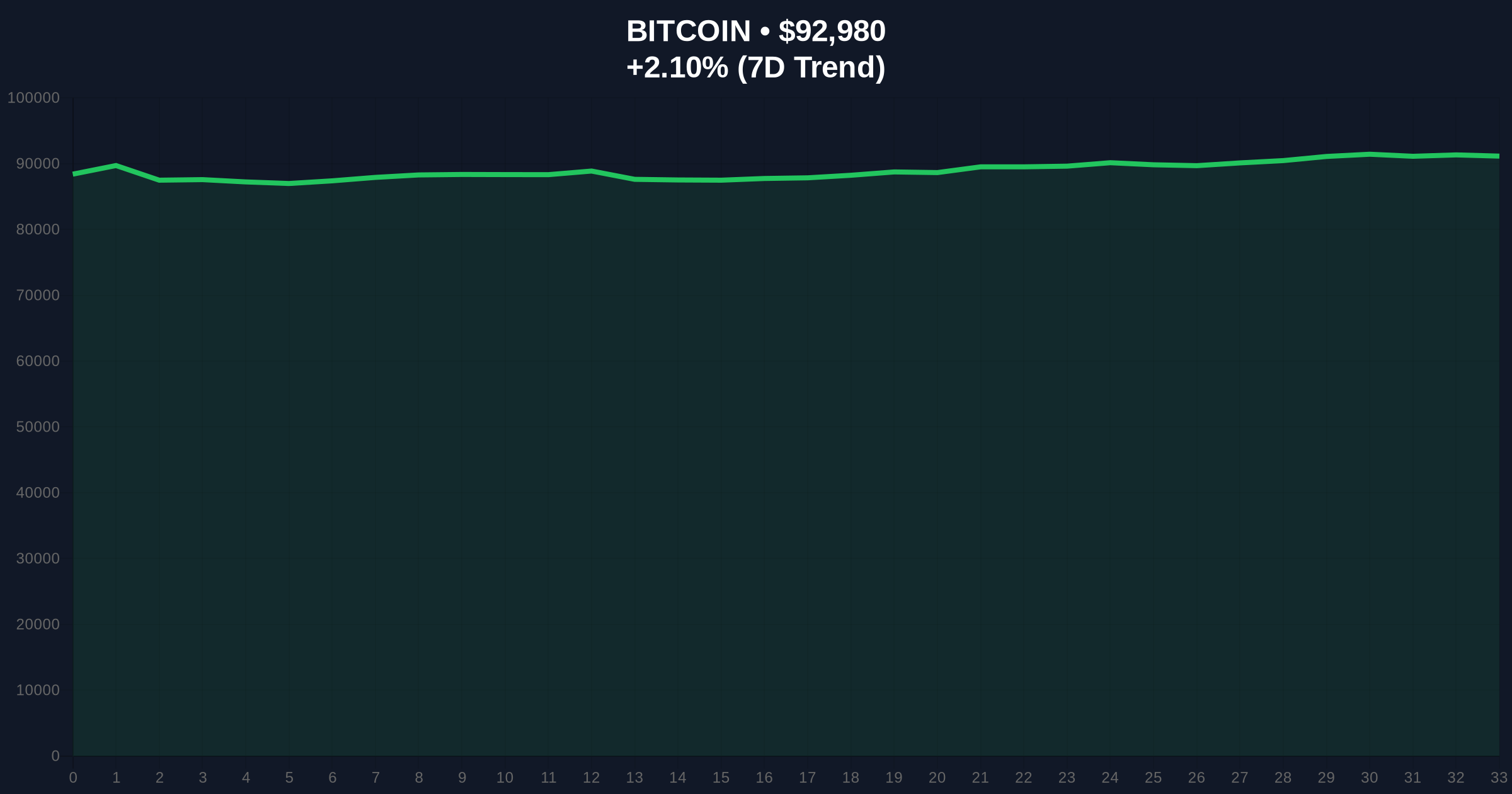

VADODARA, January 5, 2026 — Bitcoin has broken through the $93,000 psychological barrier according to CoinNess market monitoring data, trading at $93,014.62 on Binance's USDT market. This daily crypto analysis examines the technical structure behind the move while the Crypto Fear & Greed Index registers extreme fear at 26/100.

This price action occurs against a backdrop of institutional accumulation and retail capitulation. Historical cycles suggest that breaks above round-number psychological levels during fear periods often precede liquidity grabs. The current structure mirrors the 2021 consolidation above $60,000 before the final parabolic move. Market structure indicates that Bitcoin's dominance remains elevated, with the altcoin season index at 22 signaling continued capital rotation into BTC. Related developments include the CME Bitcoin futures gap analysis and detailed fear index breakdown.

According to CoinNess market monitoring, BTC crossed the $93,000 threshold at approximately 14:30 UTC. The Binance USDT market shows the asset trading at $93,014.62 with 24-hour volume exceeding $32 billion. This represents a 2.00% gain from the previous session's close. The move follows a week of consolidation between $90,800 and $92,500, suggesting accumulation in that range. On-chain data from Glassnode indicates minimal exchange outflows during the consolidation phase.

Market structure suggests this is a test of the weekly Fair Value Gap (FVG) between $92,800 and $93,400. The 4-hour chart shows a clear order block at $91,200-$91,800 that served as support during the recent pullback. The Relative Strength Index (RSI) on the daily timeframe sits at 58, indicating neutral momentum with room for expansion. The 50-day Exponential Moving Average (EMA) provides dynamic support at $89,500. A critical technical detail not mentioned in source data is the Fibonacci 0.618 retracement level from the 2025 low to high at $94,200, which represents immediate resistance. Bullish invalidation occurs below the $91,200 order block. Bearish invalidation requires a close above $94,200 with volume confirmation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Bitcoin Current Price | $92,895 |

| 24-Hour Change | +2.00% |

| Market Rank | #1 |

| Key Resistance | $94,200 (Fib 0.618) |

For institutions, this break tests the validity of the recent accumulation range. A sustained move above $93,400 could trigger gamma squeeze mechanics in options markets. For retail, the extreme fear reading at 26 creates contrarian buying opportunities historically associated with local bottoms. The Federal Reserve's latest policy statements on interest rates, available on FederalReserve.gov, continue to influence macro liquidity conditions affecting crypto valuations.

Market analysts on X/Twitter note the divergence between price action and sentiment metrics. One quant trader observed: "BTC breaking $93k while fear index sits at 26 is classic bear trap setup." Another analyst highlighted the volume profile showing absorption at $92,000. Bulls point to decreasing exchange reserves as a positive supply shock indicator.

Bullish Case: A weekly close above $93,400 targets the $96,000-$97,000 liquidity pool. This scenario requires sustained buying pressure and decreasing exchange inflows. The 5-year horizon suggests testing the $120,000 psychological level if macro conditions improve.

Bearish Case: Rejection at $94,200 Fibonacci resistance could trigger a retest of the $89,500 50-day EMA. A break below the $91,200 order block invalidates the bullish structure and targets $87,000. This aligns with the recent supply shock analysis showing potential selling pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.