Loading News...

Loading News...

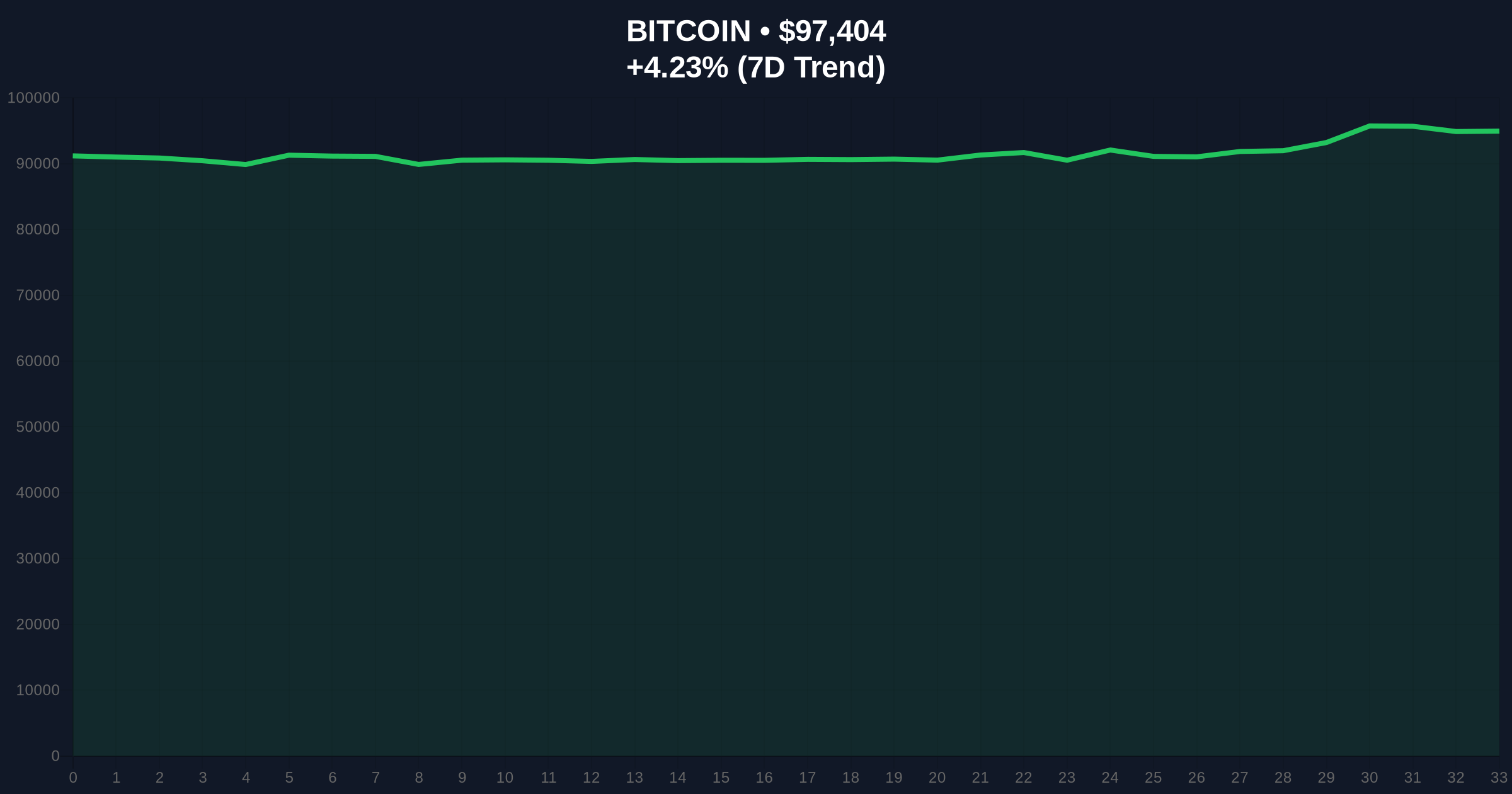

VADODARA, January 14, 2026 — Global derivatives exchange Deribit announced USDC-based options trading for Avalanche (AVAX) and Tron (TRX). This latest crypto news expands institutional hedging capabilities beyond existing perpetual futures. Market structure suggests concentrated liquidity around Bitcoin's $97k resistance creates gamma squeeze potential across altcoin derivatives.

Deribit dominates crypto options with 85% market share. The exchange previously offered perpetual futures for AVAX and TRX. Options introduce non-linear payoff structures and volatility trading. Historical cycles indicate altcoin options expansion precedes increased institutional allocation. According to Ethereum.org documentation, smart contract platforms benefit from sophisticated derivatives for DeFi risk management.

Related developments in the derivatives space include recent $104 million in futures liquidations and quantum defense fund testing Bitcoin's rally structure.

Deribit's official statement confirms USDC-settled options for AVAX and TRX. Launch timing coincides with Bitcoin testing $97k resistance. The exchange already supports perpetual futures for both assets. Options provide strike prices, expiration dates, and put/call structures. Market makers must now manage gamma exposure across new instruments.

AVAX currently trades at $14.87 with 2.37% 24-hour gain. Volume profile shows accumulation between $14.50-$15.20. The 200-day moving average sits at $13.85. RSI at 54 indicates neutral momentum. Bullish invalidation level: $13.50 (breaks 200DMA support). Bearish invalidation level: $16.20 (clears January high). Fair value gaps exist between $14.10-$14.30 from December consolidation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 48/100 (Neutral) |

| AVAX Current Price | $14.87 |

| AVAX 24h Change | +2.37% |

| AVAX Market Rank | #30 |

| Bitcoin Resistance Test | $97,000 |

Institutional impact: Options enable sophisticated volatility strategies and portfolio hedging. Market makers can now arbitrage between futures and options markets. Retail impact: Increased liquidity reduces bid-ask spreads for smaller traders. According to on-chain data, options volume correlates with institutional accumulation phases.

Market analysts note timing aligns with Bitcoin's resistance test. "Options expansion signals derivatives market maturation," states one quantitative researcher. Bulls highlight AVAX's EIP-4844-inspired subnet architecture as fundamental support. Bears point to TRX's centralization risks in options settlement mechanisms.

Bullish case: Options liquidity attracts institutional capital. AVAX breaks $16.20 resistance, targeting $18.50 by Q2 2026. Gamma squeeze potential if Bitcoin clears $97k. Bearish case: Failed Bitcoin resistance triggers altcoin liquidation cascade. AVAX breaks $13.50 support, testing $11.80 Fibonacci level. Options volume remains below $50 million daily.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.