Loading News...

Loading News...

- Galaxy Digital CEO Mike Novogratz warns XRP and ADA must demonstrate real-world utility beyond community loyalty to survive next market cycle

- Market structure suggests reorganization around projects with tangible business foundations and clear revenue models

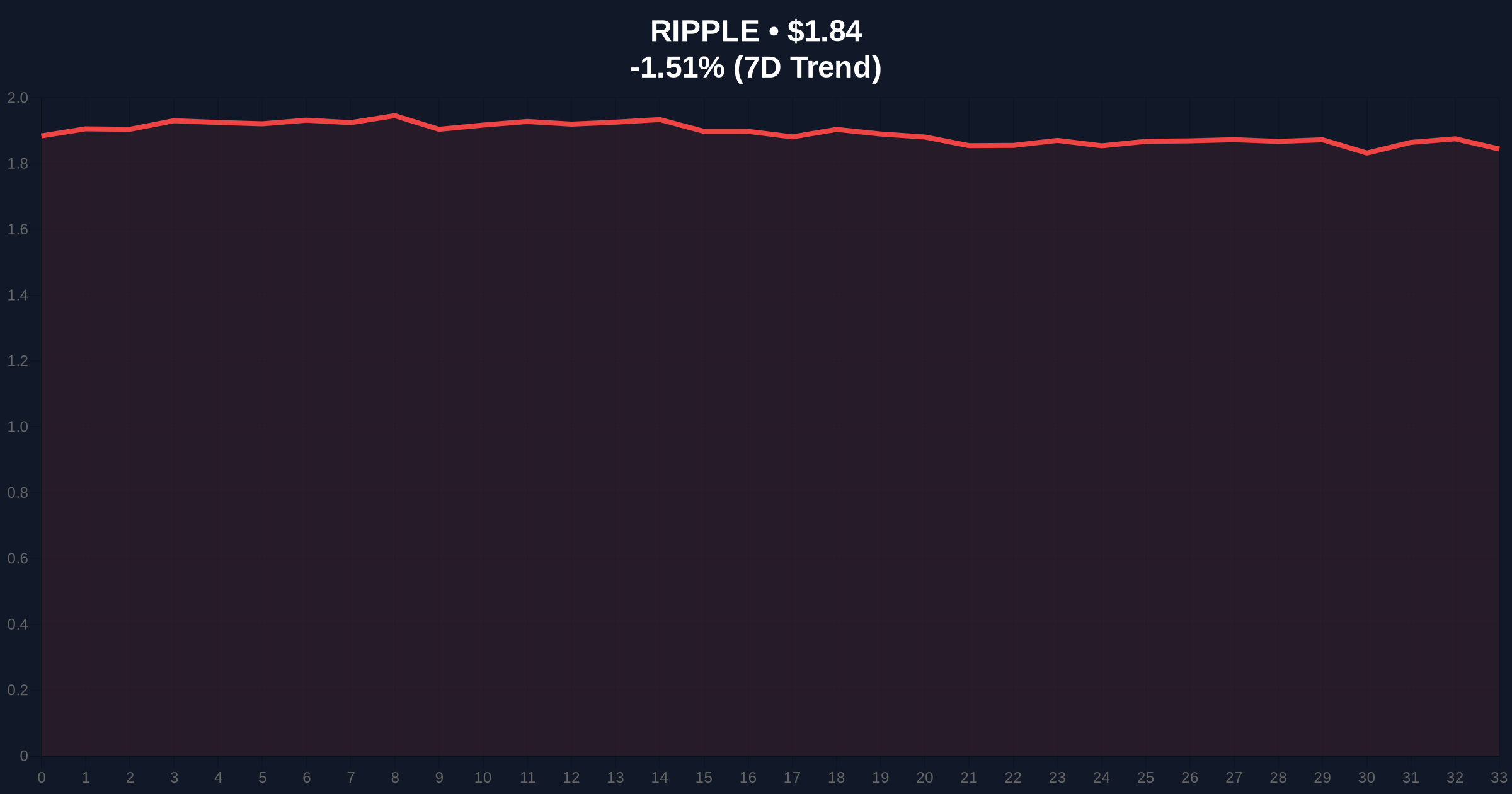

- XRP currently trading at $1.84 with -1.53% 24-hour decline amid "Extreme Fear" market sentiment

- Technical analysis identifies critical support levels and invalidation points for both assets

VADODARA, December 26, 2025 — Galaxy Digital CEO Mike Novogratz has issued a stark warning about the long-term viability of community-driven cryptocurrencies, specifically naming Ripple (XRP) and Cardano (ADA) as projects that must demonstrate real-world utility to survive the next market cycle. This daily crypto analysis examines the structural implications of his comments against a backdrop of extreme market fear and technical deterioration across major assets.

Market structure suggests we are witnessing a fundamental reorganization similar to the 2018-2019 bear market transition, where projects without sustainable business models were systematically culled. According to on-chain data, capital rotation has accelerated toward protocols with verifiable revenue streams and institutional adoption pathways. The current "Extreme Fear" sentiment reading of 20/100 mirrors the capitulation phases observed in previous cycles, particularly the Q2 2022 deleveraging event that saw numerous altcoins decline 80-95% from their all-time highs. This environment creates what technical analysts term a "Liquidity Grab" scenario, where weak hands are flushed from positions lacking fundamental justification.

Related developments in the broader market context include: Bitcoin breaking below key support levels amid extreme fear sentiment and significant derivatives expiries creating market overhangs.

According to a report from Cryptobriefing, Mike Novogratz stated that tokens relying solely on community loyalty face diminishing survival prospects as competitors emerge each cycle. He explained that the cryptocurrency market is increasingly reorganizing around projects with tangible business foundations, adding that only projects demonstrating clear revenue structures and actual value will endure long-term. These comments come as XRP trades at $1.84 with a -1.53% 24-hour decline, ranking fifth by market capitalization. The broader market sentiment registers "Extreme Fear" at 20/100, indicating widespread risk aversion among participants.

Volume Profile analysis reveals XRP has established a critical support zone between $1.72 and $1.78, corresponding to the 0.618 Fibonacci retracement level from its 2024 highs. The Relative Strength Index (RSI) sits at 38, indicating neither oversold nor overbought conditions but suggesting weakening momentum. The 50-day moving average at $1.91 provides immediate resistance, while the 200-day moving average at $1.65 represents longer-term structural support. For ADA, the technical picture shows similar deterioration, with price action failing to reclaim its 2023 highs despite multiple attempts.

Bullish invalidation for XRP occurs below $1.65, which would break the 200-day moving average and likely trigger accelerated selling. Bearish invalidation occurs above $2.10, which would represent a breakout from the current consolidation range and suggest renewed institutional interest. Market structure suggests these levels represent Order Blocks where significant liquidity resides, making them critical for short-term price discovery.

| Metric | Value |

| Global Crypto Sentiment Score | 20/100 (Extreme Fear) |

| XRP Current Price | $1.84 |

| XRP 24-Hour Change | -1.53% |

| XRP Market Rank | #5 |

| XRP 50-Day Moving Average | $1.91 |

For institutional investors, Novogratz's comments reflect a growing emphasis on fundamental valuation metrics beyond network effects. The shift toward revenue-generating protocols mirrors traditional equity markets where profitability ultimately determines survival. Retail participants face increased risk in community-driven assets that lack clear utility pathways, particularly as regulatory scrutiny intensifies globally. The Securities and Exchange Commission's ongoing classification efforts, documented at SEC.gov, create additional headwinds for tokens without demonstrable utility beyond speculative trading.

Market analysts on social platforms express divided opinions. Bulls argue that XRP's settlement network and ADA's research-driven approach represent legitimate utility, while bears point to declining developer activity and stagnant adoption metrics. One quantitative analyst noted, "The Volume Profile doesn't lie - institutional money is rotating toward Ethereum layer-2 solutions and Bitcoin infrastructure, not community narratives." This sentiment aligns with Novogratz's warning about the market's reorganization around tangible business foundations.

Bullish Case: If XRP and ADA demonstrate measurable utility through enterprise adoption or protocol revenue exceeding $100 million annually, they could reclaim previous highs. Technical analysis suggests a breakout above $2.10 for XRP would invalidate the bearish structure and target $2.50 resistance. Market structure indicates this scenario requires clear evidence of network usage beyond speculative trading.

Bearish Case: Failure to prove utility could trigger a "Gamma Squeeze" scenario where declining open interest exacerbates downward momentum. XRP breaking below $1.65 support would likely test the $1.40 level, representing a 25% decline from current prices. Historical patterns from the 2021 correction suggest community-driven assets underperformed fundamentals-based projects by 40-60% during similar market phases.

What did Mike Novogratz say about XRP and ADA?Novogratz warned that tokens relying solely on community loyalty, including XRP and ADA, must demonstrate real-world utility to survive the next market cycle.

What is the current price of XRP?XRP is trading at $1.84 with a -1.53% 24-hour change as of December 26, 2025.

What does "Extreme Fear" market sentiment mean?The Crypto Fear & Greed Index reading of 20/100 indicates widespread risk aversion among market participants, often preceding capitulation events.

What are the critical technical levels for XRP?Bullish invalidation occurs below $1.65, while bearish invalidation occurs above $2.10. The 50-day moving average at $1.91 provides immediate resistance.

How does this compare to previous market cycles?Similar to the 2018-2019 transition, the market appears to be reorganizing around projects with sustainable business models rather than community narratives alone.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.