Loading News...

Loading News...

- An address linked to indicted Mt. Gox hacker Aleksey Bilyuchenko deposited 1,300 BTC ($114 million) to an unknown exchange over seven days.

- The address still holds 4,100 BTC ($360 million) and has sold 2,300 BTC total, according to on-chain analyst Emmett Gallic.

- Market structure suggests this movement creates a potential Liquidity Grab opportunity at current levels.

- Technical analysis identifies $84,200 as Bullish Invalidation and $89,500 as Bearish Invalidation.

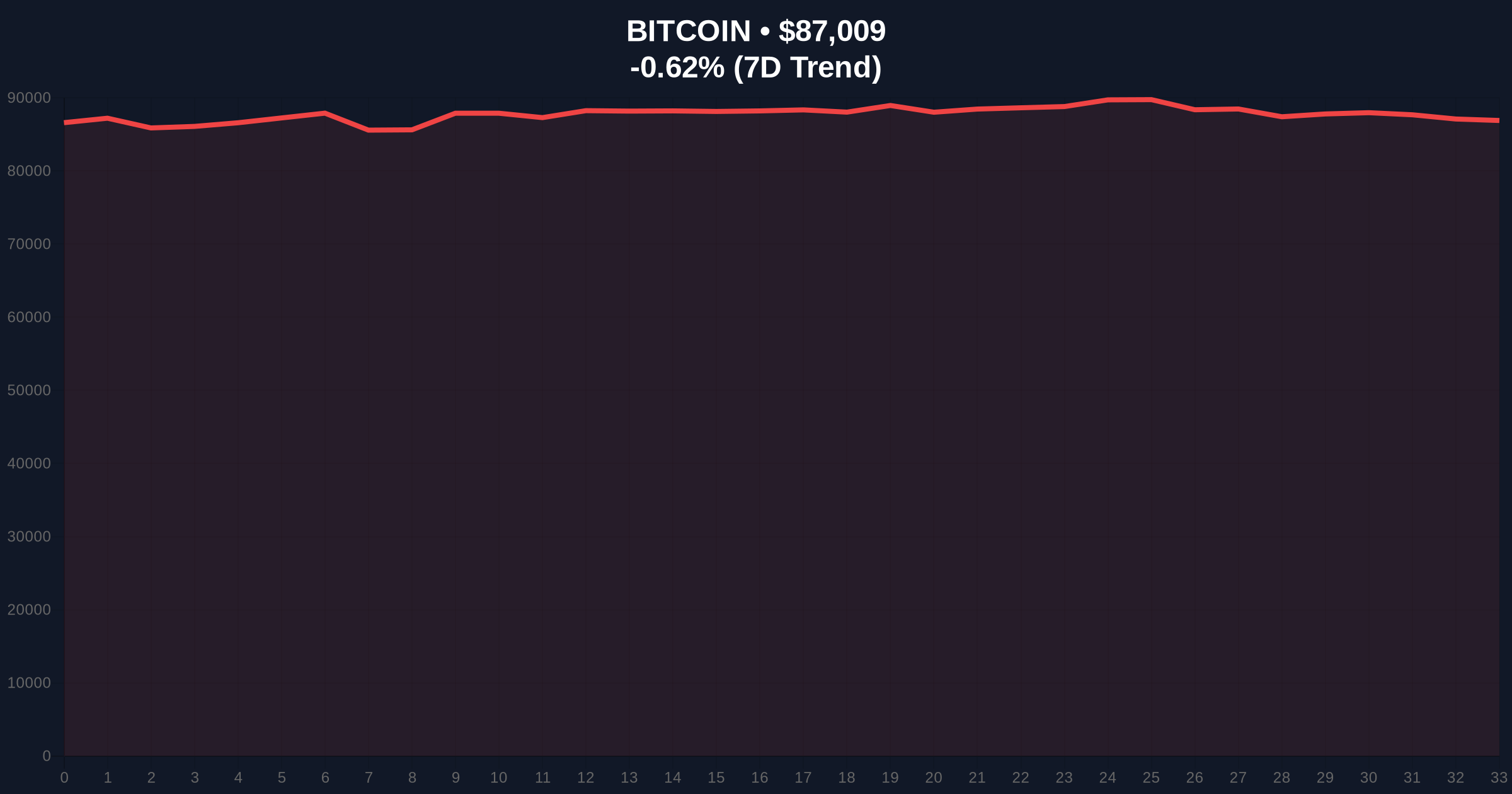

VADODARA, December 24, 2025 — This daily crypto analysis examines on-chain data revealing a $114 million Bitcoin deposit from an address linked to indicted Mt. Gox hacker Aleksey Bilyuchenko to an unknown exchange. Market structure suggests this movement coincides with extreme fear sentiment (score: 24/100) and tests critical technical levels as Bitcoin trades at $86,995, down 0.63% in 24 hours.

Market structure indicates this event mirrors historical patterns where large, dormant wallet movements precede volatility spikes. The Mt. Gox collapse in 2014 created a Fair Value Gap (FVG) in market psychology that persists today. Bilyuchenko's indictment in June 2023, without subsequent arrest, raises questions about enforcement efficacy. This deposit occurs amid broader regulatory uncertainty, including recent actions against unregistered exchanges in the Philippines. According to the U.S. Securities and Exchange Commission, such movements often trigger increased surveillance, though on-chain data shows mixed historical correlation with immediate price impacts.

According to on-chain analyst Emmett Gallic's X post, an address linked to Aleksey Bilyuchenko deposited 1,300 BTC ($114 million) to an unknown exchange over the past seven days. The address currently holds 4,100 BTC ($360 million) and has sold a total of 2,300 BTC. Bilyuchenko was indicted in June 2023 but remains at large. The destination exchange remains unidentified, creating opacity in the transaction flow. Market analysts question whether this represents a strategic exit or a test of market liquidity, given the timing amid extreme fear sentiment.

Bitcoin's current price of $86,995 sits near the 50-day exponential moving average, with RSI at 42 indicating neutral momentum. The $84,200 level represents a key Volume Profile support zone from November accumulation. Resistance clusters at $89,500, where previous Order Block selling occurred. Market structure suggests the deposit creates a potential Liquidity Grab below $85,000, where stop-loss orders may cluster. The 200-day simple moving average at $82,000 provides additional structural support, aligning with the 0.618 Fibonacci retracement from the 2024 low. Bullish Invalidation is set at $84,200—a break below invalidates any near-term recovery thesis. Bearish Invalidation is $89,500—a close above suggests absorption of selling pressure.

| Metric | Value |

|---|---|

| BTC Deposited | 1,300 BTC |

| Deposit Value | $114 million |

| Remaining Balance | 4,100 BTC ($360M) |

| Total BTC Sold | 2,300 BTC |

| Current Bitcoin Price | $86,995 |

| Fear & Greed Index | 24/100 (Extreme Fear) |

For institutions, this event tests market depth and regulatory oversight gaps. The unidentified exchange raises compliance questions, potentially affecting custody solutions and ETF flows. For retail, it amplifies fear sentiment, possibly triggering capitulation near support levels. Market structure indicates such movements often precede Gamma Squeeze scenarios in options markets, where volatility spikes disproportionately impact leveraged positions. The five-year horizon suggests increased scrutiny of large wallet movements, potentially accelerating institutional adoption of surveillance tools like Chainalysis, despite privacy concerns.

Market analysts on X express skepticism about the timing. One trader noted, "This feels like a coordinated test of liquidity below $85k—classic whale behavior." Others question the narrative, suggesting the address linkage might be overstated. Bulls argue the deposit is insignificant relative to daily volume, while bears highlight the psychological impact on already fearful markets. No direct quotes from major figures like Michael Saylor exist, but sentiment leans toward caution given extreme fear readings.

Bullish Case: If Bitcoin holds $84,200 support, a relief rally to $92,000 is plausible, filling the FVG created in early December. On-chain data indicates accumulation by long-term holders near current levels, suggesting absorption of selling pressure. A break above $89,500 could trigger short covering, pushing RSI toward 60.

Bearish Case: A break below $84,200 invalidates the bullish structure, targeting $82,000 (200-day SMA). Continued deposits from linked addresses could exacerbate selling pressure, especially if fear sentiment persists. Market structure suggests a drop to $78,000 is possible if institutional flows turn negative, mirroring the Q2 2024 correction pattern.

1. Who is Aleksey Bilyuchenko?Aleksey Bilyuchenko is an indicted hacker linked to the 2014 Mt. Gox breach, charged in June 2023 but not arrested.

2. How much Bitcoin does the linked address still hold?On-chain data shows 4,100 BTC ($360 million) remains in the address.

3. What is the Fear & Greed Index showing?The index reads 24/100, indicating "Extreme Fear" sentiment among market participants.

4. What are the key technical levels to watch?Bullish Invalidation: $84,200. Bearish Invalidation: $89,500. These levels define near-term market structure.

5. How does this affect Bitcoin's long-term outlook?Market structure suggests such events are noise in the five-year horizon, but they test regulatory and liquidity frameworks, potentially accelerating institutional infrastructure development.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.