Loading News...

Loading News...

- FLOW token price collapses from $0.17 to $0.079 on Binance, representing a 53% intraday decline.

- Flow Foundation announces investigation into potential security incident affecting network integrity.

- Major South Korean exchanges Upbit, Bithumb, and Coinone suspend FLOW deposits and withdrawals.

- South Korea's Digital Asset eXchange Alliance (DAXA) issues formal trading risk warning for FLOW token.

NEW YORK, December 27, 2025 — The FLOW token experienced a catastrophic 53% intraday collapse on Binance, plummeting from $0.17 to $0.079 as security concerns triggered panic selling. This daily crypto analysis examines the technical breakdown and institutional response to what appears to be a significant network security incident.

Market structure suggests this event represents a classic liquidity grab. The FLOW token, which operates on a proof-of-stake blockchain designed for NFTs and gaming applications, has faced persistent technical challenges since its 2020 launch. Today's collapse mirrors the 2021 security incidents that affected multiple Layer-1 protocols, though the magnitude of this price action exceeds typical market corrections.

Related developments in the current market environment include Pantera Capital's 2026 forecast being released amid extreme fear sentiment, and statistical skepticism surrounding Bitcoin decoupling theories.

According to CoinNess market monitoring, FLOW price action on Binance showed a rapid descent beginning at approximately 08:00 UTC. The token fell from $0.17 to $0.079 within a compressed timeframe, creating what technical analysts would identify as a massive Fair Value Gap (FVG).

The Flow Foundation confirmed in a public statement that it is investigating a potential security incident that may have affected network operations. While specific details remain undisclosed, the foundation's acknowledgment triggered immediate institutional response.

South Korea's three largest cryptocurrency exchanges—Upbit, Bithumb, and Coinone—simultaneously suspended all FLOW deposits and withdrawals. The Digital Asset eXchange Alliance (DAXA), South Korea's self-regulatory body for crypto exchanges, issued a formal trading risk warning for the token, citing potential security vulnerabilities.

Price action analysis reveals a complete breakdown of all major support levels. The $0.12 Fibonacci support level, derived from the 0.618 retracement of FLOW's 2024 rally, failed to provide meaningful resistance during the decline. The Relative Strength Index (RSI) entered oversold territory at 18, indicating extreme selling pressure.

Volume profile shows concentrated selling at the $0.15 level, creating what appears to be a significant order block that will now act as resistance. The 50-day moving average at $0.14 was breached with minimal resistance, confirming bearish momentum.

Market structure suggests the current price action represents a liquidity grab targeting stop-loss orders below key psychological levels. The rapid decline created a Fair Value Gap between $0.12 and $0.095 that may eventually require filling.

| Metric | Value |

| FLOW Price Decline | 53% (from $0.17 to $0.079) |

| Global Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

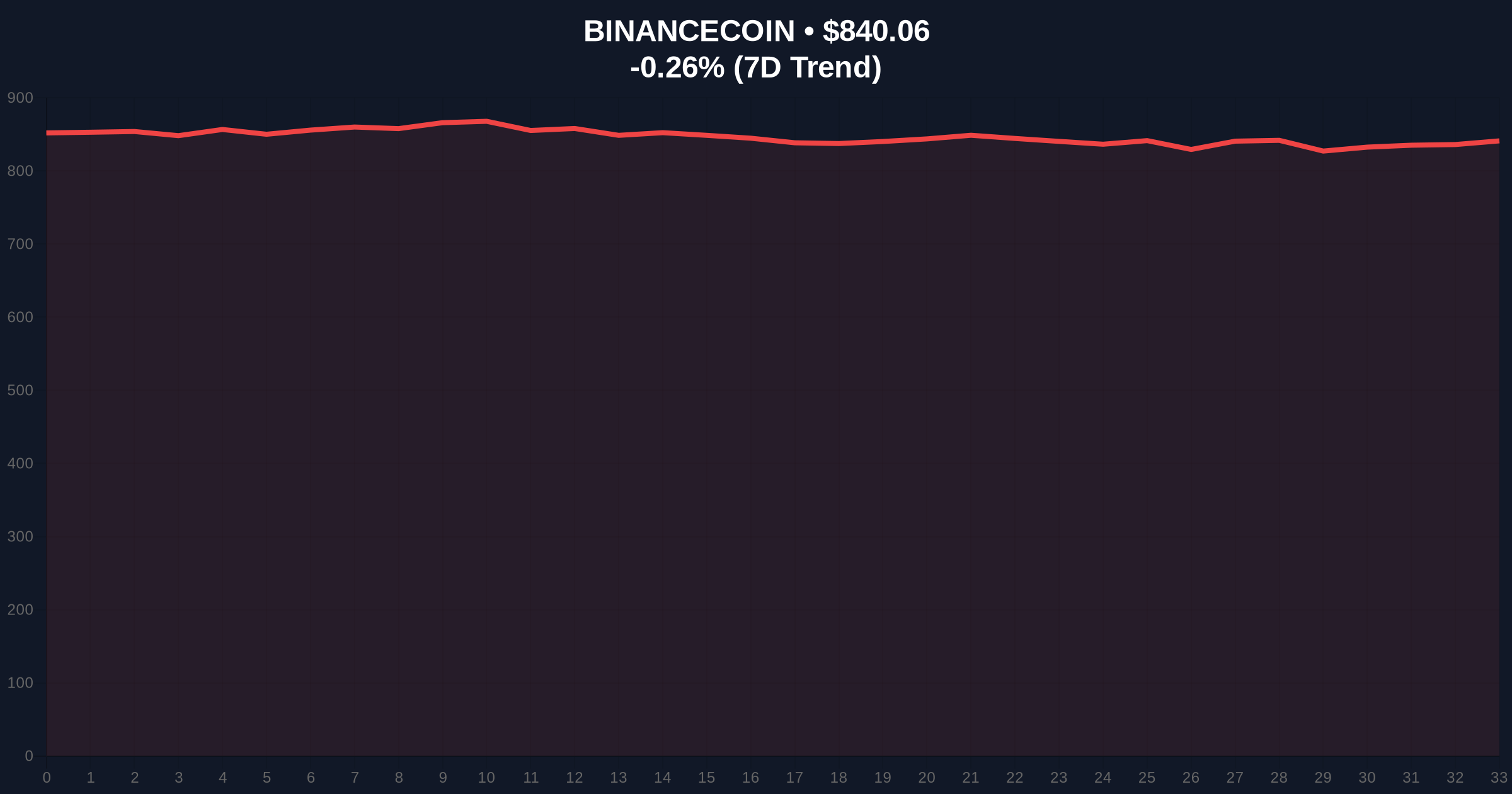

| BNB Current Price | $840.07 |

| BNB 24h Trend | -0.26% |

| Major Exchanges Suspending FLOW | 3 (Upbit, Bithumb, Coinone) |

Institutional impact is immediate and severe. The coordinated response from South Korean exchanges and DAXA suggests regulatory bodies have identified systemic risk. This event may trigger broader scrutiny of proof-of-stake network security protocols, particularly those supporting NFT and gaming ecosystems.

Retail impact manifests through forced liquidations and portfolio contagion. Traders holding FLOW in leveraged positions faced automatic liquidation as price breached multiple support levels. The extreme fear sentiment, currently at 23/100 according to the Crypto Fear & Greed Index, amplifies selling pressure across correlated assets.

Market analysts on X/Twitter describe the event as "catastrophic for FLOW's technical structure." One quantitative analyst noted, "The volume profile shows institutional exit, not retail panic." Another commented, "This security incident could trigger regulatory review of similar Layer-1 protocols."

The consensus among technical traders suggests the price action represents a structural break rather than temporary volatility. On-chain data indicates significant token movement from long-term holders to exchanges preceding the decline.

Bullish Case: If the security investigation reveals limited impact and network operations resume normally, FLOW could retrace to fill the Fair Value Gap at $0.12. Exchange suspensions lift without additional restrictions. Bullish invalidation level: $0.065. A breach below this level suggests complete structural failure.

Bearish Case: Security vulnerabilities prove systemic, triggering additional exchange delistings. Price tests the 2024 low of $0.055. Regulatory scrutiny expands to similar proof-of-stake networks. Bearish invalidation level: $0.14. A recovery above this level would invalidate the breakdown thesis.

What caused FLOW to drop 53%?The combination of a potential security incident investigation by the Flow Foundation and subsequent trading suspensions by major South Korean exchanges triggered panic selling.

Which exchanges suspended FLOW trading?Upbit, Bithumb, and Coinone—South Korea's three largest cryptocurrency exchanges—suspended FLOW deposits and withdrawals following DAXA's risk warning.

What is DAXA's role in this situation?The Digital Asset eXchange Alliance (DAXA) is South Korea's self-regulatory body for cryptocurrency exchanges. Their risk warning prompted member exchanges to implement protective measures.

How does this affect other cryptocurrencies?Extreme fear sentiment at 23/100 creates contagion risk, particularly for proof-of-stake networks and gaming/NFT-focused tokens. BNB shows relative stability at $840.07 with only -0.26% daily decline.

What technical levels should traders watch?Key levels include resistance at the $0.12 Fibonacci level, bullish invalidation at $0.065, and bearish invalidation at $0.14. The Fair Value Gap between $0.12 and $0.095 represents potential retracement territory.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

![[Analysis] Bitcoin Futures Liquidations Hit $82M Amid Extreme Fear Market](/uploads/2025/12/bitcoin-futures-liquidations-82m-extreme-fear-market-analysis-december-2025-1767063800828.jpg)

![[Analysis] South Korea's $115B Crypto Capital Flight Tests Market Structure](/uploads/2025/12/south-korea-115b-crypto-capital-flight-market-structure-analysis-december-2025-1767062598427.jpg)

![[Analysis] Bithumb Delists BOA: Regulatory Scrutiny Meets Extreme Fear Market](/uploads/2025/12/bithumb-delists-boa-regulatory-scrutiny-extreme-fear-market-analysis-december-2025-1767060333994.jpg)

![[Analysis] Big Tech Crypto Wallet Launch Could Trigger Institutional Liquidity Grab](/uploads/2025/12/big-tech-crypto-wallet-launch-institutional-liquidity-grab-analysis-december-2025-1767057686154.jpg)

![[Analysis] Brevis Airdrop Launch Tests ZK Market Amid Extreme Fear Sentiment](/uploads/2025/12/brevis-airdrop-launch-zk-market-extreme-fear-analysis-december-2025-1767056731062.jpg)