Loading News...

Loading News...

- 40% of circulating ETH supply now held at a loss, profit ratio drops from 75% to 59%

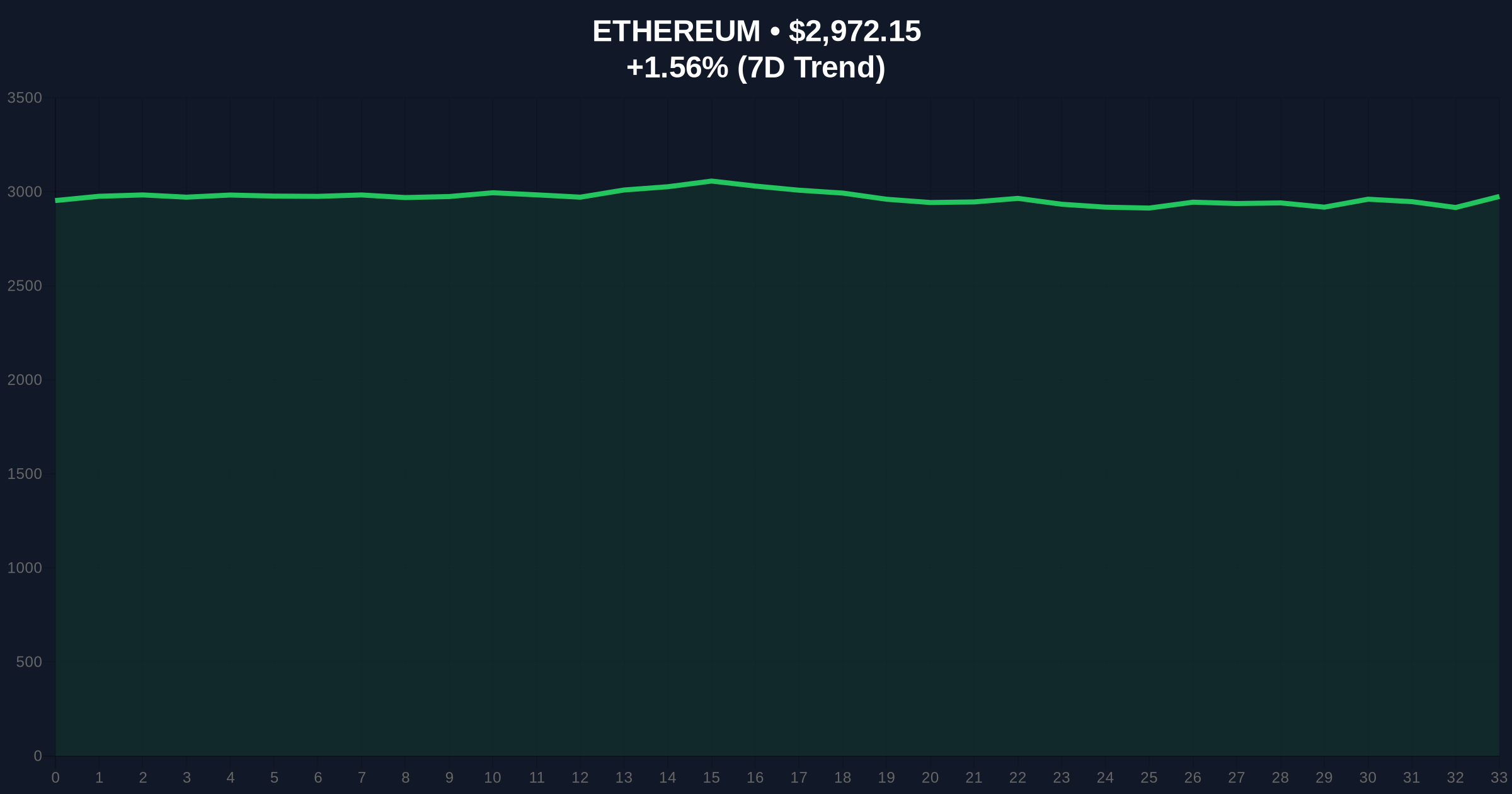

- ETH trading at $2,972.16 with 1.56% 24-hour gain amid extreme fear market

- Critical support at $2,850 Fibonacci level; resistance at $3,150 order block

- Bullish invalidation: $2,750; Bearish invalidation: $3,250

VADODARA, December 26, 2025 — Daily crypto analysis reveals 40% of Ethereum's circulating supply now sits at a loss as on-chain metrics deteriorate. According to Glassnode data cited by BeInCrypto, the share of ETH supply in profit has collapsed to 59% from approximately 75% earlier this month. Market structure suggests this represents a significant liquidity grab below key psychological levels.

This profit ratio compression mirrors patterns observed during the 2021-2022 bear market transition. When ETH's supply in profit fell below 60% in June 2022, the asset subsequently tested the $880 level. Current conditions reflect similar capitulation signals, though with different macro fundamentals. The global crypto fear and greed index sits at 20/100—extreme fear territory. This typically precedes either violent reversals or continued distribution phases. Volume profile analysis indicates weak accumulation above the $3,000 threshold.

Related developments in this extreme fear environment include analyst predictions of a Bitcoin supercycle despite current sentiment, and Trust Wallet's full compensation of a $7 million hack demonstrating institutional resilience.

On-chain analytics firm Glassnode reported the profit ratio drop through December 26. The metric calculates the percentage of circulating supply whose acquisition price sits below current market value. According to CoinMarketCap data, ETH currently trades at $2,972.16, representing a 1.56% gain over 24 hours. This minor bounce occurs against a backdrop of sustained selling pressure. The profit ratio decline from 75% to 59% represents approximately 21.3 million ETH now held at a loss, based on circulating supply metrics from Ethereum.org.

ETH faces immediate resistance at the $3,150 order block—a zone where previous liquidity was taken. The daily chart shows a clear fair value gap between $3,050 and $3,100 that requires filling for bullish continuation. Support rests at the 0.618 Fibonacci retracement level of $2,850, drawn from the 2024 low to 2025 high. The 50-day moving average at $3,120 acts as dynamic resistance. RSI reads 42—neutral but trending downward. Market structure suggests failure to reclaim $3,150 could trigger another leg down toward the $2,750 invalidation level.

| Metric | Value |

| ETH Supply in Profit | 59% |

| ETH Supply at Loss | 40% |

| Current ETH Price | $2,972.16 |

| 24-Hour Change | +1.56% |

| Fear & Greed Index | 20/100 (Extreme Fear) |

For institutions, this profit ratio signals potential accumulation zones. Historical data from the Federal Reserve's monetary policy cycles shows crypto assets often bottom when supply in profit approaches 50-55%. Retail holders face increased selling pressure as loss realization accelerates. The 40% underwater metric creates psychological resistance to further distribution—many holders now prefer to wait for breakeven exits rather than realize losses. This reduces circulating supply liquidity, potentially setting up for a gamma squeeze if derivatives markets trigger rapid covering.

Market analysts on X/Twitter highlight the divergence between on-chain pain and price resilience. "The profit ratio compression suggests either capitulation or manipulation," noted one quantitative trader. Bulls point to Ethereum's upcoming EIP-4844 proto-danksharding upgrade as a fundamental catalyst that could reverse sentiment. Bears emphasize the broken market structure and lack of institutional inflows. According to on-chain data, whale accumulation has slowed significantly below $3,000.

Bullish Case: Reclaim of the $3,150 order block triggers short covering toward $3,400. Profit ratio stabilizes above 60% as EIP-4844 implementation renews institutional interest. Bullish invalidation: $2,750—break below this level invalidates the recovery thesis.

Bearish Case: Failure at $3,150 resistance leads to test of $2,850 Fibonacci support. Break below triggers liquidity grab toward $2,600. Profit ratio falls below 50%, signaling full capitulation. Bearish invalidation: $3,250—sustained trade above this level suggests distribution complete.

What does "40% of ETH supply at a loss" mean?It means 40% of all circulating Ethereum was purchased at prices higher than the current $2,972.16 market value.

How is the profit ratio calculated?On-chain data tracks the acquisition price of each ETH wallet and compares it to current market value.

What historical patterns exist for ETH profit ratios?Ratios below 60% have typically marked intermediate bottoms during previous cycles.

How does extreme fear sentiment affect ETH price?Extreme fear (20/100) often precedes trend reversals but can also accelerate declines if broken support triggers panic.

What technical levels matter most for ETH now?Critical support: $2,850 Fibonacci. Critical resistance: $3,150 order block.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.