Loading News...

Loading News...

- Binance founder Changpeng Zhao notes early Bitcoin buyers accumulated during periods of market FUD, not at price peaks

- Current market sentiment registers at "Extreme Fear" with a score of 23/100, historically correlating with accumulation zones

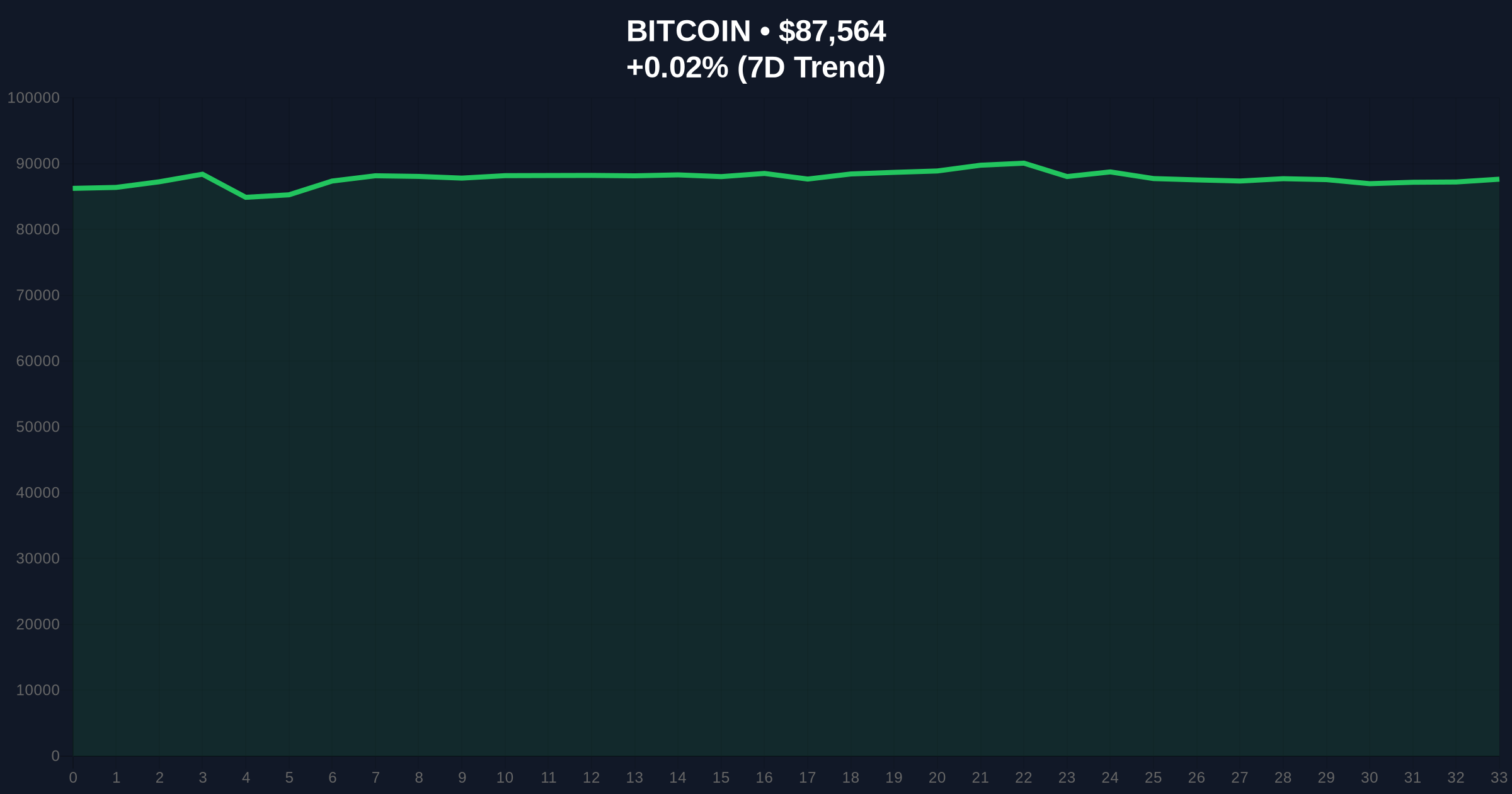

- Bitcoin trades at $87,561 with minimal 24-hour movement, suggesting consolidation above key Fibonacci support

- Market structure indicates potential liquidity grab below $85,000 before continuation of primary trend

VADODARA, December 25, 2025 — Binance founder Changpeng Zhao's recent social media commentary on Bitcoin accumulation patterns during fear-driven market conditions provides a critical framework for today's daily crypto analysis. In a post on X, Zhao questioned whether followers regretted not buying Bitcoin before it reached all-time highs, emphasizing that early adopters purchased not at peaks but during periods of fear, uncertainty, and doubt (FUD). This observation arrives as Bitcoin trades at $87,561 with the Crypto Fear & Greed Index registering "Extreme Fear" at 23/100, creating a potential psychological inflection point for market participants.

Historical Bitcoin price action demonstrates a consistent pattern where maximum accumulation occurs during periods of negative sentiment, not euphoria. The 2018 bear market bottom near $3,200 coincided with widespread regulatory uncertainty and exchange failures. Similarly, the March 2020 COVID-19 crash to $3,858 occurred amid global economic panic. Market structure suggests these events created substantial Fair Value Gaps (FVGs) that were subsequently filled during bull market expansions. The current environment mirrors these historical precedents, with institutional adoption metrics continuing to rise despite retail sentiment deterioration. According to on-chain data from Glassnode, long-term holder supply has increased during recent volatility, indicating accumulation behavior similar to previous cycle bottoms.

Related developments in the current market environment include the Crypto Fear & Greed Index reaching extreme fear levels, dormant whale movements during market stress, and the Altcoin Season Index collapsing to historically low levels.

On December 25, 2025, Changpeng Zhao posted on X addressing Bitcoin accumulation psychology. The Binance founder specifically noted that successful early buyers entered positions "when the market was rife with fear, uncertainty, and doubt (FUD)," not during price peaks or periods of market euphoria. Zhao concluded his message with seasonal greetings but provided no additional trading advice or market predictions. The post generated significant engagement, with market analysts interpreting the commentary as highlighting the counter-cyclical nature of successful cryptocurrency investing. This perspective aligns with quantitative research showing that Bitcoin's highest risk-adjusted returns have historically occurred following periods of extreme negative sentiment, as documented in Federal Reserve economic research on digital asset volatility patterns.

Bitcoin currently trades at $87,561, representing a 0.02% change over the past 24 hours. The price action shows consolidation above the critical Fibonacci 0.618 retracement level at $85,200, drawn from the recent swing high at $92,000 to the November low at $78,500. The Relative Strength Index (RSI) on daily charts reads 42, indicating neutral momentum with slight bearish bias. The 50-day exponential moving average at $86,400 provides immediate support, while the 200-day simple moving average at $82,100 establishes a longer-term trend reference. Volume profile analysis reveals significant accumulation between $84,000 and $87,000, suggesting institutional interest at current levels.

Market structure suggests two potential scenarios. The bullish invalidation level sits at $82,000, where breakage would indicate failure of the current consolidation pattern and potential retest of the November lows. The bearish invalidation level is $90,500, representing the recent resistance zone that must be overcome for continuation of the primary uptrend. A liquidity grab below $85,000 appears probable before any sustained upward movement, as market makers typically target stop-loss clusters below psychologically significant levels.

| Metric | Value |

| Bitcoin Current Price | $87,561 |

| 24-Hour Price Change | +0.02% |

| Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

| Fibonacci 0.618 Support | $85,200 |

| 50-Day EMA | $86,400 |

Zhao's commentary matters because it highlights the psychological discipline required for successful cryptocurrency investing at both institutional and retail levels. For institutions, periods of extreme fear often present the most favorable entry points for large-scale accumulation, as evidenced by corporate treasury purchases during previous market downturns. For retail investors, the observation reinforces the importance of counter-cyclical behavior rather than trend-chasing. Market structure suggests that current sentiment extremes may signal a potential accumulation zone, particularly when combined with positive fundamental developments like increasing hash rate and institutional adoption. The psychological aspect of investing during FUD periods represents a consistent edge that has persisted across multiple market cycles, as behavioral finance research from academic institutions confirms.

Market analysts on social media platforms have largely interpreted Zhao's comments as reinforcing contrarian investment principles. One quantitative trader noted, "The data supports CZ's observation—on-chain metrics show address growth accelerates during fear periods, not greed." Another analyst highlighted the technical context: "Extreme fear at 23 on the index has preceded every major Bitcoin rally since 2020. This is statistical fact, not opinion." The broader community appears divided, with some viewing the commentary as obvious wisdom and others as timely reinforcement during current market conditions. Notably absent is any discussion of specific price targets or trading recommendations, focusing instead on behavioral principles.

Bullish Case: If Bitcoin maintains above the Fibonacci 0.618 support at $85,200 and breaks through the $90,500 resistance, the next target becomes the previous all-time high near $92,000. Sustained trading above this level could trigger a gamma squeeze as options dealers hedge short positions, potentially propelling prices toward $95,000. This scenario assumes continued institutional accumulation during fear periods and resolution of current macroeconomic uncertainties.

Bearish Case: Failure to hold $85,200 support suggests a retest of the 200-day moving average at $82,100. Break below this level would invalidate the current consolidation structure and potentially target the November low at $78,500. This scenario would likely coincide with worsening macroeconomic conditions or unexpected regulatory developments. The bearish invalidation level for this outlook is a sustained break above $90,500.

What did Changpeng Zhao say about Bitcoin buying? Zhao noted that early Bitcoin buyers accumulated during periods of market fear, uncertainty, and doubt (FUD), not at price peaks.

What is the current Crypto Fear & Greed Index reading? The index registers 23/100, indicating "Extreme Fear" market sentiment.

Where is Bitcoin's key technical support level? The Fibonacci 0.618 retracement level at $85,200 represents critical support, with the 200-day moving average at $82,100 providing secondary support.

How does current sentiment compare to historical accumulation periods? Current extreme fear levels mirror sentiment during previous cycle bottoms in 2018 and 2020, which preceded significant rallies.

What is the significance of accumulation during FUD periods? Historical data shows that accumulation during fear periods provides superior risk-adjusted returns compared to buying during euphoric market phases.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.