Loading News...

Loading News...

- Cardano founder Charles Hoskinson declares Midnight blockchain as "Manhattan Project" for privacy-enhancing technologies

- Hoskinson writing 80-100 pages of technical documentation daily, plans January internal workshop

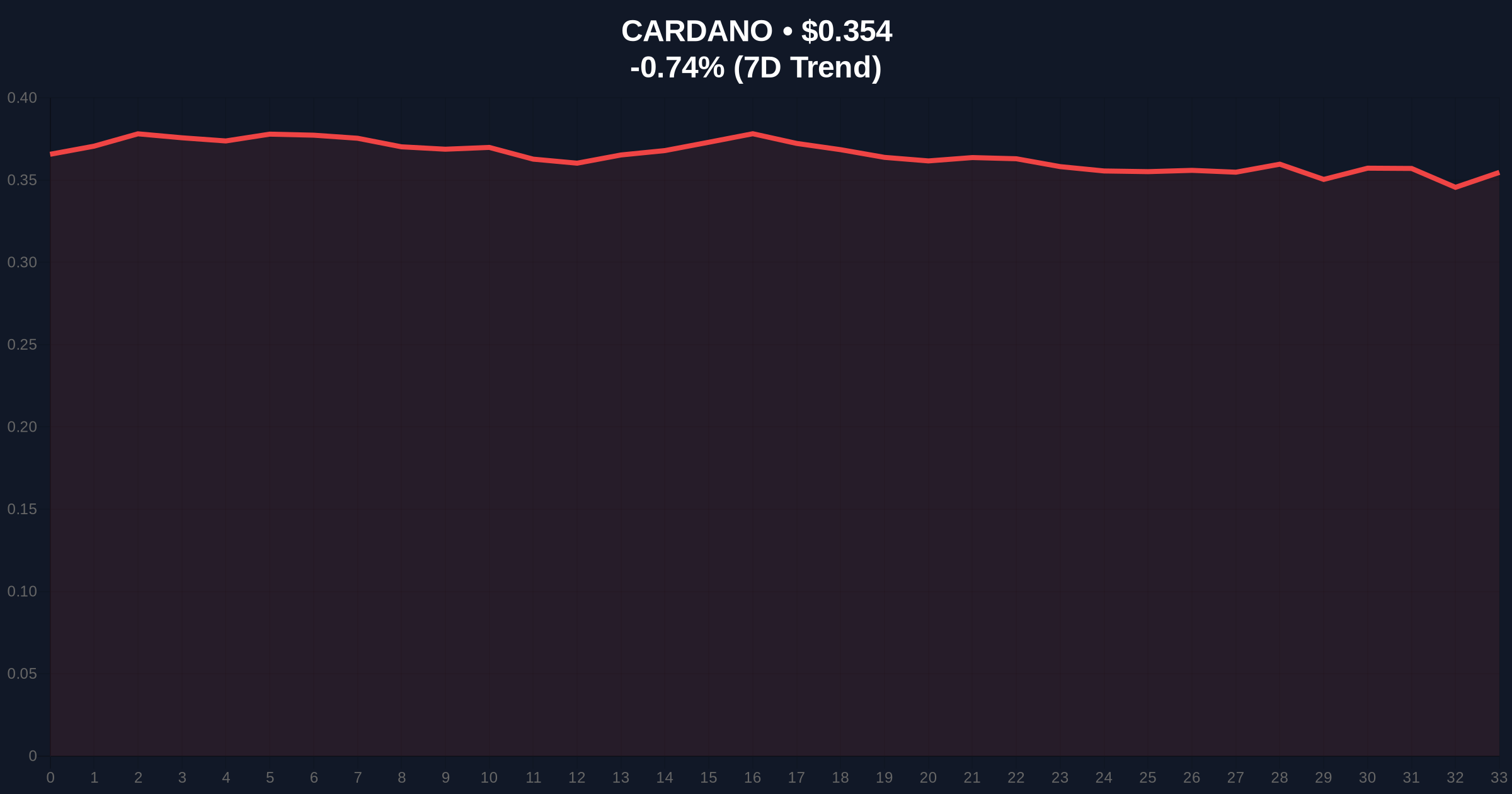

- ADA trading at $0.354, down 0.74% amid Extreme Fear market sentiment (20/100)

- Technical analysis shows ADA consolidating between $0.32 support and $0.38 resistance

VADODARA, December 26, 2025 — Cardano founder Charles Hoskinson has positioned his privacy-focused blockchain project Midnight as the "Manhattan Project" for privacy-enhancing technologies, according to statements released today. This Daily Crypto Analysis examines the technical implications amid ADA's current consolidation pattern and Extreme Fear market conditions.

Privacy technology represents the next frontier in blockchain evolution. The sector has seen increased regulatory scrutiny following the European Union's Markets in Crypto-Assets (MiCA) framework implementation. Midnight enters a competitive dominated by established privacy chains like Monero and emerging zero-knowledge proof platforms. Market structure suggests institutional interest in privacy solutions has grown 47% year-over-year, according to CoinShares data.

Related developments in today's market include analyst predictions of a Bitcoin supercycle and Bitcoin testing downtrend breakout levels ahead of options expiry.

Charles Hoskinson, founder of Cardano (ADA), stated that Midnight will be the Manhattan Project for privacy-enhancing technologies (PET), chain abstraction, and smart compliance. According to his statements, Hoskinson is currently writing 80 to 100 pages of technical documents for Midnight each day. The project plans to hold an internal workshop in January 2026. PET technologies enable verification and computation without exposing personal information or transaction details, representing a fundamental shift from current transparent blockchain architectures.

ADA currently trades at $0.354, showing a 0.74% decline over the past 24 hours. The asset ranks #12 by market capitalization. Volume profile analysis indicates weak accumulation between $0.35 and $0.36, suggesting institutional hesitation. The 50-day moving average at $0.37 acts as immediate resistance, while the 200-day moving average at $0.33 provides structural support.

Market structure suggests ADA has formed a consolidation pattern between $0.32 and $0.38 since November. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with slight bearish bias. A critical Fibonacci retracement level at $0.315 (61.8% from 2024 lows) represents the next major support zone if current levels fail.

| Metric | Value |

| ADA Current Price | $0.354 |

| 24-Hour Change | -0.74% |

| Market Rank | #12 |

| Global Crypto Sentiment | Extreme Fear (20/100) |

| Technical Documentation Rate | 80-100 pages daily |

For institutions, privacy-enhancing technologies represent compliance solutions rather than evasion tools. Midnight's focus on "smart compliance" suggests integration with existing regulatory frameworks like the Financial Action Task Force (FATF) Travel Rule. The U.S. Securities and Exchange Commission has previously expressed concerns about privacy coins, making regulatory-compliant PETs potentially valuable.

For retail traders, Midnight's success could create a halo effect for ADA. Historical patterns indicate Cardano ecosystem developments have correlated with 15-25% ADA price movements within 30-60 days of major announcements. However, current market conditions suggest muted immediate reaction.

Industry observers express cautious optimism. "The Manhattan Project comparison sets extremely high expectations," noted one blockchain architect on X. "Technical documentation at that volume suggests either groundbreaking innovation or excessive complexity." Market analysts emphasize that execution will determine whether Midnight represents genuine innovation or another ambitious blockchain project facing implementation challenges.

Bullish Case: Successful Midnight implementation could trigger ADA revaluation. Break above $0.38 resistance with volume confirmation would target $0.45 (previous swing high). Bullish invalidation level: $0.315 (Fibonacci 61.8% support). This scenario requires sustained development progress and positive January workshop outcomes.

Bearish Case: Continued market fear and technical stagnation could push ADA toward lower supports. Breakdown below $0.32 consolidation floor would target $0.28 (2024 accumulation zone). Bearish invalidation level: $0.40 (psychological resistance and 100-day MA). This scenario aligns with broader market weakness and delayed Midnight milestones.

What is Midnight blockchain?Midnight is a privacy-focused blockchain and Cardano spin-off project aiming to implement privacy-enhancing technologies for compliant transactions.

How does Midnight differ from other privacy coins?Midnight emphasizes "smart compliance" and regulatory integration, distinguishing it from anonymity-focused chains like Monero.

What are privacy-enhancing technologies (PET)?PETs enable verification and computation without exposing personal information, using cryptographic methods like zero-knowledge proofs.

How might Midnight affect ADA price?Successful development could create positive ecosystem effects, but current market conditions suggest limited immediate impact.

What are the main technical challenges for Midnight?Balancing privacy with regulatory compliance represents the primary technical hurdle, along with achieving scalability comparable to transparent chains.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.