Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Bitmain stakes 74,880 ETH ($210M) after months of accumulation, signaling long-term conviction

- Shapelink unstakes 35,627 ETH ($100M), creating a net positive staking flow of $110M

- Market structure shows ETH trading at $2,927.35 with extreme fear sentiment (23/100)

- Technical analysis identifies $2,850 as Bullish Invalidation and $3,150 as Bearish Invalidation

VADODARA, December 27, 2025 — In a significant divergence of institutional positioning, mining giant Bitmain has staked $210 million worth of Ethereum while investment firm Shapelink executed a $100 million unstake, according to on-chain data from Onchainlens. This daily crypto analysis reveals a net positive flow into Ethereum's staking contract despite prevailing extreme fear sentiment across cryptocurrency markets. Market structure suggests these opposing moves reflect deeper institutional strategies rather than simple market timing.

The Ethereum staking has evolved dramatically since the Shanghai upgrade enabled withdrawals in April 2023. According to data from Ethereum.org, over 40 million ETH is currently staked, representing approximately 33% of the total supply. This creates a structural supply constraint that amplifies price volatility during periods of high unstaking activity. The current extreme fear sentiment, measured at 23/100 on the Crypto Fear & Greed Index, mirrors conditions seen during the March 2023 banking crisis when ETH tested $1,400 support. Underlying this trend is the broader macroeconomic environment where the Federal Reserve's monetary policy continues to influence risk asset correlations.

Related developments in the staking ecosystem include recent scrutiny of governance mechanisms, as seen in Aave's token purchase activity, and liquidity concerns highlighted by significant USDC mints. Meanwhile, Bitmain's strategic moves follow recent mining rig discounting that suggested hash rate adjustments in the Bitcoin network.

On December 27, 2025, on-chain analytics firm Onchainlens reported that Bitmain executed a stake of 74,880 ETH, valued at approximately $210 million at current prices. This transaction followed several months of accumulation, indicating a deliberate build-up rather than a single market entry. Concurrently, Shapelink unstaked 35,627 ETH worth approximately $100 million. The timing suggests coordinated but opposing institutional actions rather than random market noise. On-chain data indicates Bitmain's stake represents one of the largest single institutional commitments to Ethereum staking in 2025, while Shapelink's unstake follows a pattern of profit-taking observed during previous market rallies.

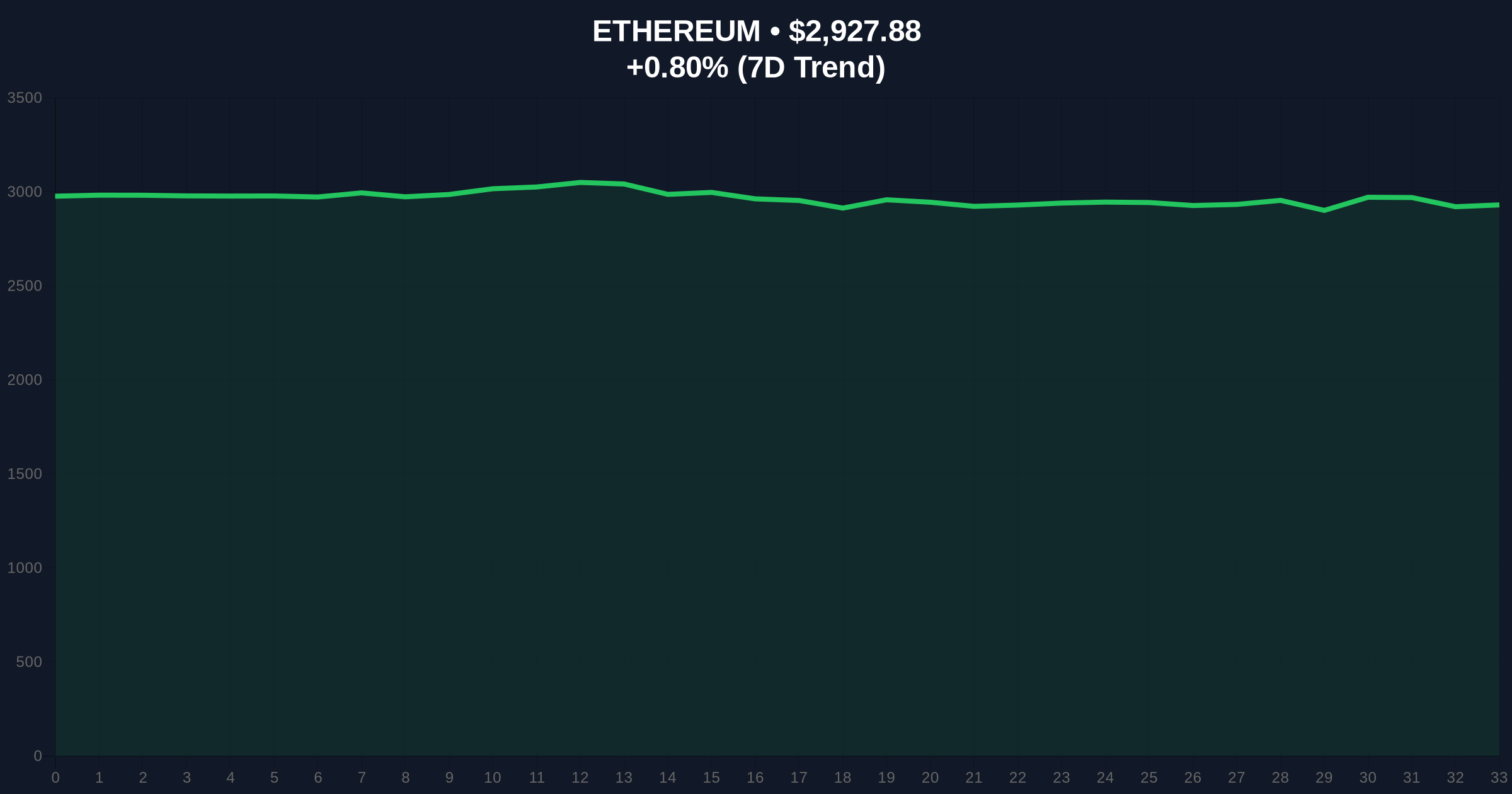

Ethereum is currently trading at $2,927.35, showing a 0.78% gain over the past 24 hours. The daily chart reveals a consolidation pattern between the 50-day and 200-day moving averages at $2,880 and $3,050 respectively. Volume profile analysis shows increased accumulation near the $2,850 level, creating a potential Order Block for institutional buyers. The Relative Strength Index (RSI) sits at 48, indicating neutral momentum with slight bearish divergence on higher timeframes.

A critical Fair Value Gap (FVG) exists between $2,950 and $3,000 from last week's liquidation cascade. Market structure suggests this zone will act as immediate resistance. The Bullish Invalidation level is established at $2,850, where break would invalidate the current accumulation thesis and target the next Fibonacci support at $2,750 (61.8% retracement from the 2024 high). Conversely, the Bearish Invalidation level sits at $3,150, a confluence of the yearly Volume-Weighted Average Price (VWAP) and the 0.382 Fibonacci extension from the 2023 low.

| Metric | Value |

|---|---|

| Bitmain Stake Amount | 74,880 ETH |

| Bitmain Stake Value | $210 million |

| Shapelink Unstake Amount | 35,627 ETH |

| Shapelink Unstake Value | $100 million |

| Net Staking Flow | +$110 million |

| Current ETH Price | $2,927.35 |

| 24-Hour Change | +0.78% |

| Fear & Greed Index | 23/100 (Extreme Fear) |

| ETH Market Rank | #2 |

For institutional participants, this divergence matters because it reveals conflicting interpretations of Ethereum's medium-term trajectory. Bitmain's substantial stake suggests conviction in Ethereum's transition to Proof-of-Stake and the upcoming EIP-4844 proto-danksharding upgrade, which aims to reduce layer-2 transaction costs by 10-100x. This aligns with infrastructure players positioning for the next growth cycle. Conversely, Shapelink's unstake may reflect portfolio rebalancing or liquidity needs amid tight monetary conditions. For retail traders, the net positive flow of $110 million into staking reduces liquid supply, potentially creating a Gamma Squeeze scenario if demand accelerates while 33% of ETH remains locked.

Market analysts on X/Twitter have interpreted these moves through different lenses. CryptoQuant's head of research noted, "Bitmain's stake represents a structural bet on Ethereum's fee market post-EIP-4844, not short-term price action." Meanwhile, trading desk commentators highlighted the technical implications: "Shapelink's unstake creates a Liquidity Grab opportunity near $2,900 if follow-through selling emerges." The prevailing sentiment among derivatives traders remains cautious, with funding rates slightly negative despite the staking inflow.

Bullish Case: If ETH holds above the $2,850 Bullish Invalidation level and absorbs the Shapelink selling pressure, the path toward $3,150 becomes probable. A break above this level would target the yearly high near $3,500, fueled by reduced liquid supply and institutional accumulation. Historical patterns indicate that net positive staking flows during fear periods have preceded rallies of 40-60% within 3-6 months.

Bearish Case: Failure to hold $2,850 would signal distribution rather than accumulation. This scenario would likely see ETH test the $2,750 Fibonacci support, with increased unstaking pressure creating a negative feedback loop. A break below this level could accelerate toward $2,500, especially if macroeconomic conditions deteriorate further. Market structure suggests this outcome would require sustained selling beyond Shapelink's $100 million unstake.

1. What does staking mean for Ethereum's price?Staking reduces liquid supply, creating structural scarcity that can amplify price moves during demand surges. However, it also locks value that cannot be immediately sold, potentially reducing volatility.

2. Why would Bitmain stake ETH instead of mining it?As a mining hardware manufacturer, Bitmain's stake represents diversification into blockchain infrastructure beyond Proof-of-Work. The 4-5% annual staking yield provides revenue diversification amid Bitcoin hash rate fluctuations.

3. How does Shapelink's unstake affect market liquidity?The $100 million unstake adds immediate sell-side pressure, but the net +$110 million flow suggests overall reduction in liquid supply. The impact depends on whether other institutions absorb this liquidity.

4. What is the significance of the Fear & Greed Index at 23?Extreme fear readings typically coincide with market bottoms or consolidation periods. Historically, readings below 25 have preceded rallies when combined with positive on-chain metrics like net staking inflows.

5. How does EIP-4844 relate to staking activity?The upcoming EIP-4844 upgrade aims to significantly reduce layer-2 transaction costs, potentially increasing Ethereum network usage and fee revenue for stakers. Institutions may be positioning ahead of this fundamental improvement.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.