Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

- Bitcoin OG address 1011short adds 207,351 SOL to existing long position

- Address holds $43 million in unrealized losses across leveraged BTC, ETH, and SOL positions

- Market structure suggests institutional capital rotating from Bitcoin to altcoin exposure

- Global crypto sentiment remains at "Extreme Fear" (23/100) despite position accumulation

VADODARA, December 25, 2025 — A Bitcoin original gangster (OG) has significantly increased exposure to Solana while maintaining substantial leveraged positions in Bitcoin and Ethereum, according to on-chain data. This Daily Crypto Analysis examines the implications of a single address accumulating 207,351 additional SOL tokens amid $43 million in unrealized losses, signaling potential institutional rotation strategies during extreme market fear.

Large-scale position accumulation during periods of extreme fear represents a classic contrarian signal. The current market environment mirrors the 2021 cycle when institutional capital rotated from Bitcoin dominance into altcoin exposure during consolidation phases. On-chain data indicates sophisticated players often accumulate during sentiment extremes, particularly when leverage positions show significant unrealized losses. This behavior suggests conviction in longer-term price appreciation despite short-term pain.

Related developments in the derivatives market provide additional context. The Coinglass 2025 Report revealed significant contradictions in derivatives positioning, while Jim Cramer's bear market prediction sparked debate about contrarian signals. These events create a complex backdrop for the current position accumulation.

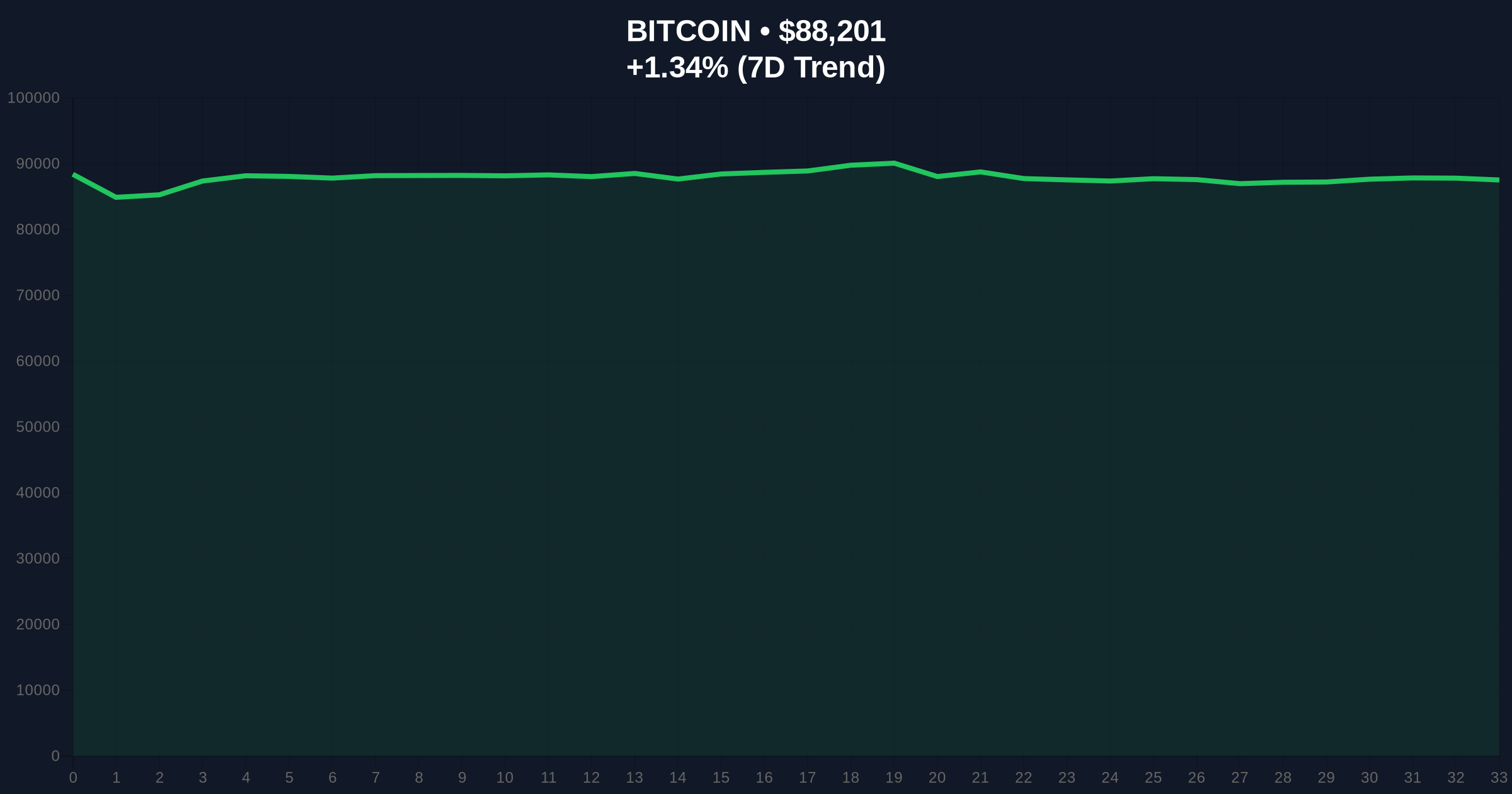

Lookonchain reported that address 1011short, identified as a Bitcoin OG, increased its SOL long position by 207,351 tokens. The address maintains a 5x leveraged long position of 203,341 ETH, a 5x leveraged long position of 1,000 BTC, and a 10x leveraged long position of 508,929 SOL. Current unrealized losses across these positions total $43 million. The accumulation occurred despite Bitcoin trading at $88,202 with a 1.34% 24-hour gain, while global crypto sentiment remains at "Extreme Fear" with a score of 23/100.

Market structure suggests the current accumulation represents a liquidity grab below key psychological levels. Bitcoin faces immediate resistance at the $90,000 order block, with support at the $85,000 fair value gap (FVG) created during last week's volatility. The 200-day moving average at $82,500 provides additional structural support. Solana's volume profile shows accumulation between $140-$160, with the current position likely targeting the $180 gamma squeeze level.

Bullish invalidation occurs if Bitcoin breaks below the $82,000 Fibonacci support level (61.8% retracement from the 2024 high). Bearish invalidation triggers if Solana fails to hold the $135 volume node, which would indicate distribution rather than accumulation. The simultaneous maintenance of leveraged positions across three major assets suggests a portfolio hedging strategy rather than directional speculation.

| Metric | Value |

|---|---|

| SOL Position Increase | 207,351 tokens |

| Total Unrealized Losses | $43 million |

| BTC Leverage Position | 1,000 BTC (5x long) |

| ETH Leverage Position | 203,341 ETH (5x long) |

| Global Crypto Sentiment | Extreme Fear (23/100) |

| Bitcoin Current Price | $88,202 |

For institutional investors, this represents a case study in position sizing during extreme sentiment. The maintenance of $43 million in unrealized losses indicates either extraordinary conviction or potential margin call risk. Retail traders should note that large players accumulate during fear, not after price confirmation. The rotation from Bitcoin dominance to altcoin exposure suggests changing capital allocation strategies as the market matures.

The regulatory context matters. The SEC's continued classification of certain altcoins as securities creates jurisdictional uncertainty, though Ethereum's transition to proof-of-stake via EIP-4844 established important precedents for network evolution.

Market analysts on X/Twitter highlight the contrarian nature of the accumulation. "When OGs add during extreme fear, history suggests they see value others miss," noted one quantitative trader. Others point to the leverage risk: "$43M in unrealized losses with 5-10x leverage creates potential cascade effects if prices move against these positions." The debate centers on whether this represents smart accumulation or dangerous over-leverage.

Bullish Case: If Bitcoin holds the $85,000 FVG and Solana breaks the $180 gamma squeeze level, the accumulated positions could trigger a short squeeze. Institutional rotation into altcoins could propel SOL toward $220 while Bitcoin tests $95,000 resistance. The extreme fear sentiment would flip to greed, validating the accumulation strategy.

Bearish Case: If Bitcoin breaks below $82,000 Fibonacci support, the $43 million in unrealized losses could force liquidations. A cascade sell-off could push Bitcoin to $78,000 and Solana below $120. The leveraged positions would amplify losses, potentially triggering broader market contagion.

What is a Bitcoin OG? A Bitcoin original gangster refers to early adopters who accumulated Bitcoin during its formative years, typically before 2013.

Why would someone maintain $43M in unrealized losses? Sophisticated investors often tolerate short-term losses when accumulating large positions, betting on longer-term appreciation.

What does 5x and 10x leverage mean? Leverage amplifies both gains and losses. A 5x position means the investor controls 5 times their capital exposure.

How reliable is on-chain data for predicting price movements? On-chain data provides transparency into wallet activity but doesn't guarantee price outcomes. It's one tool among many.

What's the significance of accumulation during extreme fear? Historical patterns show that accumulation during sentiment extremes often precedes price reversals, as fear capitulation creates buying opportunities.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.