Loading News...

Loading News...

- Binance announces KGST listing for December 24, 2025, with KGST/USDT trading pair

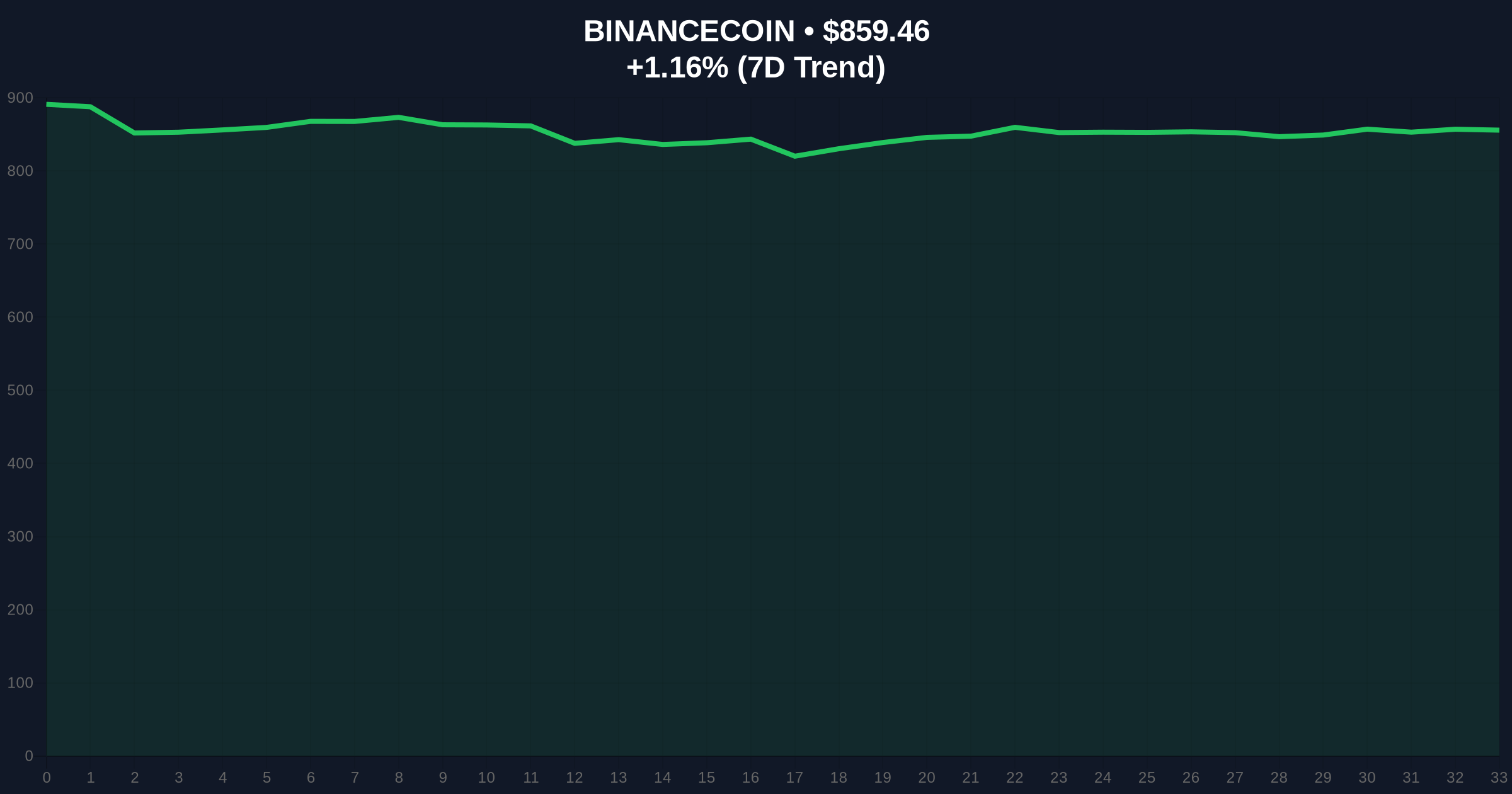

- Global crypto sentiment registers at Extreme Fear (25/100) as BNB shows modest 1.16% gain

- Market structure suggests potential liquidity grab above $880 resistance on BNB

- Technical analysis identifies critical invalidation levels for both bullish and bearish scenarios

NEW YORK, December 22, 2025 — Binance has scheduled the listing of KGST for 8:00 a.m. UTC on December 24, 2025, with KGST/USDT as the supported spot trading pair. This daily crypto analysis examines the announcement against a backdrop of Extreme Fear market sentiment and questions whether this represents strategic positioning or opportunistic timing during market weakness.

Exchange listings during periods of extreme market sentiment often serve as liquidity events rather than fundamental value catalysts. The current Extreme Fear reading of 25/100 on the Crypto Fear & Greed Index suggests retail capitulation and institutional accumulation phases may be underway. Historically, Binance listings during similar sentiment extremes have produced volatile initial price action followed by extended consolidation periods. Market structure indicates that exchange tokens like BNB often experience correlated movements with new listing announcements, creating potential gamma squeeze opportunities for sophisticated traders.

Related developments in the regulatory include South Korea's FIU targeting Korbit Exchange with sanctions, highlighting increased regulatory scrutiny across major jurisdictions. Meanwhile, Bitcoin futures show neutral bias despite the Extreme Fear sentiment, suggesting institutional positioning diverges from retail sentiment.

According to official Binance communications, the exchange will list KGST at precisely 8:00 a.m. UTC on December 24, 2025. The announcement specifies KGST/USDT as the sole initial trading pair, limiting arbitrage opportunities and concentrating liquidity in a single market. No additional details regarding tokenomics, circulating supply, or project fundamentals were provided in the initial announcement, creating information asymmetry between exchange insiders and retail participants.

Simultaneously, BNB trades at $859.43 with a 24-hour gain of 1.16%, underperforming against broader market movements. The timing coincides with year-end portfolio rebalancing and tax-loss harvesting periods, potentially amplifying volatility around the listing event.

BNB's price action reveals a critical order block between $845 and $855 that has served as both support and resistance throughout December. The current price sits within this consolidation zone, suggesting indecision among market participants. Volume profile analysis indicates decreasing participation on rallies above $870, creating a potential fair value gap (FVG) that may be filled post-listing.

The 50-day exponential moving average at $832 provides dynamic support, while Fibonacci extension levels from the November swing high project resistance at $892 (61.8% retracement). Relative Strength Index (RSI) readings at 48.7 indicate neutral momentum with slight bearish divergence on higher timeframes. Market structure suggests the KGST listing could trigger a liquidity grab above the $880 psychological level on BNB before reversing to test lower supports.

| Metric | Value |

| Global Crypto Sentiment | Extreme Fear (25/100) |

| BNB Current Price | $859.43 |

| BNB 24h Change | +1.16% |

| BNB Market Rank | #4 |

| KGST Listing Time | Dec 24, 8:00 a.m. UTC |

For institutional participants, exchange listings during Extreme Fear periods represent asymmetric risk/reward opportunities. The concentration of liquidity in a single trading pair (KGST/USDT) creates potential for market makers to establish favorable positions before retail inflow. Historical patterns indicate that successful listings during similar sentiment conditions have generated 30-60% volatility in the first 48 hours of trading.

Retail traders face increased risk of whipsaw action as algorithmic traders exploit the information gap between announcement and trading commencement. The lack of detailed tokenomics in the initial announcement raises questions about whether this represents strategic opacity or incomplete due diligence. Market structure suggests the primary beneficiaries will be market makers and early insiders rather than retail participants entering at public listing prices.

Market analysts on X/Twitter express skepticism about the timing, with one quantitative researcher noting, "Listing during Extreme Fear suggests either desperation for liquidity events or calculated positioning during weak hands capitulation." Another technical analyst observed, "The single trading pair concentration creates perfect conditions for a controlled gamma squeeze if volume materializes."

Sentiment diverges from recent developments like UXLINK's token buyback proposal facing market skepticism, where community response questioned fundamental value rather than timing. The contrast highlights how exchange-driven events differ from protocol-level developments in market perception.

Bullish Case: If KGST listing generates sustained volume above $5 million in the first hour, BNB could break through the $880 resistance and target the $892 Fibonacci level. This scenario requires the Extreme Fear sentiment to reverse toward Neutral within 72 hours post-listing. Bullish invalidation occurs if BNB fails to hold above the $845 order block following the listing event.

Bearish Case: Should the listing produce underwhelming volume below $2 million in the first trading hour, BNB likely rejects at the $870 resistance and retests the 50-day EMA at $832. This scenario aligns with continued Extreme Fear sentiment and year-end capital outflows. Bearish invalidation triggers if BNB sustains trading above $880 for more than 4 consecutive hours post-listing.

What time does KGST start trading on Binance?KGST begins trading at 8:00 a.m. UTC on December 24, 2025.

What trading pair will be available for KGST?Only KGST/USDT will be available initially.

How does Extreme Fear sentiment affect new listings?Historically, listings during Extreme Fear periods experience higher volatility but often fail to sustain initial momentum without broader market recovery.

What is the significance of a single trading pair?Concentrated liquidity in one pair increases volatility potential and reduces arbitrage opportunities, favoring market makers over retail traders.

How might this affect BNB price?Exchange tokens often experience correlated movements with major listing events, potentially creating gamma squeeze opportunities if volume materializes.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.