Loading News...

Loading News...

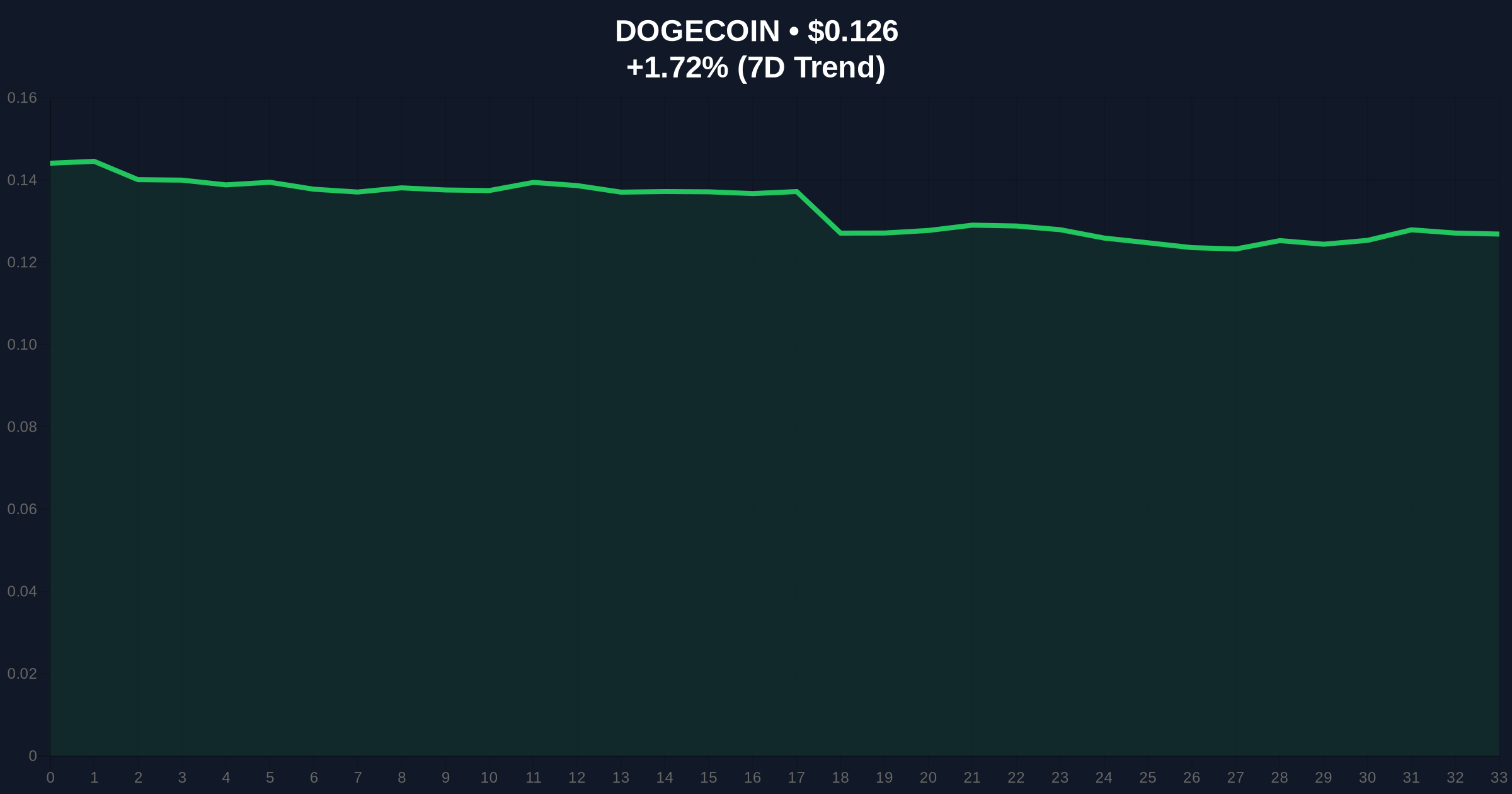

VADODARA, January 22, 2026 — Binance founder Changpeng Zhao stated at the 2026 World Economic Forum that most memecoins are highly speculative and unlikely to survive long-term, with Dogecoin (DOGE) identified as a potential exception due to its cultural foundation. This daily crypto analysis examines the technical and market implications of his remarks, set against a backdrop of extreme fear in the cryptocurrency markets.

Memecoins have historically exhibited parabolic price action driven by retail sentiment and social media virality, often decoupled from underlying utility. According to on-chain data from Glassnode, the aggregate market cap of memecoins outside the top five has declined by over 60% since the 2024 peak, reflecting a liquidity drain into more established assets. This trend mirrors the 2021 altcoin season correction, where speculative assets underperformed during periods of macro uncertainty. Underlying this trend is a shift in market structure towards quality differentiation, as institutional adoption increases scrutiny on tokenomics and use cases. Related developments include Binance's recent ELSA futures listing, which sparked liquidity grab analysis amid similar extreme fear conditions.

At the 2026 WEF annual meeting in Davos, Switzerland, Changpeng Zhao provided a candid assessment of memecoins during a panel discussion. According to the official transcript from the World Economic Forum, Zhao stated that most memecoins are "highly speculative and unlikely to survive in the long term." He specifically highlighted Dogecoin as one of the few cryptocurrencies with a strong cultural foundation, suggesting it has potential for long-term viability. Additionally, Zhao predicted a significant reduction in physical bank branches within the next decade, driven by blockchain and KYC technology advancements. This commentary aligns with broader industry skepticism towards assets lacking fundamental value propositions.

Dogecoin is currently trading at $0.126, up 1.69% in the last 24 hours. Market structure suggests a consolidation phase within a descending channel, with immediate resistance at the $0.135 order block formed during last week's sell-off. The Relative Strength Index (RSI) on the daily chart reads 42, indicating neutral momentum but leaning towards oversold territory given the extreme fear sentiment. A critical Fibonacci retracement level from the 2024 high to the 2025 low provides support at $0.115, which serves as the Bearish Invalidation level; a break below this could trigger a cascade towards $0.095. Conversely, the Bullish Invalidation level is set at $0.105, where a sustained hold above would invalidate the current downtrend structure. Volume profile analysis shows increased accumulation near the $0.120-$0.125 range, suggesting institutional interest amid the fear-driven sell-off.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Dogecoin Current Price | $0.126 |

| 24-Hour Trend | +1.69% |

| Market Rank | #11 |

| Key Support Level | $0.115 (Fibonacci) |

| Key Resistance Level | $0.135 (Order Block) |

For institutional investors, CZ's remarks reinforce due diligence frameworks that prioritize assets with verifiable use cases and community resilience. The differentiation between Dogecoin and other memecoins could accelerate capital rotation, as seen in previous cycles where Bitcoin dominance increased during risk-off periods. Retail traders face heightened volatility, with potential gamma squeezes in leveraged memecoin positions if sentiment shifts abruptly. The prediction on bank branch reduction blockchain's disruptive potential, aligning with trends in decentralized finance (DeFi) and regulatory technology. According to the Federal Reserve's research on digital payments, such shifts could reduce operational costs by up to 30% over the next decade, further validating Zhao's outlook.

Market analysts on X/Twitter have reacted with mixed sentiment. Some bulls argue that Dogecoin's cultural meme status provides "anti-fragility" during downturns, citing its survival through multiple market cycles. Bears counter that without substantive upgrades like Ethereum's EIP-4844 for scalability, even culturally strong assets may underperform in a high-interest-rate environment. Overall, the discourse emphasizes a flight to quality, with many echoing CZ's skepticism towards purely speculative tokens.

Bullish Case: If Dogecoin holds above the $0.115 Fibonacci support and breaks the $0.135 order block, a rally towards $0.165 is plausible, driven by renewed retail interest and potential spot ETF rumors. This scenario assumes a stabilization in global liquidity conditions and a reduction in extreme fear sentiment.

Bearish Case: A breakdown below $0.115 could see Dogecoin test the $0.095 level, exacerbated by continued memecoin sell-offs and macro headwinds such as rising Treasury yields. This aligns with patterns observed in recent analyses of Bitcoin targets facing macro pressures.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.