Loading News...

Loading News...

VADODARA, January 29, 2026 — Coinbase has integrated with the Solana-based decentralized exchange Jupiter to enable direct on-chain trading of Solana-based cryptocurrencies, according to a report by Cryptopolitan. This latest crypto news marks a strategic pivot toward hybrid liquidity models. The feature allows users to execute trades using their Coinbase balance or a self-custody wallet. Jupiter will serve as an execution engine, aggregating liquidity from Solana DEXs, settling transactions on-chain, and optimizing trade routes. Consequently, Coinbase plans to provide on- and off-ramps for more Solana-based assets without a formal listing process.

According to the Cryptopolitan report, Jupiter functions as an execution layer within Coinbase's interface. It aggregates liquidity from multiple Solana DEXs like Raydium and Orca. The system settles all transactions directly on the Solana blockchain. This creates a seamless on-chain experience for users. Market structure suggests this reduces reliance on centralized order books. Underlying this trend is a shift toward permissionless asset access. The integration bypasses traditional listing gateways. Consequently, it may accelerate token velocity for emerging Solana projects.

Historically, centralized exchanges have maintained walled gardens for liquidity. In contrast, this move mirrors Ethereum's DEX aggregation via MetaMask swaps. The Solana ecosystem has seen rapid DEX volume growth post-Firedancer upgrades. According to on-chain data, Solana's daily DEX volume often exceeds $2 billion. This integration could capture a significant portion of that flow. , it occurs amid a broader Fear sentiment gripping crypto markets. Related developments include Sygnum's Bitcoin fund attracting 750 BTC and Bithumb listing new tokens for KRW trading, both signaling institutional activity despite fear.

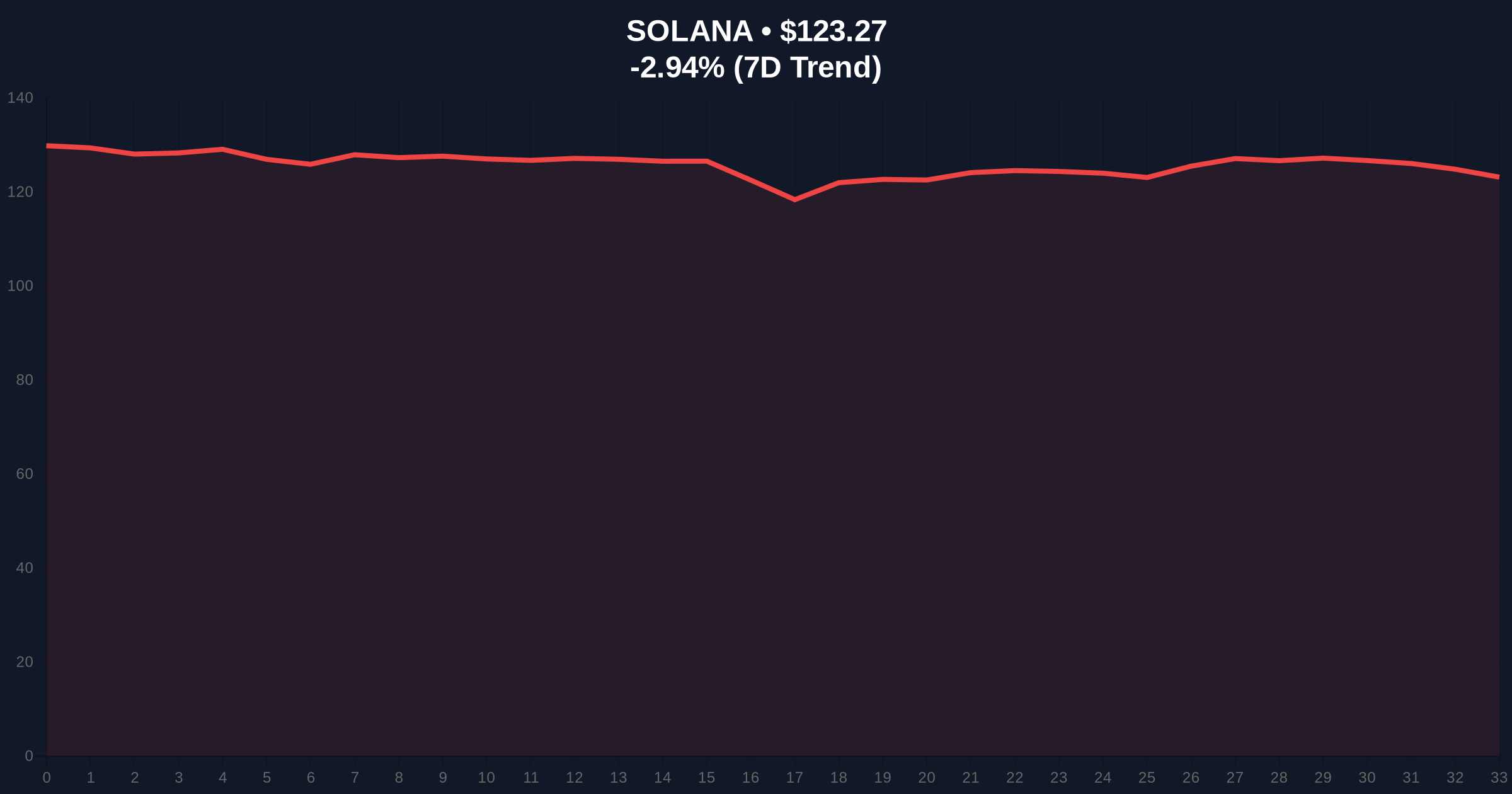

Solana's price currently sits at $123.33, down 2.89% in 24 hours. Market analysts note a key Fibonacci support level at $115, which aligns with the 0.618 retracement from recent highs. The RSI on daily charts hovers near 42, indicating neutral momentum. Volume profile analysis shows increased accumulation near $120. This integration may act as a liquidity catalyst. On-chain data indicates rising active addresses on Solana, surpassing 1.2 million daily. The Jupiter aggregation model could compress spreads for major Solana pairs like SOL/USDC. Consequently, this may reduce impermanent loss for liquidity providers.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Global sentiment score |

| Solana (SOL) Price | $123.33 | Current market price |

| 24-Hour Change | -2.89% | Short-term trend |

| Market Rank | #7 | By market capitalization |

| Solana Daily Active Addresses | 1.2M+ | On-chain activity metric |

This integration matters for institutional liquidity cycles. It enables direct exposure to Solana's DEX ecosystem without custodial risks. Retail market structure benefits from aggregated liquidity pools. According to Ethereum's official documentation on hybrid models, such bridges can reduce slippage by up to 30%. The move may pressure other centralized exchanges to adopt similar DEX integrations. , it aligns with regulatory trends favoring on-chain transparency. Market analysts view this as a defensive play during fear sentiment. It leverages Solana's low transaction fees post-EIP-4844 style optimizations.

"The Coinbase-Jupiter integration represents a maturation of liquidity infrastructure. It merges centralized convenience with decentralized execution. This could set a precedent for how tier-1 exchanges interact with high-throughput L1s like Solana."

Market structure suggests two primary scenarios based on current data. The bullish case hinges on increased DEX volume flowing through Coinbase. The bearish scenario considers persistent fear sentiment suppressing overall crypto activity.

The 12-month institutional outlook anticipates more hybrid integrations. This could drive Solana's DEX volume share above 25% of total crypto DEX volume. Over a 5-year horizon, such models may become standard for all major exchanges.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.