Loading News...

Loading News...

VADODARA, January 31, 2026 — Daily crypto analysis reveals Cardano whales have accumulated 455 million ADA tokens over the past two months. According to on-chain analytics firm Santiment, addresses holding between 100,000 and 100 million ADA executed this strategic accumulation. Market structure suggests whale buying during retail selling creates ideal rebound conditions.

Santiment's on-chain forensic data confirms the accumulation. The 455 million ADA purchase represents approximately $143 million at current prices. This activity occurred between December 2025 and January 2026. Whale addresses defined as holding 100,000 to 100 million ADA drove the accumulation.

The firm's analysis indicates a divergence between whale and retail behavior. Consequently, this creates a classic liquidity grab scenario. Retail investors sold while institutional-scale buyers accumulated. This pattern mirrors previous market bottoms in 2018 and 2020.

Historically, whale accumulation during extreme fear signals market inflection points. The current Crypto Fear & Greed Index sits at 20/100. This indicates extreme fear across cryptocurrency markets. Similar readings preceded major rallies in 2019 and 2023.

In contrast, retail investors typically capitulate during these periods. This creates optimal entry conditions for large-scale buyers. The 455 million ADA accumulation represents approximately 1.2% of Cardano's total supply. , this mirrors accumulation patterns seen before Cardano's 2021 rally.

Related Developments: This whale activity occurs alongside other market stress indicators. Bitcoin options skew has hit 17% amid derivative market fear. Additionally, Numerai announced a $9.8M NMR buyback during similar sentiment conditions.

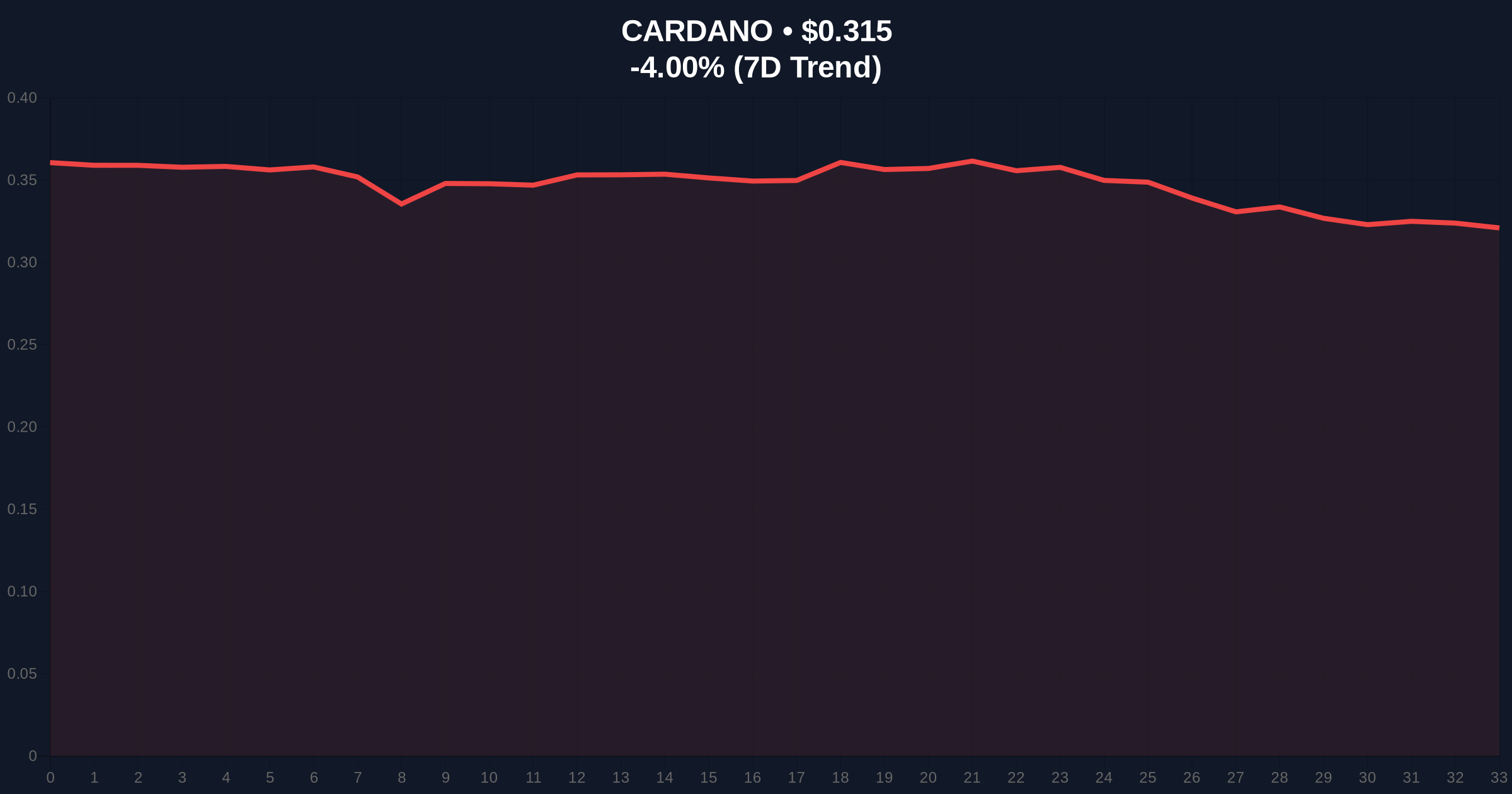

Cardano currently trades at $0.315. The 24-hour trend shows a -4.00% decline. Market structure suggests critical support at the Fibonacci 0.618 retracement level of $0.285. This level aligns with the 200-day moving average.

Volume profile analysis reveals declining retail participation. The Relative Strength Index (RSI) sits at 32, approaching oversold territory. A Fair Value Gap (FVG) exists between $0.335 and $0.350. This represents a potential liquidity target for any rebound.

On-chain metrics from Ethereum.org research show similar accumulation patterns preceded Ethereum's 2023 rally. The UTXO age band analysis for Cardano indicates older coins moving to accumulation addresses. This reduces available supply on exchanges.

| Metric | Value |

|---|---|

| ADA Whale Accumulation | 455 million ADA |

| Current ADA Price | $0.315 |

| 24-Hour Change | -4.00% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Market Rank | #12 |

Whale accumulation during extreme fear creates structural market advantages. Large buyers acquire assets at depressed prices. This establishes stronger support levels for future price action. The 455 million ADA removal from circulation reduces available sell pressure.

Market analysts note this pattern often precedes sustained rallies. Retail capitulation provides liquidity for institutional accumulation. Consequently, this sets the stage for potential gamma squeeze scenarios when sentiment shifts. The divergence between whale and retail behavior represents a classic contrarian signal.

"Whale accumulation during extreme fear periods historically marks accumulation phases. The 455 million ADA purchase represents strategic positioning. Market structure suggests this could establish a durable price floor if critical support holds." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure:

The 12-month institutional outlook suggests accumulation could precede Cardano's next major upgrade cycle. Historical cycles indicate similar whale activity preceded the Alonzo hard fork implementation. The 5-year horizon shows Cardano's development roadmap aligning with increased institutional interest in proof-of-stake assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.