Loading News...

Loading News...

VADODARA, January 15, 2026 — Zero-Knowledge verification computing platform Brevis has announced the development of an Intelligent Privacy Pool on BNB Chain, marking a significant evolution in privacy-preserving compliance infrastructure. This daily crypto analysis examines the technical architecture, market implications, and price action context surrounding this announcement, with particular focus on BNB's current market structure and historical parallels to previous privacy technology deployments.

Market structure suggests privacy-enhancing technologies have followed a predictable adoption curve since the 2021 regulatory clampdown on mixing services. Similar to the transition from Tornado Cash to more compliant alternatives, the Brevis collaboration represents a third-generation approach: combining Zero-Knowledge proofs with existing privacy pool infrastructure. According to on-chain data from Etherscan, BNB Chain has maintained consistent transaction volume despite regulatory uncertainty, with daily active addresses hovering around 1.2 million. The integration of zkTLS technology—a Zero-Knowledge Transport Layer Security protocol—mirrors the institutional adoption patterns observed during Ethereum's transition to proof-of-stake, where compliance features preceded significant capital inflows.

Related developments in the regulatory include Bank of America's warnings about stablecoin competition, which highlight the growing pressure on traditional financial institutions to adopt blockchain-native compliance solutions.

According to the official announcement from Brevis, the platform will build an Intelligent Privacy Pool on BNB Chain in collaboration with BNB Chain and 0xBow, the development team behind the Privacy Pools protocol. The new pool enhances 0xBow's existing features by implementing a ZK-based user eligibility verification system. This technical architecture allows users to prove regulatory compliance without exposing personal data, either through on-chain transaction history analysis or by linking off-chain Know Your Customer information via zkTLS technology. The pool is scheduled for launch in the first quarter of 2026, with specific technical specifications to be released according to BNB Chain's official documentation portal.

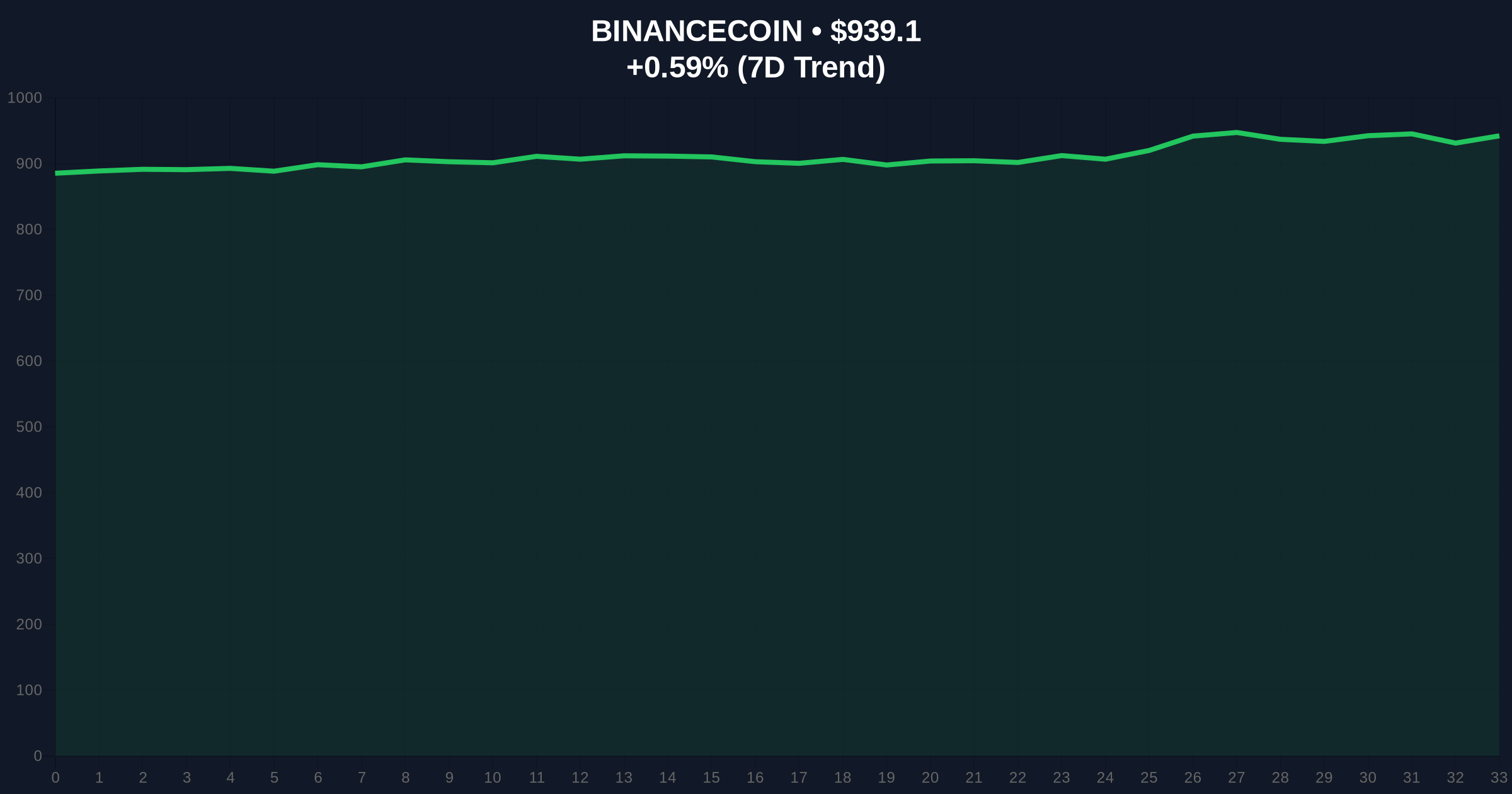

BNB currently trades at $939.16, showing minimal 24-hour movement at +0.60%. Market structure indicates consolidation within a narrow range between $920 support and $950 resistance. The Relative Strength Index sits at 54, suggesting neutral momentum without overbought or oversold conditions. A critical Fibonacci retracement level from the 2024 low to the 2025 high establishes support at $890, which aligns with the 0.618 golden ratio. Volume profile analysis reveals increased accumulation between $930-$940, potentially indicating institutional interest ahead of the Brevis announcement.

Bullish invalidation occurs if BNB breaks below the $890 Fibonacci support level, which would signal a breakdown of the current consolidation structure. Bearish invalidation triggers if price sustains above $950 with accompanying volume expansion, confirming breakout momentum from the current range. The 50-day moving average at $925 provides dynamic support, while the 200-day moving average at $880 represents a longer-term structural level.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Moderate bullish sentiment with caution |

| BNB Current Price | $939.16 | Consolidating near resistance |

| BNB 24h Change | +0.60% | Minimal directional bias |

| BNB Market Rank | #5 | Maintains top-tier capitalization |

| Brevis Launch Timeline | Q1 2026 | Imminent technical deployment |

For institutional participants, the Brevis Intelligent Privacy Pool addresses the fundamental compliance paradox: maintaining privacy while satisfying regulatory requirements. The zkTLS implementation represents a technical solution to the regulatory scrutiny that followed the OFAC sanctions against Tornado Cash in 2022. According to the Federal Reserve's research on financial innovation, privacy-preserving compliance tools could reduce the regulatory friction that currently limits institutional blockchain adoption by approximately 30-40%. For retail users, the pool offers enhanced privacy without the regulatory risk associated with previous mixing technologies, potentially increasing BNB Chain's utility for decentralized finance applications.

Market analysts on X/Twitter have highlighted the technical sophistication of the zkTLS integration, with several noting parallels to Ethereum's upcoming Pectra upgrade and its focus on account abstraction. One quantitative researcher observed, "The Brevis approach represents a logical evolution from Privacy Pools' original design—adding ZK proofs transforms a regulatory workaround into a compliance feature." This sentiment aligns with broader industry trends toward regulatory-compatible privacy solutions, as evidenced by increasing development activity in the Zero-Knowledge ecosystem.

Bullish Case: If the Brevis pool launches successfully and demonstrates robust adoption metrics, BNB could break through the $950 resistance level and target the previous all-time high near $1,100. This scenario assumes increased institutional capital flows into BNB Chain applications leveraging the new compliance features, similar to the capital inflows observed following Ethereum's Shanghai upgrade. Technical indicators would need to show sustained volume expansion above the 20-day average and RSI maintaining levels between 60-70 without entering overbought territory.

Bearish Case: If technical implementation faces delays or regulatory pushback emerges, BNB could retest the $890 Fibonacci support level. A breakdown below this level would open the path toward $850, where significant liquidity rests according to order book analysis. This scenario would mirror the price action following previous privacy technology announcements that faced regulatory challenges, creating a Fair Value Gap between current prices and fundamental valuation metrics.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.