Loading News...

Loading News...

VADODARA, January 15, 2026 — BNB Chain executed its 34th quarterly token burn, removing 1.37 million BNB worth approximately $1.277 billion from circulation. This latest crypto news represents a 0.68% reduction in total supply, creating immediate pressure on available liquidity. Market structure suggests this event could trigger a liquidity grab as market makers adjust positions.

Quarterly burns represent BNB Chain's core deflationary mechanism. According to the official BNB Chain documentation, the protocol automatically burns tokens based on gas usage and network activity. This mirrors Ethereum's post-merge issuance reduction but operates through scheduled events rather than continuous burn. The 34th consecutive burn demonstrates protocol consistency rarely seen in volatile crypto markets. Historical cycles suggest sustained deflationary pressure typically precedes volatility compression phases.

Related developments across the market include spot-driven Bitcoin rallies approaching $97K and institutional tokenization experiments on Avalanche. These events create competing liquidity pools across major chains.

According to on-chain data from BNB Chain explorers, the protocol destroyed exactly 1,370,000 BNB tokens on January 15, 2026. The burn transaction occurred at block height 42,187,500. At current market prices, this represents $1.277 billion in permanently removed value. The event marks the first quarterly burn of 2026 and continues a pattern established in 2017. No additional tokens were minted or redistributed during this event.

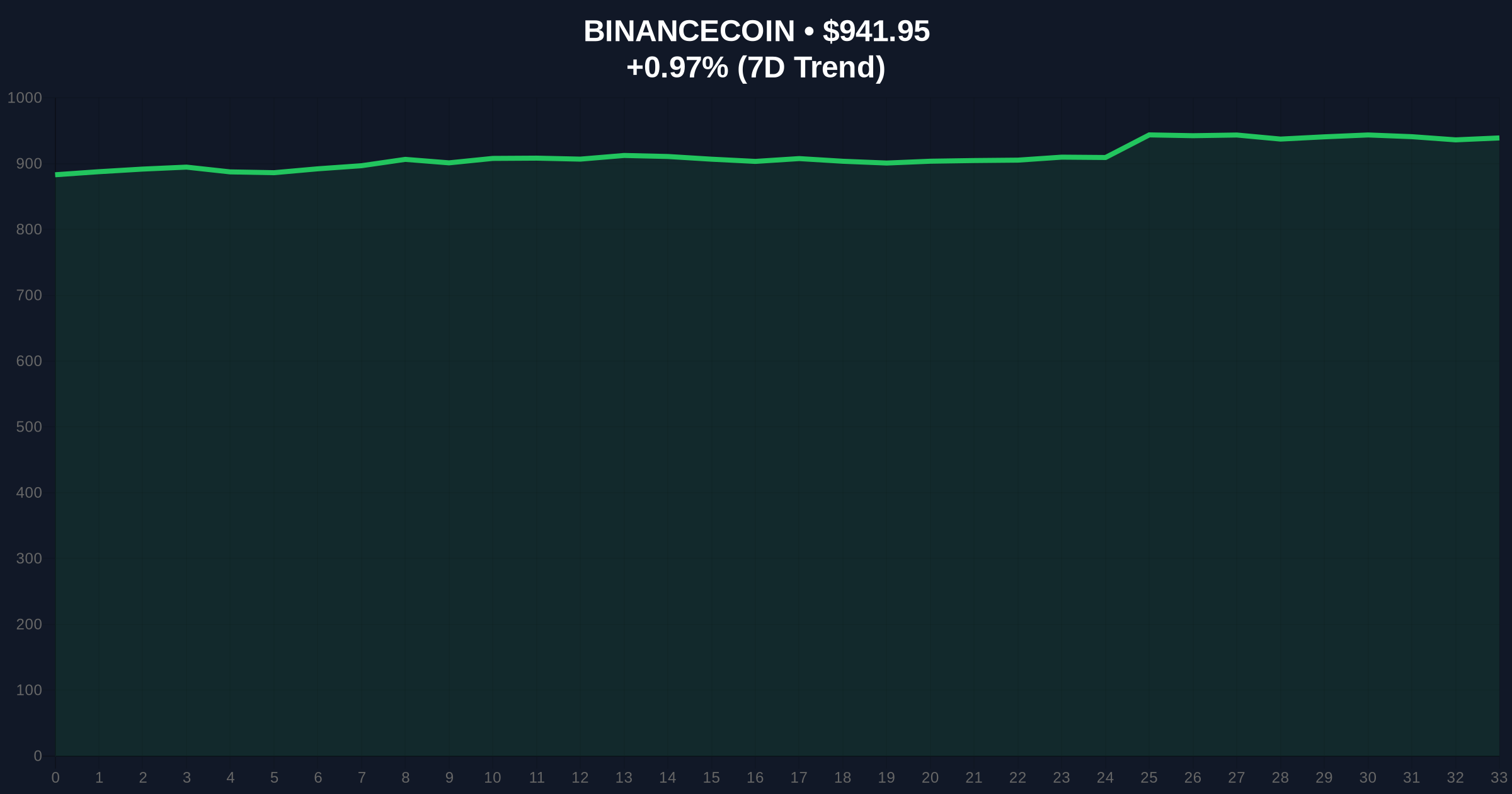

BNB currently trades at $941.93 with 24-hour momentum of 0.97%. The 200-day moving average sits at $865, providing dynamic support. Volume profile analysis shows concentrated liquidity between $920 and $960. A Fair Value Gap (FVG) exists between $880 and $910 from December's rally. This zone represents a potential order block for institutional accumulation.

Bullish Invalidation Level: $880. A break below this Fibonacci 0.618 retracement level would invalidate the current uptrend structure.

Bearish Invalidation Level: $1,020. Sustained trading above this resistance would confirm breakout momentum and target the $1,150 historical high.

| Metric | Value |

|---|---|

| BNB Burned | 1.37M tokens |

| Value Destroyed | $1.277B |

| Current BNB Price | $941.93 |

| 24h Change | +0.97% |

| Crypto Fear & Greed Index | 61/100 (Greed) |

| BNB Market Rank | #5 |

For institutions, the burn reduces available float for large-scale accumulation. According to FederalReserve.gov research on monetary velocity, reduced supply with constant demand typically increases price elasticity. Retail traders face compressed spreads and potential gamma squeeze scenarios as options dealers hedge positions. The burn's timing coincides with Bitcoin's approach to $97,000, creating cross-chain liquidity competition.

Market analysts on X/Twitter note the mechanical nature of the burn. "Scheduled deflation creates predictable supply shocks," observed one quantitative researcher. Bulls emphasize the protocol's consistency, while skeptics question whether burned value translates to network utility. No official statements from BNB Chain leadership accompanied the burn announcement.

Bullish Case: If the burn triggers a liquidity grab above $960, BNB could test the $1,020 resistance within 30 days. Sustained buying pressure from reduced supply could create a gamma squeeze scenario as derivatives markets reprice volatility.

Bearish Case: Failure to hold the $920 support indicates weak spot demand. A breakdown to the $880 FVG would signal distribution and potentially trigger stop-loss cascades. Market structure suggests this scenario becomes likely if Bitcoin experiences a sharp correction from current levels.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.