Loading News...

Loading News...

VADODARA, January 5, 2026 — Bitcoin price action faces a geopolitical catalyst as pro-Bitcoin Nobel Peace Prize laureate Maria Corina Machado emerges as a leading contender for Venezuela's presidency following the U.S. arrest of President Nicolás Maduro. According to Cointelegraph, Machado's 28% probability of leadership creates a structural narrative shift for Bitcoin adoption in hyperinflationary economies.

Venezuela represents a textbook case study for Bitcoin's value proposition. The country has experienced hyperinflation exceeding 1,000,000% annually, destroying local currency purchasing power. Historical cycles suggest Bitcoin adoption accelerates during monetary crises, similar to patterns observed in Argentina and Turkey. Market structure currently shows Bitcoin dominance at 54.3% while the Altcoin Season Index sits at 22, indicating capital remains concentrated in Bitcoin amid broader market uncertainty. Related developments include recent Bitcoin price action breaking above $93k and analysis of Bitcoin dominance during market fear.

Following the U.S. arrest of Venezuelan President Nicolás Maduro, opposition leader Maria Corina Machado has emerged with a 28% probability of becoming Venezuela's next leader according to U.S. prediction market platform Kalshi. Machado, awarded the 2025 Nobel Peace Prize, has publicly described Bitcoin as "a lifeline for Venezuelans" and "a technology for freedom." She advocates Bitcoin as a solution to poverty through property rights protection, inflation control, and equal opportunity creation. The frontrunner remains Edmundo González Urrutia with 32% probability, currently in exile following election fraud allegations.

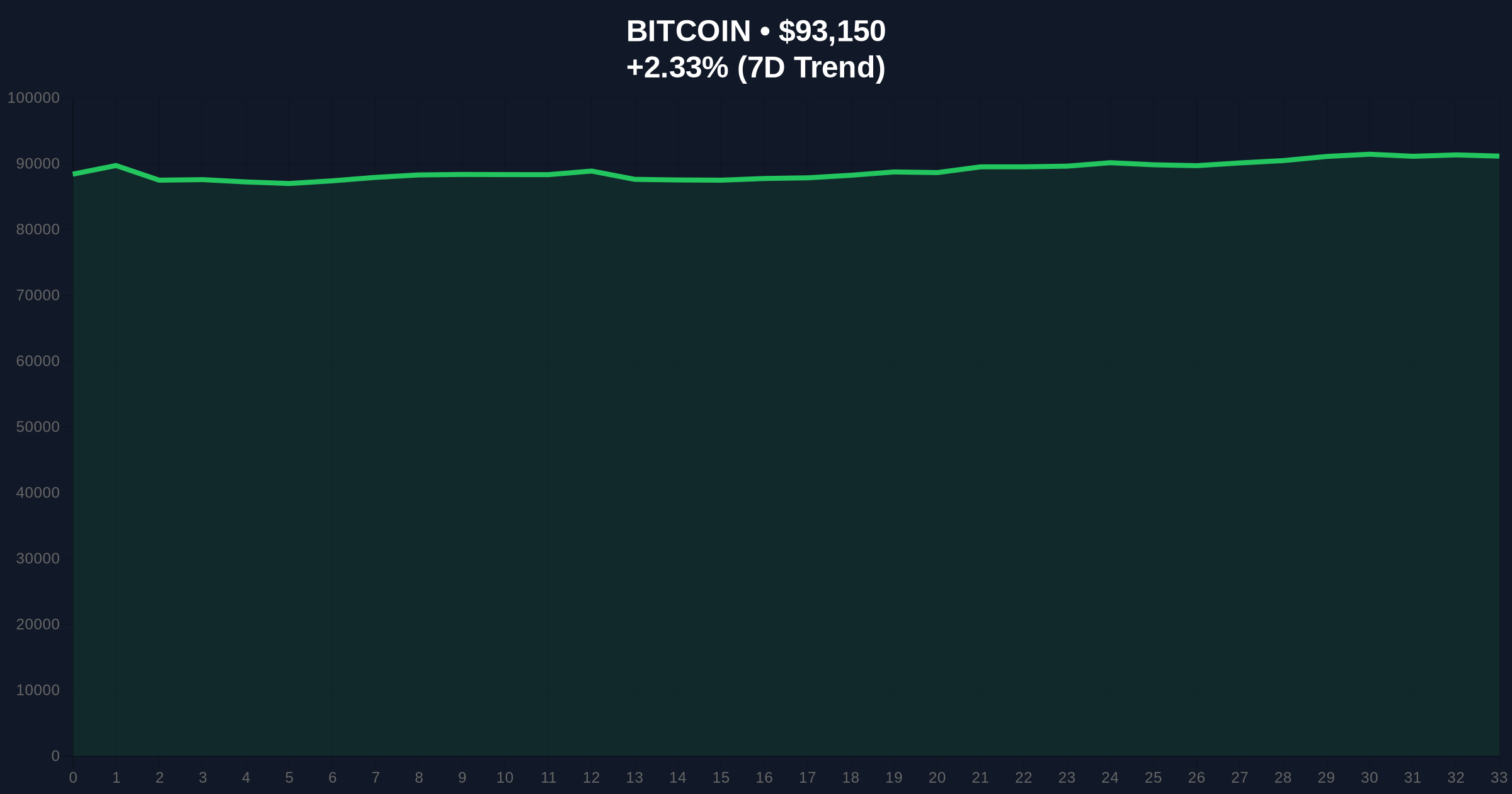

Bitcoin currently trades at $93,013 with a 24-hour trend of 2.17%. The weekly chart shows a clear order block between $89,500 and $91,200 that must hold for bullish continuation. A daily Fair Value Gap (FVG) exists between $94,800 and $95,200 that requires filling. RSI sits at 58 on the 4-hour timeframe, indicating neutral momentum with room for expansion. Volume profile analysis shows significant liquidity accumulation at $90,000, creating a critical support zone. The 200-day moving average at $87,400 provides additional structural support. Bullish invalidation occurs below $89,500 (weekly order block low). Bearish invalidation occurs above $95,200 (daily FVG high).

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme fear despite price appreciation |

| Bitcoin Current Price | $93,013 | Testing daily resistance zone |

| 24-Hour Trend | 2.17% | Positive momentum amid fear |

| Market Rank | #1 | Dominance at 54.3% |

| Machado Leadership Probability | 28% | Second-highest contender |

Institutional impact centers on sovereign adoption narratives. A pro-Bitcoin Venezuelan leader could accelerate Bitcoin's recognition as a reserve asset among emerging markets, similar to El Salvador's 2021 adoption. Retail impact involves potential remittance corridor optimization and hyperinflation hedging. The Federal Reserve's monetary policy stance, detailed in official Federal Reserve documentation, creates dollar weakness that amplifies Bitcoin's appeal in dollarized economies like Venezuela. Market structure suggests this geopolitical development creates a gamma squeeze potential as options markets reprice volatility expectations.

Market analysts on X/Twitter highlight the asymmetric risk/reward profile. "Venezuela represents the ultimate stress test for Bitcoin's inflation hedge properties," noted one quantitative researcher. Bulls emphasize Machado's Nobel credibility as validation of Bitcoin's humanitarian potential. Bears counter that political transitions create near-term instability that could pressure risk assets. The consensus: this development represents a long-term structural tailwind with short-term volatility implications.

Bullish Case: Machado's increased probability triggers sovereign adoption speculation. Bitcoin breaks above $95,200 resistance, filling the daily FVG and targeting $98,500 (1.618 Fibonacci extension). Increased Venezuelan adoption creates new demand vectors, pushing Bitcoin toward $100,000 psychological resistance. On-chain data indicates accumulation by Venezuelan addresses could increase by 300% within six months.

Bearish Case: Political uncertainty triggers risk-off sentiment. Bitcoin fails to hold $89,500 support, triggering a liquidity grab toward $87,400 (200-day MA). Market fear intensifies, with the Crypto Fear & Greed Index dropping below 20. Traditional safe-haven flows dominate, creating correlation breakdown with risk assets. Price action retraces to $85,000 volume node.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.