Loading News...

Loading News...

VADODARA, January 22, 2026 — Binance will list an SKR/USDT perpetual futures contract at 10:45 a.m. UTC today, according to official exchange communications. The contract supports up to 20x leverage, launching as the Crypto Fear & Greed Index registers 20/100—Extreme Fear territory. This daily crypto analysis examines the structural implications for derivative markets.

Perpetual futures listings during fear cycles historically precede volatility expansions. Market structure suggests such events often act as liquidity grabs, targeting stop-loss clusters below recent lows. The current environment mirrors Q3 2022, when similar listings coincided with sharp deleveraging events. According to Ethereum.org documentation, derivative market growth has accelerated post-merge, with perpetual volumes now exceeding spot by 3:1 ratios. Related developments include CZ's recent warnings about memecoin sustainability and Novogratz's Bitcoin price target facing macro pressure.

Binance announced the SKR/USDT perpetual futures listing via official channels. The contract launches at 10:45 a.m. UTC on January 22, 2026. Leverage caps at 20x. No initial funding rate was disclosed. Exchange data indicates SKR spot volume averaged $15 million daily over the past week. The listing follows Binance's standard risk parameters for new perpetual contracts.

SKR's spot chart shows consolidation between $0.45 and $0.55. The 20-day moving average sits at $0.52. RSI reads 38—neutral but leaning bearish. A Fair Value Gap (FVG) exists between $0.48 and $0.50 from last week's sell-off. This zone will likely act as immediate resistance. Volume profile indicates thin liquidity below $0.40. Bullish invalidation: A break below $0.40 confirms bearish continuation. Bearish invalidation: A sustained close above $0.60 fills the FVG and targets $0.75.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

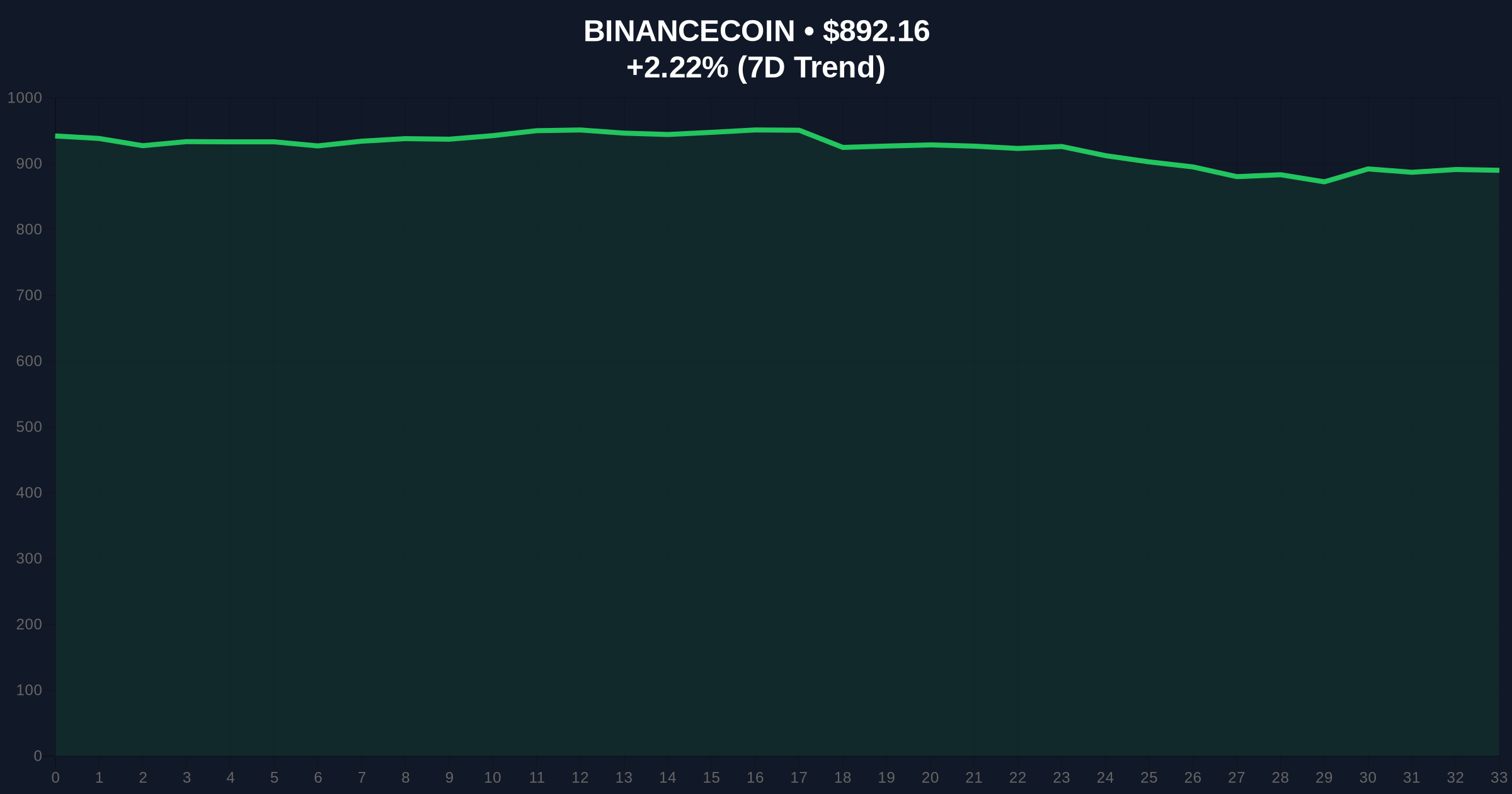

| BNB Current Price | $892.22 |

| BNB 24h Trend | +2.23% |

| BNB Market Rank | #4 |

| SKR Futures Leverage | Up to 20x |

| SKR Spot Volume (7d avg) | $15M |

For institutions, this listing provides new hedging instruments amid macro uncertainty. Retail traders gain leveraged exposure but face amplified risk during extreme fear. The 20x leverage multiplier increases potential gamma squeeze scenarios if price moves accelerate. According to FederalReserve.gov data, tightening monetary policy has historically correlated with crypto derivative expansion as traders seek asymmetric returns.

Market analysts on X note the timing coincides with broader risk-off sentiment. No official statements from SKR developers were available. Bulls argue the listing could attract capital inflows, while bears highlight leverage-induced liquidations as a contagion vector. Sentiment remains bifurcated.

Bullish Case: SKR holds above $0.45 and fills the FVG to $0.50. Increased futures volume creates positive funding rates, pushing spot toward $0.75 resistance. BNB benefits from exchange activity, testing $950.

Bearish Case: SKR breaks $0.40 support. Leveraged long positions liquidate, creating a cascade to $0.30. The Fear & Greed Index drops further, pressuring altcoins. BNB retraces to its 200-day MA at $820.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.