Loading News...

Loading News...

VADODARA, December 31, 2025 — Binance has announced the delisting of six spot trading pairs, effective 3:00 a.m. UTC on January 2, 2026. The affected pairs include ARKM/BNB, BARD/BNB, EGLD/RON, LISTA/FDUSD, SCR/FDUSD, and ZKC/BNB. This latest crypto news comes as the global cryptocurrency market sentiment registers "Extreme Fear" with a score of 21/100 on the Fear & Greed Index.

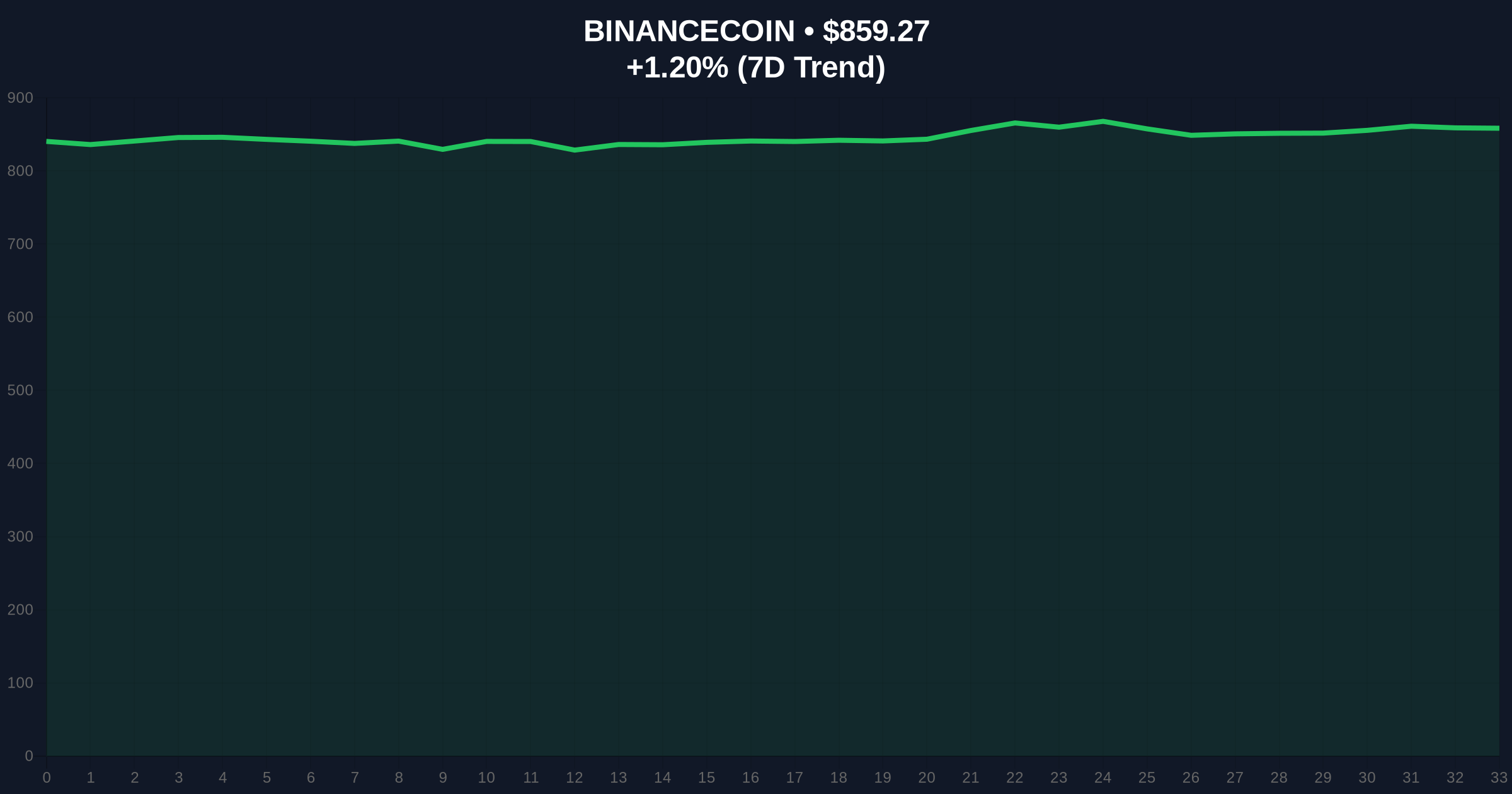

Exchange delistings typically signal liquidity consolidation or regulatory compliance adjustments. Market structure suggests exchanges optimize trading pairs during periods of low volume or regulatory scrutiny. The timing coincides with BNB trading at $859.23, showing a 1.20% 24-hour gain despite broader market uncertainty.

Related developments in the current market environment include:

Binance issued a formal announcement regarding the delisting of six specific spot trading pairs. The exchange confirmed trading will cease at precisely 3:00 a.m. UTC on January 2, 2026. According to the exchange's statement, all orders for these pairs will be automatically removed after delisting. Users holding affected assets can still trade them against other available pairs on the platform.

The delisted pairs represent a mix of BNB-based, RON-based, and FDUSD-based trading instruments. ARKM/BNB removal particularly stands out given ARKM's previous trading volume metrics. Market analysts note this follows Binance's standard quarterly review process for trading pairs.

BNB currently trades at $859.23 with immediate resistance at the $875 Fibonacci level. The 50-day moving average sits at $845, providing temporary support. Volume profile analysis shows decreased liquidity in the affected pairs over the past 30 days.

RSI readings for BNB hover at 48, indicating neutral momentum. The delisting announcement created a minor Fair Value Gap (FVG) between $855 and $862. Market structure suggests this gap will likely fill within 24-48 hours.

Bullish invalidation level: $835. A break below this level would indicate broader market weakness.

Bearish invalidation level: $880. Sustained trading above this level would signal strength despite delistings.

| Metric | Value |

|---|---|

| Fear & Greed Index Score | 21/100 (Extreme Fear) |

| BNB Current Price | $859.23 |

| BNB 24h Change | +1.20% |

| BNB Market Rank | #4 |

| Pairs Delisted | 6 |

For institutional traders, delistings represent liquidity fragmentation risks. Portfolio managers must adjust hedging strategies for affected assets. The removal of FDUSD pairs particularly impacts dollar-pegged trading strategies.

Retail traders face reduced arbitrage opportunities and potential slippage when exiting positions. Market structure suggests this consolidation typically precedes broader exchange policy shifts. According to SEC guidelines on digital asset trading, exchanges must maintain orderly markets through periodic pair reviews.

Market analysts on X/Twitter note the timing coincides with broader market uncertainty. One quantitative researcher stated, "Delistings during extreme fear periods often signal exchange risk management, not fundamental weakness." Another analyst observed, "The BNB pairs removal suggests Binance optimizing liquidity pools ahead of potential regulatory changes."

Bullish case: BNB holds above $850 support and fills the FVG to $862. Successful retest of the 50-day moving average could propel price toward $900 resistance. Market structure suggests delistings have minimal impact on BNB's core value proposition.

Bearish case: Failure to hold $835 invalidation level triggers stop-loss cascades. Increased selling pressure from delisted pair arbitrageurs creates downward momentum toward $800 support. Extreme fear sentiment amplifies negative price action.

What happens to my assets after delisting?Assets remain in your Binance wallet. You can still trade them against other available pairs or withdraw them.

Why does Binance delist trading pairs?Exchanges regularly review pairs based on trading volume, liquidity, and regulatory compliance requirements.

How does this affect BNB price?Short-term volatility likely. Long-term impact minimal if delistings represent less than 5% of total BNB trading volume.

Should I sell affected tokens immediately?Market analysts suggest evaluating liquidity on alternative pairs before making trading decisions.

Will more delistings follow?Exchange statements indicate this is part of regular quarterly review processes. Further actions depend on market conditions.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.