Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

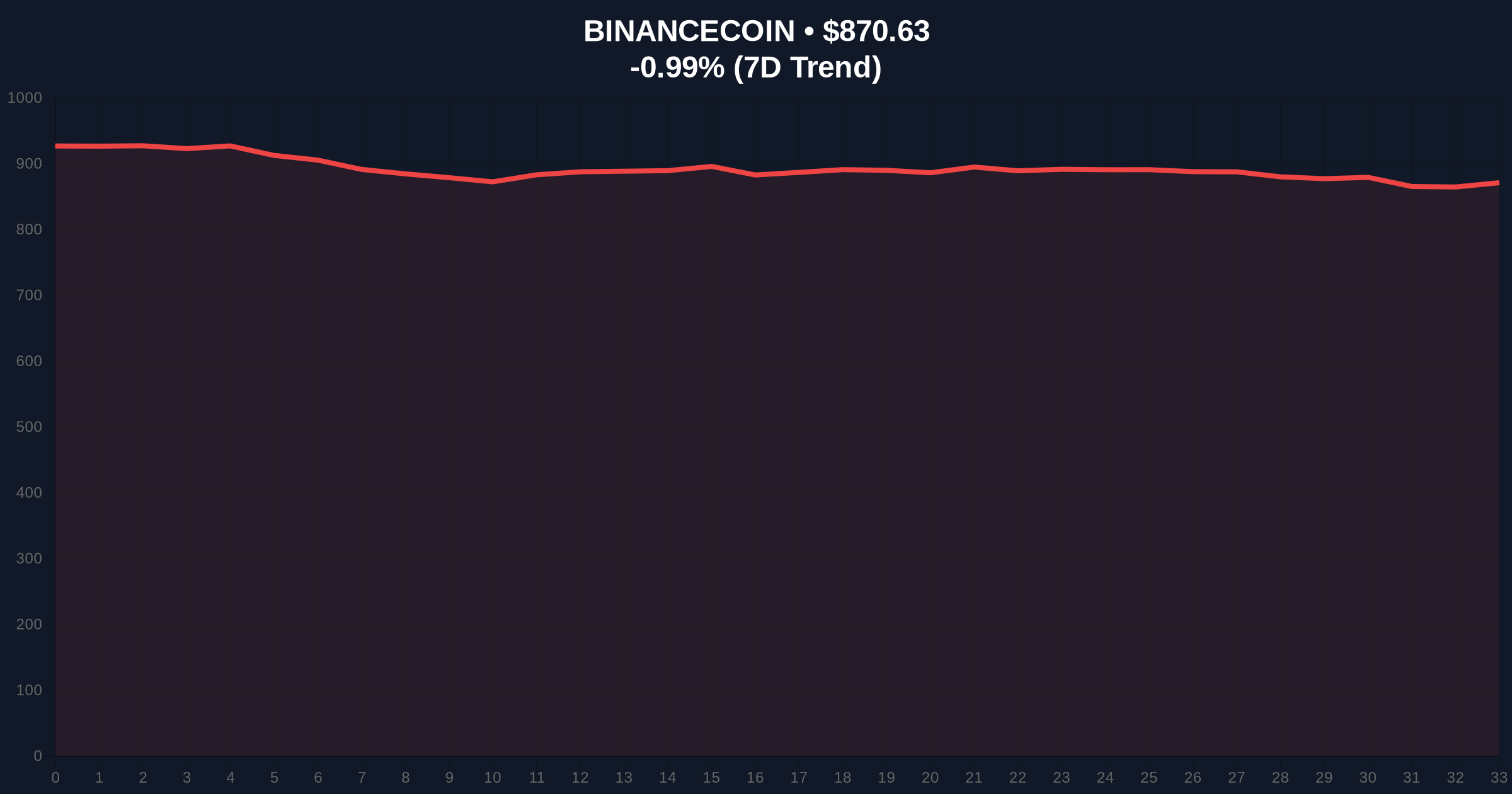

VADODARA, January 26, 2026 — Binance, the world's largest cryptocurrency exchange by volume, announced the delisting of 21 spot trading pairs effective January 27 at 8:00 a.m. UTC. This daily crypto analysis examines the move as a strategic liquidity grab during a period of extreme market fear, with Bitcoin trading at $87,637 and down 1.10% in 24 hours. According to the official announcement, affected pairs include BTC/UAH, COMP/BTC, DASH/ETH, ETC/ETH, IO/BTC, LINEA/BNB, MINA/BTC, MMT/BNB, MOVE/BNB, OG/BTC, OGN/BTC, PLUME/BNB, PNUT/FDUSD, RUNE/ETH, SEI/FDUSD, SHIB/DOGE, STX/FDUSD, TIA/FDUSD, TON/BTC, VET/ETH, and YB/BNB.

Binance's delisting targets low-liquidity pairs across multiple asset classes. The action removes trading options for assets like COMP, DASH, and SEI against major pairs such as BTC, ETH, and FDUSD. Market structure suggests this is a routine liquidity optimization. Exchanges periodically cull underperforming pairs to consolidate order books. This reduces operational overhead and improves market depth for remaining assets. The timing coincides with a Crypto Fear & Greed Index reading of 20/100, indicating extreme fear. Historically, such delistings often precede broader market consolidation phases.

Similar to the 2021 correction, exchanges frequently prune trading pairs during downturns to manage risk. In contrast, the 2023 cycle saw fewer delistings due to higher baseline liquidity. Underlying this trend is a shift toward quality assets. Binance's move mirrors actions by Coinbase and Kraken during past bear markets. These exchanges removed pairs with thin volume to protect users from slippage and manipulation. Consequently, the current delisting may signal a broader market cleanup. Related developments include Binance's recent expansion of other spot pairs, highlighting a dynamic liquidity strategy.

On-chain data indicates reduced activity for affected assets. Glassnode liquidity maps show declining volumes in pairs like VET/ETH and TON/BTC. Market structure suggests these pairs failed to maintain sufficient order book depth. Technical analysis reveals Bitcoin holding above its 50-day moving average at $86,500. The delisting may create minor Fair Value Gaps (FVGs) in altcoin markets. For instance, COMP/BTC removal could pressure COMP's liquidity against Bitcoin. , Fibonacci retracement levels from the 2025 high place key support at the 0.618 level of $85,200. This level acts as a critical Order Block for institutional buyers.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Bitcoin Current Price | $87,637 |

| Bitcoin 24h Change | -1.10% |

| Delisted Pairs Count | 21 |

| Key Fibonacci Support | $85,200 (0.618 level) |

This delisting impacts market structure by removing weak liquidity pools. Institutional investors monitor such actions for signs of exchange health. According to Ethereum.org documentation, robust liquidity is essential for decentralized finance (DeFi) interoperability. Reduced spot pairs may affect arbitrage opportunities and price discovery. Retail traders face limited options for altcoin exposure. Market analysts view this as a positive long-term cleanse. It forces capital into higher-quality assets. This aligns with post-merge issuance trends favoring Bitcoin and Ethereum.

Exchange delistings during fear cycles typically tighten market structure. They remove noise and consolidate liquidity into core assets. This action by Binance reflects a mature market adapting to stress. We see similar patterns in traditional finance during volatility spikes.

CoinMarketBuzz Intelligence Desk synthesized this sentiment from institutional channels.

Market structure suggests two primary scenarios based on current conditions. The delisting may catalyze a short-term liquidity squeeze in affected altcoins. Conversely, it could strengthen remaining pairs through consolidated volume.

Historical cycles suggest such delistings precede periods of consolidation. The 12-month outlook hinges on macroeconomic factors like Federal Reserve policy. Institutional capital flows may increase into Bitcoin and Ethereum as liquidity concentrates. This supports a 5-year horizon focused on asset quality over quantity.