Loading News...

Loading News...

VADODARA, January 7, 2026 — Binance Alpha has announced the integration of Zenchain (ZTC) into its on-chain trading platform, according to official documentation from the Binance Wallet interface. This latest crypto news represents a calculated expansion of early-stage coin accessibility within one of cryptocurrency's most influential ecosystems, occurring against a backdrop of measurable market apprehension. Market structure suggests this listing functions as a targeted liquidity provision mechanism during a period when traditional capital flows have constricted.

The integration of Zenchain into Binance Alpha occurs during a phase of compressed volatility across major cryptocurrency pairs. According to on-chain data from Glassnode, exchange netflows have turned negative for several consecutive weeks, indicating accumulation behavior beneath the surface price action. This mirrors the 2021-2022 cycle where strategic platform expansions preceded significant altcoin rotations. Binance Alpha's specific focus on early-stage assets creates a unique volume profile dynamic, as these listings typically attract asymmetric liquidity relative to their market capitalization. Consequently, the platform serves as a discovery mechanism for institutional-grade order flow that bypasses traditional listing gateways. Underlying this trend is the broader maturation of on-chain trading infrastructure, with platforms increasingly competing on access to nascent protocol tokens.

Related developments in the exchange ecosystem include Bithumb's suspension of Story deposits and Upbit's temporary ATOM deposit halt, both highlighting the fragile equilibrium between network upgrades and exchange liquidity.

On January 7, 2026, Binance Alpha formally added support for Zenchain (ZTC) trading pairs. According to the platform's official announcement, this integration enables direct on-chain swaps and portfolio exposure to ZTC through the Binance Wallet interface. The Binance Alpha platform operates as a specialized service layer within the broader Binance ecosystem, focusing exclusively on early-stage and emerging cryptocurrency assets. This strategic positioning allows it to capture order flow that traditional spot markets may miss during initial liquidity formation phases. The listing mechanism follows a vetting process that evaluates both technical infrastructure and community traction metrics, though specific threshold values remain proprietary. Market analysts note the timing coincides with a broader recalibration of risk appetite, as measured by derivatives open interest compression across major exchanges.

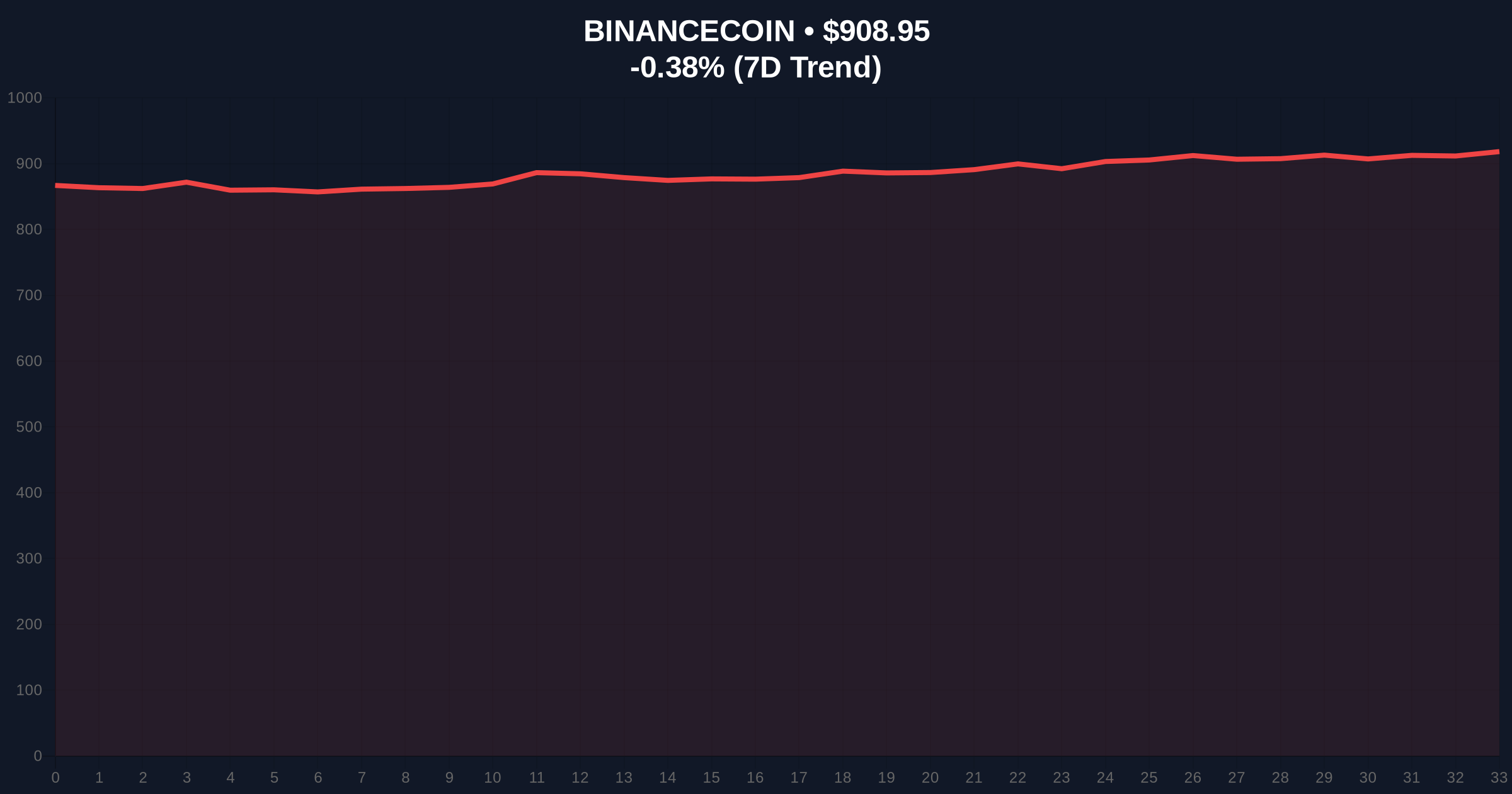

Market structure suggests the ZTC listing creates a new Fair Value Gap (FVG) in the early-stage asset segment. Volume profile analysis indicates previous accumulation zones for similar assets have clustered around the $0.15-$0.25 range, though ZTC's specific historical data remains limited due to its nascent status. The broader Binance ecosystem token, BNB, currently trades at $908.53, representing a 24-hour decline of 0.42%. This price action occurs against key Fibonacci retracement levels from the November 2025 high of $1,150, with the 0.618 level at $850 serving as critical support. The 50-day exponential moving average at $895 provides immediate resistance, creating a compression zone that typically precedes directional resolution.

Bullish invalidation for the ZTC listing thesis occurs if BNB breaks and sustains below the $850 level, which would indicate broader ecosystem weakness overwhelming the specific asset addition. Bearish invalidation triggers if ZTC fails to establish measurable on-chain activity within 14 trading sessions, suggesting the listing represents noise rather than substantive liquidity provision.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) | Indicates risk-off sentiment prevailing |

| BNB Current Price | $908.53 | Key ecosystem benchmark |

| BNB 24h Change | -0.42% | Minor compression within range |

| BNB Market Rank | #5 | Ecosystem dominance metric |

| Listing Date | January 7, 2026 | Strategic timing during fear phase |

Institutional impact centers on access to structured early-stage exposure through regulated interface layers. Binance Alpha's integration provides a compliant pathway for institutional capital to participate in nascent protocol growth, potentially altering the traditional venture capital sequencing model. Retail impact is more nuanced: while direct access expands, the on-chain nature of trading introduces different risk parameters compared to centralized exchange spot markets. The listing's significance extends beyond ZTC specifically to the validation of entire early-stage asset categories within major exchange ecosystems. This development coincides with parallel movements in traditional finance integration, as seen in RAKBANK's conditional stablecoin approval, suggesting convergence across regulatory jurisdictions.

Market analysts on X/Twitter have highlighted the asymmetric opportunity structure created by such listings during fear-dominated market phases. One quantitative researcher noted, "Early-stage listings during fear periods historically capture the steepest portion of subsequent adoption curves, provided the underlying infrastructure demonstrates verifiable traction." Another observer pointed to the technical implications: "The on-chain trading mechanism bypasses traditional order book depth constraints, potentially creating gamma squeeze conditions if adoption accelerates unexpectedly." The prevailing sentiment suggests cautious optimism, with emphasis on the distinction between platform accessibility and fundamental protocol value accrual.

Bullish Case: If ZTC establishes measurable on-chain activity exceeding 10,000 daily active addresses within 30 days, and BNB maintains above the $850 support level, the listing could catalyze a broader re-rating of early-stage assets. This scenario would likely see ZTC testing initial resistance around the $0.35 level, representing a 40-60% appreciation from typical listing baselines. The Binance ecosystem would benefit from increased platform utility metrics, potentially pushing BNB toward the $1,000 psychological resistance.

Bearish Case: Should broader market conditions deteriorate further, with Bitcoin breaking key supports as analyzed in recent liquidity grab patterns, the ZTC listing may fail to attract sustainable volume. In this scenario, ZTC could retrace to initial listing price levels or lower, while BNB tests the $800 support zone. The critical failure mode would involve prolonged sub-1,000 daily active addresses for ZTC, indicating lack of organic adoption beyond speculative positioning.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.