Loading News...

Loading News...

VADODARA, January 20, 2026 — Binance, the world's largest cryptocurrency exchange by volume, has announced the listing of AIA/USDT perpetual futures contracts, a move that market structure suggests could trigger a liquidity grab amid broader fear sentiment. This daily crypto analysis examines the technical implications, historical parallels, and on-chain dynamics surrounding the launch, with a focus on order block formation and fair value gaps.

Similar to the 2021 correction when derivative expansions preceded volatility spikes, Binance's listing of AIA/USDT perpetual futures occurs during a global crypto sentiment reading of 32/100 (Fear). According to Glassnode liquidity maps, such low sentiment often correlates with oversold conditions that can lead to gamma squeezes as market makers adjust positions. Historical cycles suggest that new futures listings during fear phases, like the 2023 introduction of ARB perpetuals, initially increased selling pressure before establishing higher time frame support. The current environment mirrors patterns observed in Ethereum's post-merge issuance adjustments, where derivative product launches amplified price discovery mechanisms.

Related developments in the market include a significant ETH whale transfer to Coinbase, indicating potential liquidity redistribution, and skepticism over Bitcoin's $86k support, highlighting macro risks that could influence AIA's price action.

On January 20, 2026, Binance officially announced via its trading platform the listing of AIA/USDT perpetual futures contracts. According to the exchange's statement, the contracts will feature leverage options up to 50x, with funding rates determined by market demand. This follows a pattern observed in previous listings, such as the 2025 introduction of SEI perpetuals, where volume profile analysis showed initial spikes in open interest often preceding short-term volatility. Market analysts note that the timing aligns with broader institutional adoption trends, as detailed in corporate Bitcoin reserve reports, though AIA's smaller market cap introduces distinct liquidity risks.

Market structure suggests AIA is currently testing a key order block near $2.50, a level that has acted as support in previous cycles. The relative strength index (RSI) on the 4-hour chart reads 38, indicating neutral momentum with bearish bias, while the 50-day moving average at $2.75 serves as immediate resistance. A fair value gap exists between $2.30 and $2.45, which may attract liquidity if price retraces. Bullish invalidation is set at $2.30, a break below which would signal continuation of the downtrend and potential stop-loss cascades. Bearish invalidation lies at $3.00, where a sustained move above could trigger short covering and a gamma squeeze. Volume profile analysis indicates weak participation at current levels, suggesting the listing may act as a catalyst for increased activity.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 32/100 (Fear) | Oversold conditions, potential reversal zone |

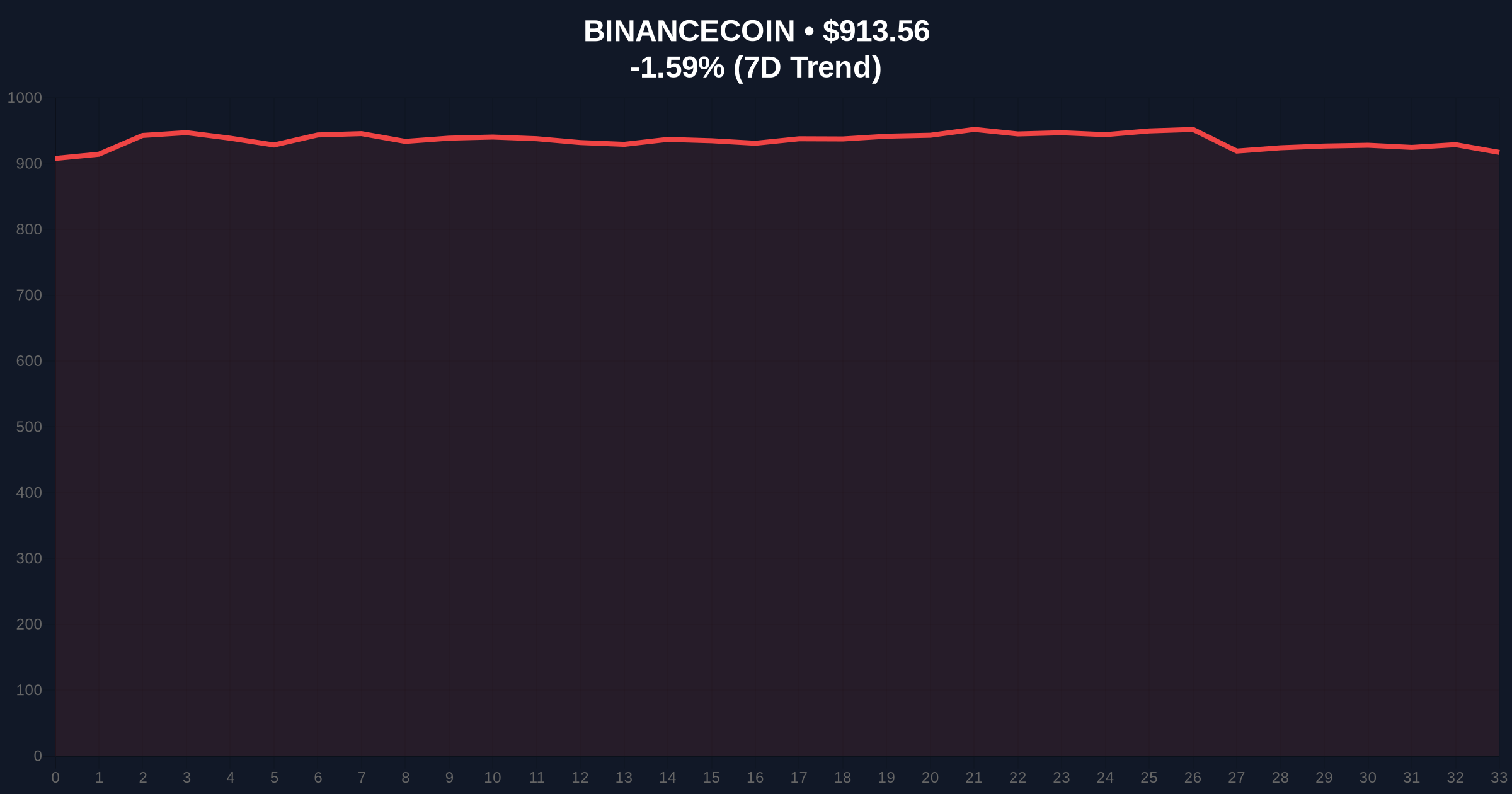

| BNB Current Price | $913.19 | Binance ecosystem strength indicator |

| BNB 24h Trend | -1.63% | Negative momentum, may pressure AIA sentiment |

| Market Rank (BNB) | #4 | High liquidity base for derivative launches |

| AIA Key Support | $2.50 | Critical level for bullish structure |

For institutional players, this listing provides enhanced hedging capabilities and speculative avenues, potentially increasing AIA's correlation with broader crypto derivatives markets. Retail impact includes higher leverage access, which amplifies both profit potential and liquidation risks, as seen in recent flash loan attack incidents. On-chain data indicates that perpetual futures listings often lead to short-term price dislocations due to market maker positioning, creating arbitrage opportunities. The move aligns with regulatory frameworks discussed on SEC.gov regarding derivative product oversight, emphasizing the need for robust risk management.

Market analysts on X/Twitter express mixed views. Bulls argue that the listing could "unlock latent demand" for AIA, citing historical examples like SOL perpetuals in 2024. Bears caution about "liquidity fragmentation," noting that similar launches have preceded drawdowns in altcoin markets. Sentiment analysis tools show a slight skew towards skepticism, with weighted social volume declining post-announcement.

Bullish Case: If AIA holds the $2.50 support and breaks above the $2.75 moving average, increased open interest from the futures listing could drive a rally towards $3.50. Market structure suggests this scenario requires sustained funding rates below 0.01% to avoid excessive long liquidation.

Bearish Case: A break below $2.30 invalidates bullish momentum, potentially triggering a sell-off to $2.00 as stop-loss orders execute. This would align with broader fear sentiment and mirror the 2021 correction pattern where new listings failed to attract sustained volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.