Loading News...

Loading News...

VADODARA, February 5, 2026 — Addresses linked to the Aperture Finance exploit have laundered 1,242.7 ETH worth approximately $2.4 million through the crypto mixing service Tornado Cash, according to blockchain security firm PeckShield. This latest crypto news follows the DeFi platform's $3.67 million loss from a January 25 exploit on its V3 and V4 smart contracts, highlighting persistent security gaps in decentralized finance protocols.

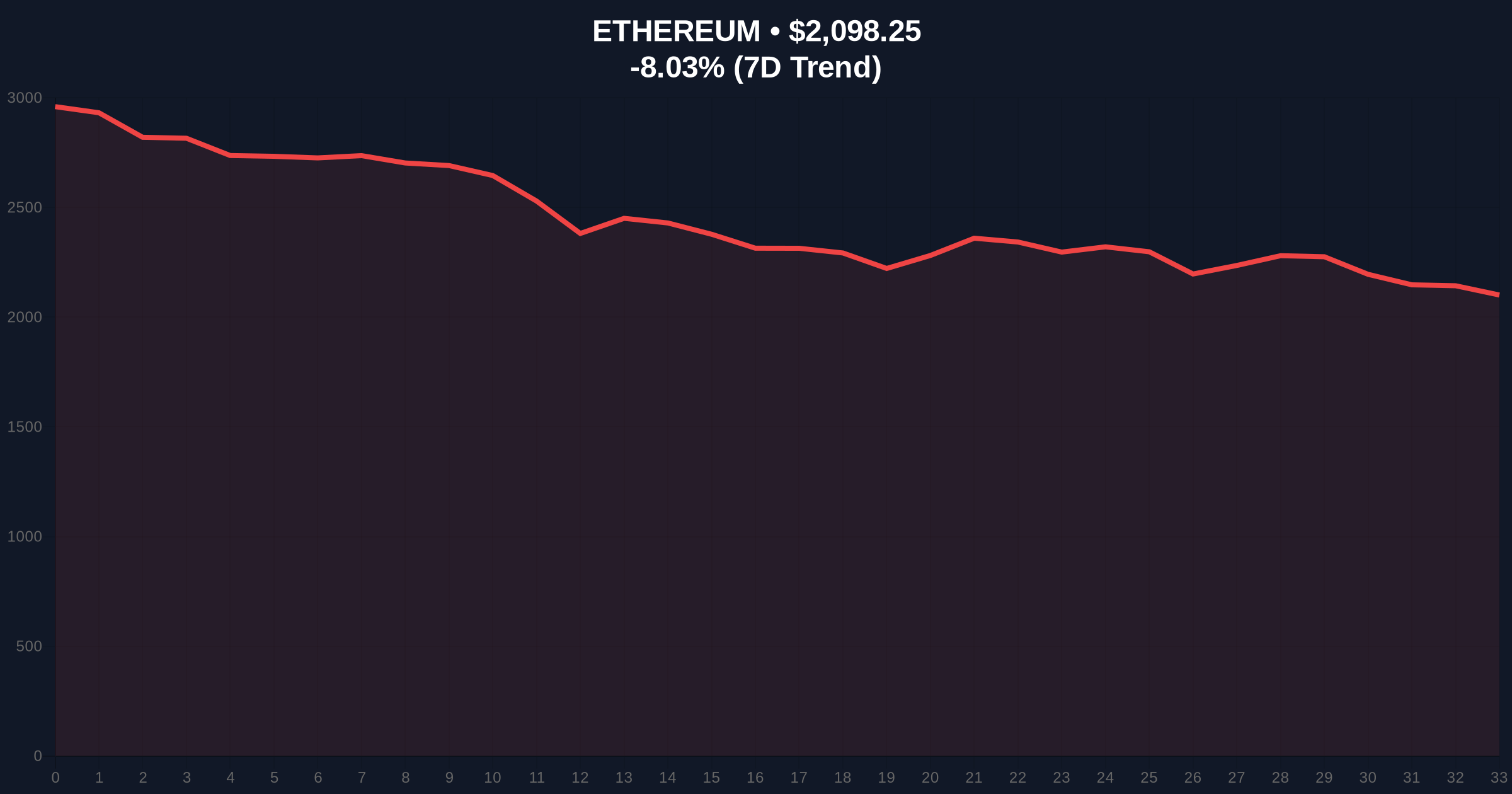

PeckShield's on-chain forensic analysis reveals the hacker moved funds in multiple transactions to Tornado Cash, a platform designed to obscure transaction trails. According to Etherscan data, the 1,242.7 ETH transfer represents approximately 65% of the total $3.67 million stolen from Aperture Finance's V3 and V4 contracts. The timing coincides with Ethereum's 8.05% price decline this week, creating optimal conditions for laundering amid heightened market volatility.

Consequently, this action demonstrates sophisticated post-exploit fund management. The hacker avoided centralized exchanges with KYC requirements, opting instead for decentralized mixing services. Underlying this trend is a broader pattern where exploiters increasingly use Tornado Cash despite OFAC sanctions, as detailed in the official Treasury Department sanction documentation.

Historically, large-scale laundering events correlate with negative price pressure on affected assets. The Aperture Finance incident mirrors the 2022 Ronin Bridge exploit, where hackers moved $625 million through mixing services over several months. In contrast, today's market faces additional headwinds from extreme fear sentiment, measured at 12/100 on the Crypto Fear & Greed Index.

, this event occurs alongside other bearish developments. For instance, analysis shows Bitcoin's bear momentum deteriorating faster than 2022, while Canaccord slashed MicroStrategy's price target by 61%. These factors create a compounded negative environment for cryptocurrency valuations.

Market structure suggests Ethereum faces critical technical tests. The asset currently trades at $2,097.6, down 8.05% in 24 hours. On-chain data indicates weak support at the $2,100 psychological level, with stronger Fibonacci support at $2,050 (0.618 retracement from recent highs). A break below this level would invalidate the current bullish structure and potentially target $1,950.

Volume profile analysis shows decreased buying interest during the laundering period. The Relative Strength Index (RSI) sits at 32, approaching oversold territory but not yet indicating a reversal. Consequently, traders monitor the 50-day moving average at $2,250 as resistance. This technical deterioration reflects broader market anxiety, as seen in exchange adjustments to token supplies amid extreme fear conditions.

| Metric | Value |

|---|---|

| ETH Laundered | 1,242.7 ETH |

| USD Value | $2.4 million |

| Original Exploit Loss | $3.67 million |

| Ethereum Current Price | $2,097.6 |

| 24-Hour Change | -8.05% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

This event matters because it exposes systemic DeFi vulnerabilities during market stress. Smart contract exploits undermine confidence in decentralized systems, potentially slowing institutional adoption. According to blockchain forensic firms, over $3 billion has been laundered through mixing services since 2020, creating regulatory pressure that impacts legitimate users.

, the timing exacerbates existing market fears. The extreme fear sentiment, combined with technical breakdowns, creates a liquidity vacuum where selling pressure intensifies. This environment benefits exploiters seeking to launder funds with reduced visibility, as transaction volumes typically decline during fear periods.

"The rapid movement of stolen ETH to Tornado Cash demonstrates calculated risk management by exploiters. They capitalize on market volatility to obscure trails while regulators focus on broader price action. This pattern suggests we'll see more sophisticated laundering techniques as DeFi TVL recovers." — CoinMarketBuzz Intelligence Desk

Market analysts project two primary scenarios based on current structure. First, if Ethereum holds the $2,050 Fibonacci support, we may see consolidation between $2,050 and $2,250 as fear subsides. Second, a break below support could trigger a liquidity grab toward $1,950, aligning with broader bearish momentum.

The 12-month outlook depends on DeFi security improvements. If audit standards and insurance protocols strengthen, institutional capital may return despite current fears. However, continued exploits could prolong the extreme fear environment, delaying Ethereum's next bullish cycle beyond 2026.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.