Loading News...

Loading News...

VADODARA, February 4, 2026 — CoinMarketCap's Altcoin Season Index declined to 29, down one point from yesterday, according to the latest crypto market data. This daily crypto analysis reveals a continued shift toward Bitcoin dominance as market sentiment plunges into extreme fear territory. The index measures the performance of the top 100 cryptocurrencies against Bitcoin, with readings below 75 indicating Bitcoin season conditions.

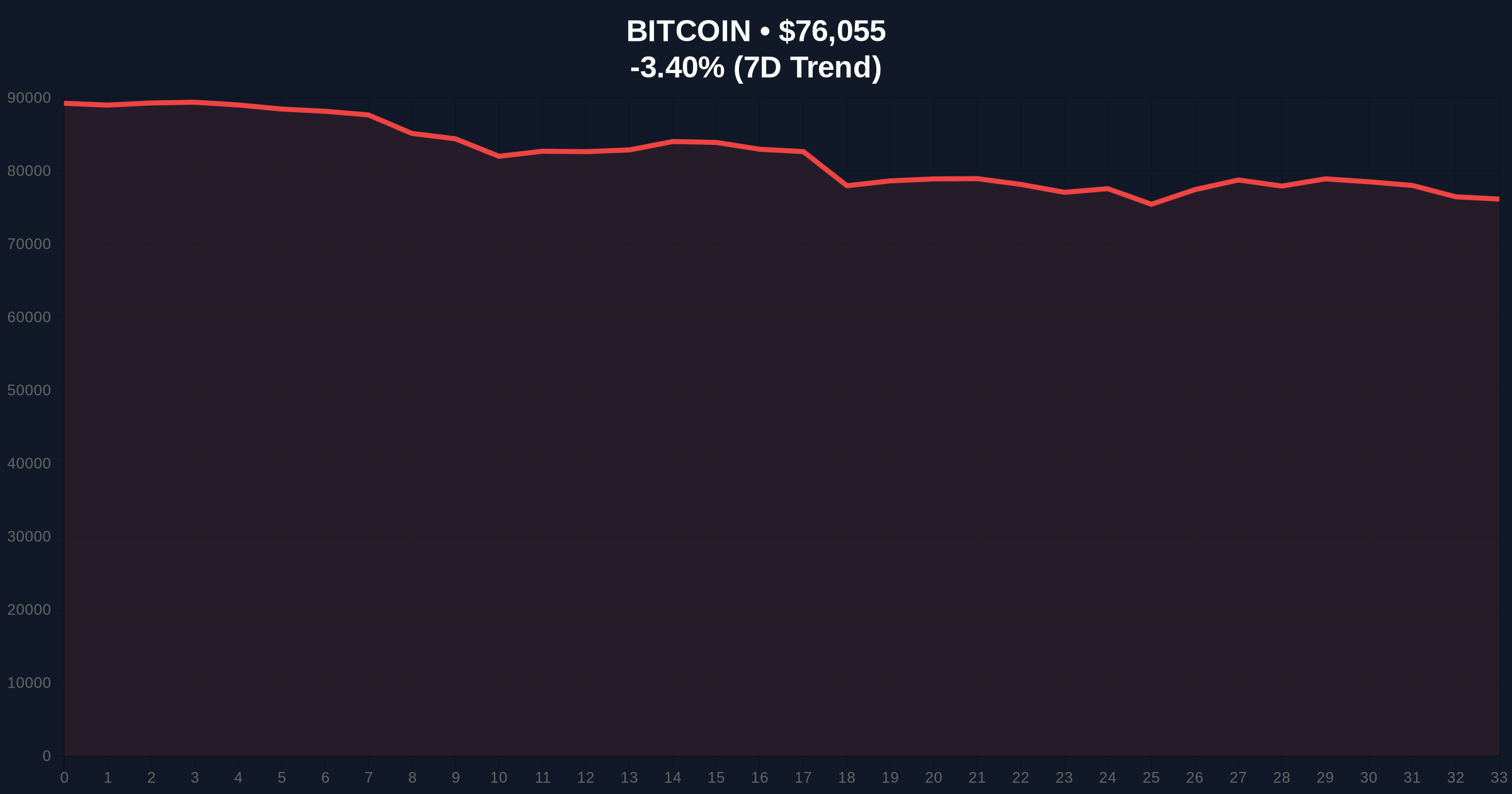

CoinMarketCap's proprietary metric now sits at 29, reflecting a one-point drop from the previous session. According to the platform's methodology, the index compares the 90-day price performance of the top 100 coins by market capitalization, excluding stablecoins and wrapped tokens, against Bitcoin's returns. A reading closer to 100 would signal favorable conditions for an altcoin season, while current levels firmly indicate Bitcoin season dominance. Market structure suggests this decline correlates with Bitcoin's price action at $75,905, down 3.59% over 24 hours.

Historically, Altcoin Season Index readings below 30 have preceded extended periods of Bitcoin outperformance. In contrast to the 2021 altcoin rally that pushed the index above 75 for months, current conditions mirror the 2018-2019 accumulation phase. Underlying this trend is a liquidity grab toward Bitcoin as a perceived safe-haven asset. Consequently, altcoins face disproportionate selling pressure during risk-off environments. This dynamic creates a self-reinforcing cycle where Bitcoin dominance suppresses altcoin valuations.

Related developments in the current market environment include Bitcoin's MVRV-Z Score hitting October 2022 lows, indicating similar market cooldown patterns, and Standard Chartered revising Solana targets downward amid the prevailing fear sentiment.

On-chain data indicates weakening altcoin network activity across most Layer-1 protocols. The Altcoin Season Index calculation inherently captures this through relative performance metrics. From a pure price action perspective, Bitcoin maintains critical support at the Fibonacci 0.618 retracement level of $72,500 from its 2025 all-time high. This level represents a major order block for institutional accumulation. , Ethereum's failure to hold its 200-day moving average against Bitcoin creates a fair value gap (FVG) that exacerbates altcoin underperformance. Market analysts observe that post-merge issuance dynamics have not provided the expected tailwind for ETH/BTC ratios.

| Metric | Value | Change |

|---|---|---|

| Altcoin Season Index | 29 | -1 point |

| Bitcoin Price | $75,905 | -3.59% (24h) |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | N/A |

| Bitcoin Dominance | 54.2% | +0.8% (7d) |

| Top 100 Altcoin Avg. Performance vs BTC (90d) | -18.3% | -2.1% (30d) |

This index movement matters because it reflects capital allocation decisions at the institutional level. According to volume profile analysis, Bitcoin ETFs continue absorbing liquidity that might otherwise flow to altcoins. The Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, creates risk-off conditions that disproportionately affect higher-beta altcoin assets. Consequently, retail traders face compressed margins in altcoin positions while institutions prioritize Bitcoin's relative stability. This divergence in market participant behavior reinforces the current Bitcoin season narrative.

The Altcoin Season Index decline to 29 confirms what on-chain liquidity maps have suggested for weeks: capital is rotating toward quality. When Bitcoin dominance expands during fear periods, it typically precedes altcoin capitulation events. The current reading suggests we're in the early stages of this cycle.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current conditions. The bearish scenario involves continued altcoin underperformance if Bitcoin holds above key support. Conversely, a sudden sentiment shift could trigger altcoin relief rallies, though this appears statistically unlikely given current readings.

The 12-month institutional outlook remains cautiously optimistic for Bitcoin, with altcoins expected to lag until macroeconomic conditions improve. Historical cycles suggest that after extended Bitcoin seasons, altcoins typically experience explosive catch-up rallies, though timing remains uncertain. The 5-year horizon still favors blockchain adoption across both Bitcoin and select altcoin protocols with proven utility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.