Loading News...

Loading News...

VADODARA, December 30, 2025 — Cryptocurrency analyst Ali Martinez has projected XRP could decline to $0.80, citing deteriorating on-chain fundamentals and whale selling pressure. This latest crypto news emerges as the global crypto market sentiment registers "Extreme Fear" with a score of 23/100, creating a backdrop where technical breakdowns could accelerate.

XRP has historically exhibited volatility tied to regulatory developments and network activity metrics. The current warning mirrors patterns observed during the 2021-2022 bear market, where declining active addresses preceded significant price corrections across altcoins. Market structure suggests that when network participation contracts while large holders distribute, it often creates a Liquidity Grab scenario where price moves rapidly to absorb resting orders.

Related developments in this environment include predictions of altcoin mass extinction and challenges to bullish institutional theses, highlighting broader market skepticism.

According to on-chain data analysis shared by Ali Martinez, who has approximately 164,000 followers on X, daily active addresses on the XRP Ledger have contracted from 46,000 to 38,500. This represents a 16.3% decline in network participation. Simultaneously, whale entities have offloaded more than $40 million in XRP over recent days, shifting from accumulation to distribution patterns.

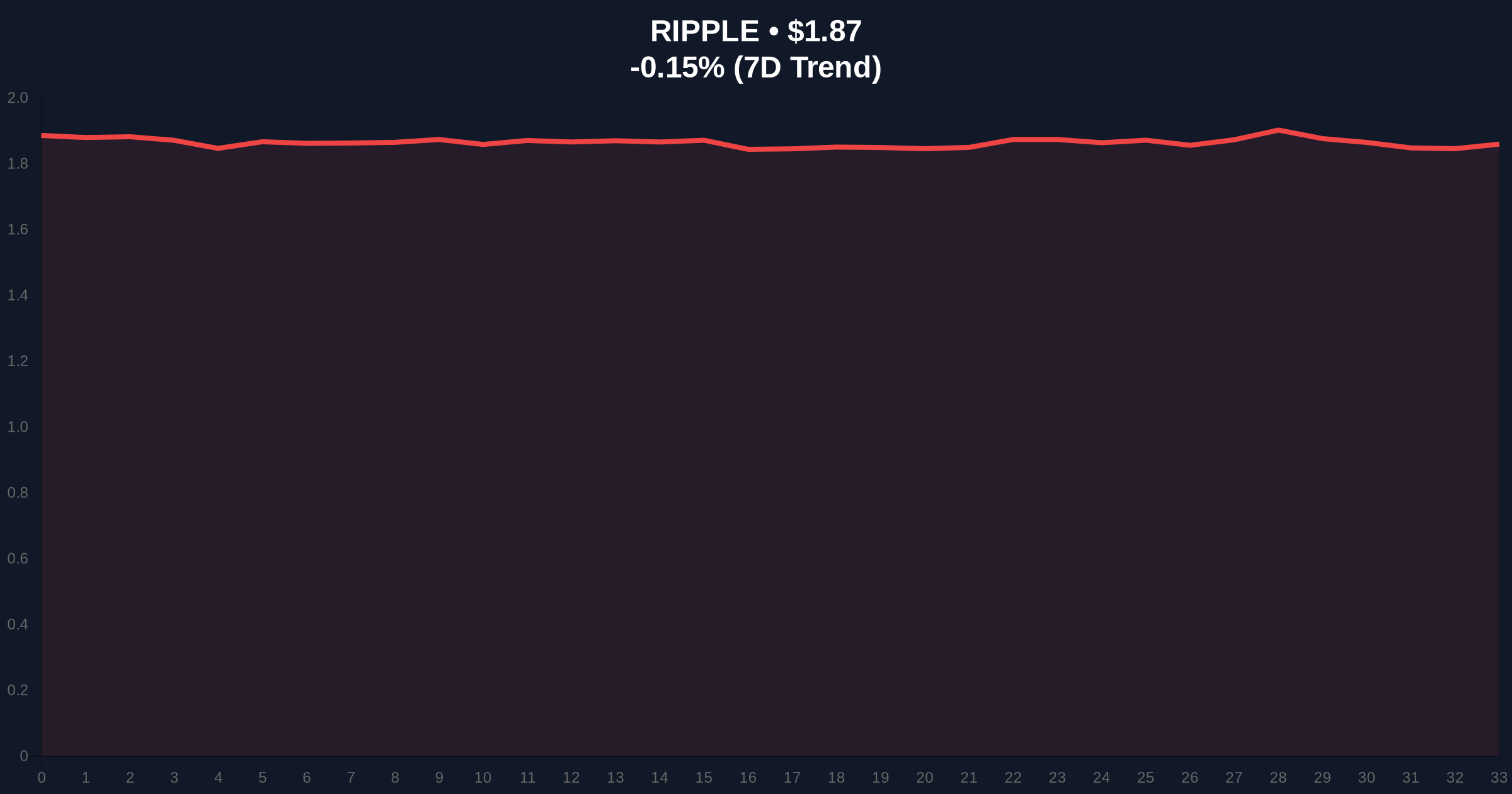

Martinez concluded that continued downward pressure could cause XRP to lose its key support at $1.77, potentially triggering a decline toward $0.80. The current price sits at $1.87, representing a -0.15% 24-hour change while maintaining the #5 market rank by capitalization.

Market structure suggests XRP is testing a critical Order Block between $1.77 and $1.85. A breakdown below this zone would create a Fair Value Gap (FVG) extending toward the $0.80 target. The Relative Strength Index (RSI) on daily timeframes shows weakening momentum, while the 50-day moving average has turned from support to resistance.

The Bullish Invalidation level is $1.77—a sustained break below this threshold would confirm the bearish thesis. The Bearish Invalidation level is $2.15—reclaiming this former resistance would negate the downward projection and suggest whale selling has been absorbed. Volume profile analysis indicates thin liquidity below $1.77, which could exacerbate any breakdown.

| Metric | Value |

|---|---|

| Current XRP Price | $1.87 |

| 24-Hour Change | -0.15% |

| Market Rank | #5 |

| Daily Active Addresses (Current) | 38,500 |

| Daily Active Addresses (Previous) | 46,000 |

| Whale Selling (Recent Days) | $40M+ |

| Global Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

For institutional investors, this analysis highlights the importance of on-chain metrics beyond price action. The contraction in active addresses suggests declining utility, which could impact long-term valuation models. Retail traders face increased risk of stop-loss cascades if the $1.77 support fails, particularly in an "Extreme Fear" market where liquidations amplify moves.

The situation raises questions about whether current network activity justifies XRP's $102 billion market capitalization. If the decline materializes, it could trigger broader altcoin weakness as capital rotates toward perceived safer assets like Bitcoin. Regulatory clarity from the SEC regarding XRP's status remains a persistent overhang, though recent court decisions have provided some framework.

Market analysts on X/Twitter appear divided. Bulls point to XRP's established position and ongoing Ripple partnerships as fundamental strengths. One commentator noted, "Network metrics fluctuate—this could be temporary consolidation rather than breakdown." However, bears emphasize the technical deterioration, with one trader stating, "When whales sell and users leave, price follows. Simple math."

The skepticism extends to broader market conditions, where institutional options activity shows hedging against further downside. Regulatory developments like South Korea's proposed exchange caps add to the uncertain environment.

Bullish Case: If XRP holds the $1.77 support and whale selling abates, a rebound toward $2.15 is plausible. Renewed network development or positive regulatory news could catalyze this move. Historical patterns indicate that "Extreme Fear" readings often precede relief rallies, though timing remains uncertain.

Bearish Case: Continued distribution by large holders and declining network activity could push XRP through $1.77, targeting $0.80. This would represent a 57% decline from current levels. In such a scenario, the next significant support aligns with the 0.618 Fibonacci retracement level from the 2023 low to 2025 high, a common technical magnet during corrections.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.