Loading News...

Loading News...

VADODARA, December 30, 2025 — XRP exchange reserves have collapsed to their lowest level since 2018, creating conditions for a potential supply shock that could drive significant price appreciation in 2026, according to on-chain data analysis. This latest crypto news emerges as global market sentiment registers at "Extreme Fear" with a score of 23/100, suggesting a classic contrarian opportunity may be forming.

Market structure suggests this reserve depletion mirrors patterns observed during Bitcoin's 2020-2021 accumulation phase, when exchange balances dropped approximately 60% before the subsequent parabolic rally. Similar to the 2021 correction that preceded Bitcoin's all-time high, current extreme fear sentiment combined with supply withdrawal creates textbook conditions for a structural bull market. Historical precedent indicates that when exchange reserves reach multi-year lows while prices hold key support levels, the probability of a sustained upward move increases significantly. The current environment parallels the 2018-2019 accumulation period when XRP exchange reserves last approached these levels, preceding a 400% price appreciation over the following 18 months.

Related developments in the current market environment include similar whale accumulation patterns observed in Bitcoin and regulatory uncertainty affecting broader market sentiment.

According to data from Glassnode, XRP balances on centralized exchanges plummeted from 3.76 billion on October 8 to 1.6 billion by December 30, representing a 57.4% reduction in just under three months. This marks the lowest exchange reserve level since 2018, when XRP was trading below $0.30. Cointelegraph's analysis indicates this data suggests weakening sell pressure among holders and significant accumulation activity, potentially by institutional entities positioning for 2026 market developments. The report specifically noted that with XRP maintaining support around $1.78, the combination of potential ETF inflows and shrinking exchange liquidity could create optimal conditions for a sustained bull market next year.

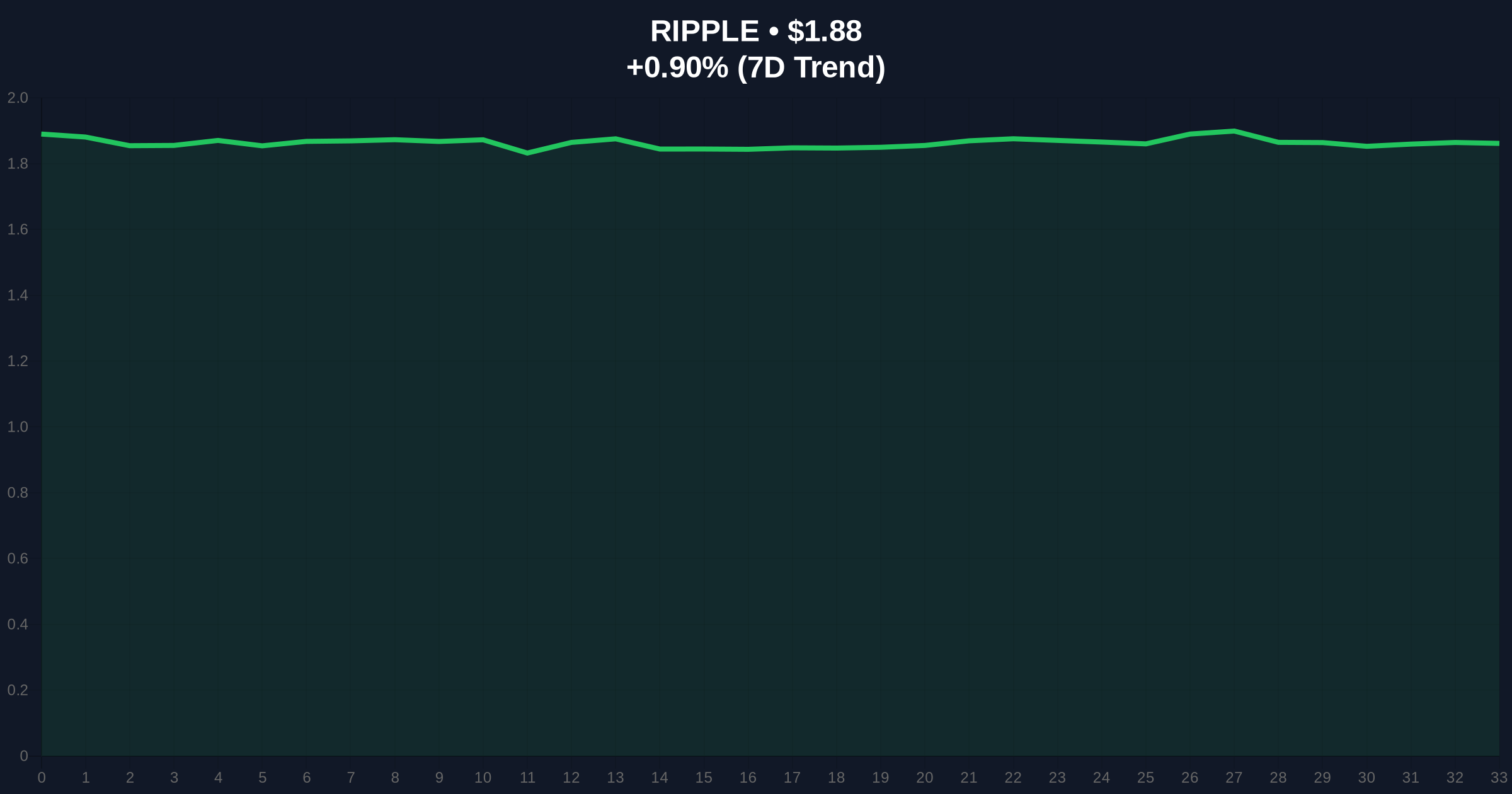

XRP currently trades at $1.88, representing a 0.89% 24-hour gain despite extreme fear market conditions. The critical support level identified at $1.78 aligns with the 0.618 Fibonacci retracement level from the 2024 high of $2.40 to the 2025 low of $1.25. Volume profile analysis shows significant accumulation between $1.75 and $1.85, creating a potential order block that could serve as springboard for upward movement. The 50-day moving average at $1.92 provides immediate resistance, while the 200-day moving average at $1.65 offers secondary support. RSI readings at 48 indicate neutral momentum with room for expansion in either direction.

Bullish invalidation level: A sustained break below $1.65 (200-day MA) would invalidate the accumulation thesis and suggest further downside toward $1.45.

Bearish invalidation level: A decisive close above $2.05 would confirm breakout from the current consolidation range and target $2.40 resistance.

| Metric | Value |

|---|---|

| XRP Exchange Reserves (Current) | 1.6 billion |

| XRP Exchange Reserves (Oct 8) | 3.76 billion |

| Reserve Reduction Percentage | 57.4% |

| Current XRP Price | $1.88 |

| 24-Hour Price Change | +0.89% |

| Global Crypto Sentiment Score | 23/100 (Extreme Fear) |

| XRP Market Rank | #5 |

For institutional investors, this reserve depletion represents a fundamental shift in supply dynamics that could precede significant price appreciation. The Securities and Exchange Commission's evolving stance on digital assets, as documented on SEC.gov, creates regulatory clarity that may facilitate institutional participation. When exchange liquidity dries up while demand remains constant or increases, the resulting supply shock can create disproportionate price movements—a phenomenon observed during Bitcoin's 2020-2021 cycle when exchange reserves dropped 30% preceding a 300% price increase.

For retail traders, the extreme fear sentiment combined with supply withdrawal creates potential for a gamma squeeze scenario if options market positioning becomes unbalanced. The current market structure suggests that retail traders holding futures positions may face increased volatility as available supply diminishes, potentially triggering cascading liquidations in either direction depending on price momentum.

Market analysts on X/Twitter have noted the reserve depletion with cautious optimism. One quantitative analyst stated, "When exchange reserves drop this dramatically while price holds key support, you're looking at either massive accumulation or preparation for something significant in 2026." Another observer commented, "The extreme fear reading at 23/100 while XRP holds above $1.78 suggests maximum pain for shorts if accumulation thesis proves correct." Bulls point to potential ETF approval in 2026 as a catalyst that could amplify the supply shock effect, while bears highlight regulatory uncertainty and broader market conditions as limiting factors.

Bullish Case: If exchange reserves continue declining while ETF prospects improve, XRP could experience a supply shock similar to Bitcoin's 2020-2021 cycle. Technical analysis suggests initial targets at $2.40 (2024 high), with extended Fibonacci projections pointing toward $3.20 if the 2026 structural bull market materializes. Market structure indicates that sustained closes above $2.05 would confirm breakout momentum and target the $2.40 resistance zone.

Bearish Case: If regulatory developments turn negative or broader market conditions deteriorate, XRP could retest the $1.65 support level (200-day MA). A break below this level would open the door to $1.45 and potentially $1.25 (2025 low). The extreme fear sentiment could persist if macroeconomic conditions worsen, creating a liquidity grab scenario where weak hands are flushed out before any sustained recovery.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.