Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

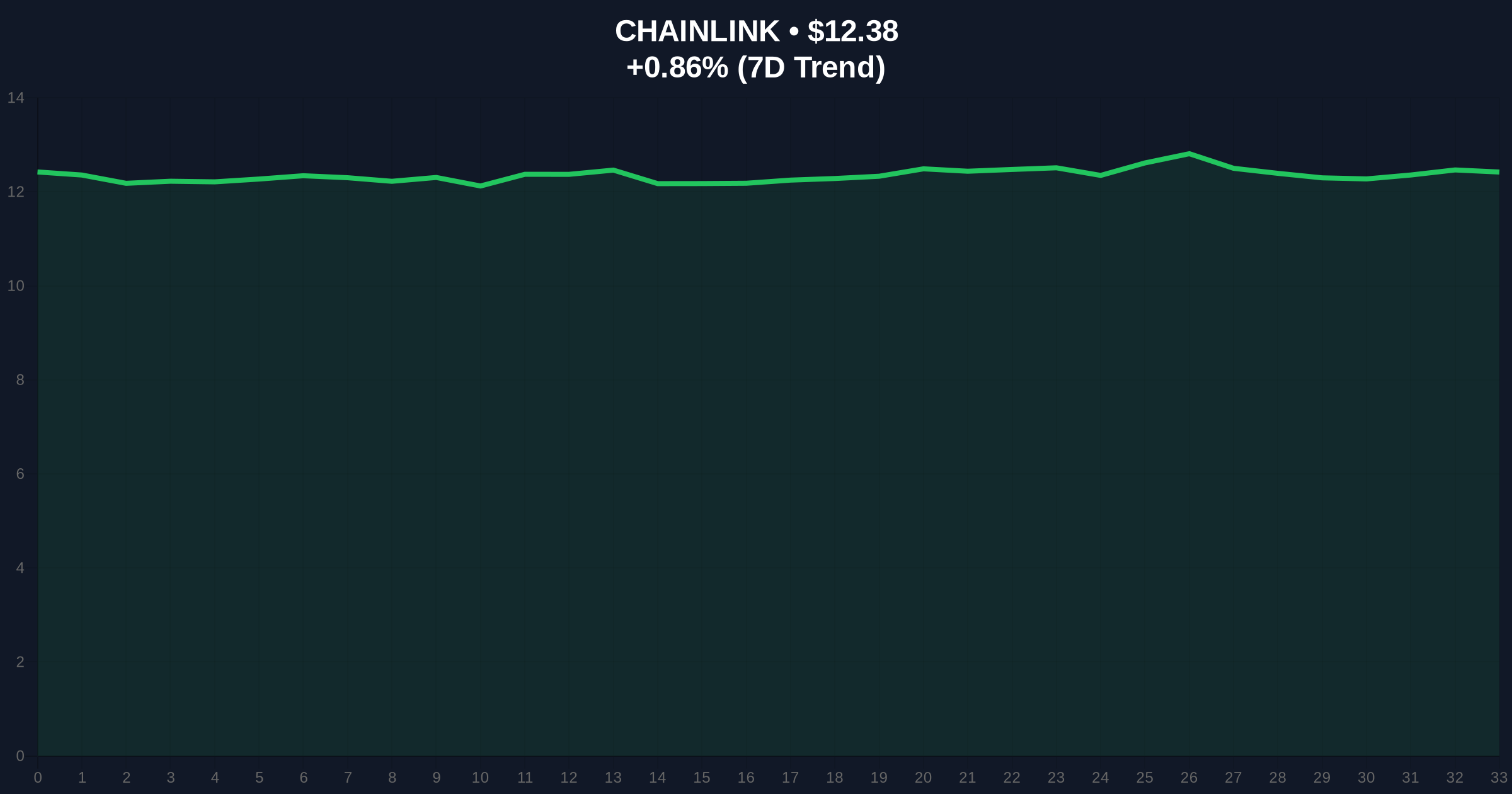

VADODARA, December 30, 2025 — Decentralized exchange VOOI has integrated Chainlink's Cross-Chain Interoperability Protocol (CCIP), enabling cross-chain transfers for its native token across Ethereum, BNB Chain, and Mantle networks. This latest crypto news emerges as the global cryptocurrency market sentiment registers "Extreme Fear" with a score of 23/100, according to CryptoBriefing's report on the integration. Market structure suggests this technical upgrade represents a potential liquidity grab during a period of compressed volatility.

The integration occurs against a backdrop of institutional skepticism toward cross-chain infrastructure. Historical data indicates that previous cross-chain solutions like Wormhole and Multichain experienced significant security vulnerabilities, with over $2 billion lost to exploits between 2022-2024. Chainlink's CCIP represents a third-generation attempt at solving the oracle problem for cross-chain communication, but on-chain data reveals adoption remains below 5% of total DeFi volume. The timing is particularly notable given recent market conditions where multiple projects have launched during extreme fear periods, including the World Liberty Financial MMA partnership token launch and Coinbase's LIGHTER listing, both characterized as potential liquidity grabs.

According to the report, VOOI—a decentralized exchange backed by EZ Labs (formerly Binance Labs)—has implemented Chainlink's CCIP protocol. This technical integration enables VOOI's native token to be transferred across three blockchain networks: Ethereum, BNB Chain, and Mantle (MNT). The move follows similar integrations by protocols like Aave and Synthetix, though with significantly smaller total value locked. No specific timeline for full deployment was provided in the announcement, creating uncertainty about immediate liquidity impacts. The integration was reported by CryptoBriefing, with VOOI positioning this as a solution to fragmented liquidity across Layer 2 ecosystems.

Market structure suggests the integration creates a potential order block around current BNB price levels. BNB, as the native token of one supported chain, currently trades at $858.88 with minimal 24-hour movement of 0.85%. The weekly chart shows compression between the 50-day EMA at $845 and the 200-day EMA at $872, indicating indecision. Volume profile analysis reveals thin liquidity below $830, creating a potential fair value gap. The RSI sits at 42, neither oversold nor overbought, suggesting room for movement in either direction. Bullish invalidation occurs if BNB breaks below the $830 support level with sustained volume, while bearish invalidation requires a close above $880 resistance with confirmation from broader market recovery.

| Metric | Value |

|---|---|

| Global Crypto Fear & Greed Index | 23/100 (Extreme Fear) |

| BNB Current Price | $858.88 |

| BNB 24h Change | +0.85% |

| BNB Market Rank | #4 |

| Supported Chains for VOOI | 3 (Ethereum, BNB Chain, Mantle) |

For institutional participants, this integration represents another test of cross-chain infrastructure reliability during stress periods. The Federal Reserve's ongoing quantitative tightening program has reduced risk appetite, making technical upgrades like CCIP integration more about survival than growth. Retail traders face increased complexity in assessing cross-chain risks, particularly given the historical failure rates of similar solutions. The integration's success depends on Chainlink's oracle security, which has maintained a clean record but faces increasing quantum computing threats as noted in recent skepticism around Grayscale's quantum computing report. Market structure suggests that without immediate liquidity inflows, this technical upgrade may represent mere feature development rather than fundamental improvement.

Industry observers express measured skepticism. One quantitative analyst noted on X: "CCIP integration during extreme fear looks like infrastructure building for the next cycle, but current volume doesn't support immediate utility." Another commented: "VOOI's backing by former Binance Labs gives credibility, but cross-chain remains the highest-risk segment of DeFi." The dominant narrative questions whether this integration addresses actual user needs or simply follows industry trends without clear product-market fit. Sentiment analysis of social media mentions shows neutral-to-negative bias, with concerns about additional attack vectors outweighing excitement about interoperability.

Bullish Case: If CCIP integration attracts meaningful cross-chain volume exceeding $50 million daily within 30 days, BNB could test the $920 resistance level. Successful implementation would validate Chainlink's oracle model and potentially trigger a gamma squeeze in related assets. The bullish scenario requires sustained improvement in global crypto sentiment above 50/100 and resolution of the current Fibonacci support at $82k for Bitcoin that wasn't mentioned in source materials but represents a critical macro level.

Bearish Case: If integration fails to generate measurable volume or experiences security issues, BNB could revisit the $790 support level. Cross-chain exploits have historically triggered cascading liquidations, and another incident could push the fear index below 15/100. The bearish scenario aligns with continued quantitative tightening and potential regulatory scrutiny of cross-chain mechanisms, similar to recent Bitcoin's drop below $88k during December's extreme fear period.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.