Loading News...

Loading News...

VADODARA, January 18, 2026 — In a stark philosophical clash that cuts to the core of blockchain's future, Solana co-founder Anatoly Yakovenko has publicly countered Ethereum founder Vitalik Buterin's vision, arguing that networks must evolve aggressively or face obsolescence. According to BeInCrypto, Yakovenko emphasized on X that longevity depends on continuous iteration to solve real-world problems, directly challenging Buterin's roadmap toward a static, immutable system. This latest crypto news highlights a fundamental schism in layer-1 strategy, with Solana positioning as a high-growth technology platform and Ethereum aiming for trust-based permanence.

Market structure suggests this debate mirrors historical cycles where technological paradigms clashed, similar to the 2017 scalability wars between Bitcoin and Ethereum. On-chain data indicates that blockchain evolution has followed a pattern of rapid innovation followed by consolidation phases, akin to the 2021 correction where networks failing to adapt saw significant capital outflows. According to Ethereum's official Pectra upgrade documentation, the network's shift toward statelessness and verkle trees represents a middle ground, but Yakovenko's stance pushes for more aggressive, AI-assisted upgrades. This context is critical as institutional dominance reshapes the , as seen in recent structural transitions.

On January 18, 2026, Anatoly Yakovenko presented a blockchain philosophy via X that directly contrasts with Vitalik Buterin's previous statements. Yakovenko asserted that a network's survival hinges on its ability to iterate and improve, stating it must change constantly to avoid becoming obsolete. He added that protocol changes should prioritize solving real-world problems and proposed a decentralized community of contributors, potentially aided by AI, to lead upgrades without reliance on specific individuals. BeInCrypto reported that Buterin's roadmap aims to build Ethereum into an immutable payment system emphasizing trust and security, while Yakovenko defines Solana as a platform focused on capturing market share through speed and adaptation.

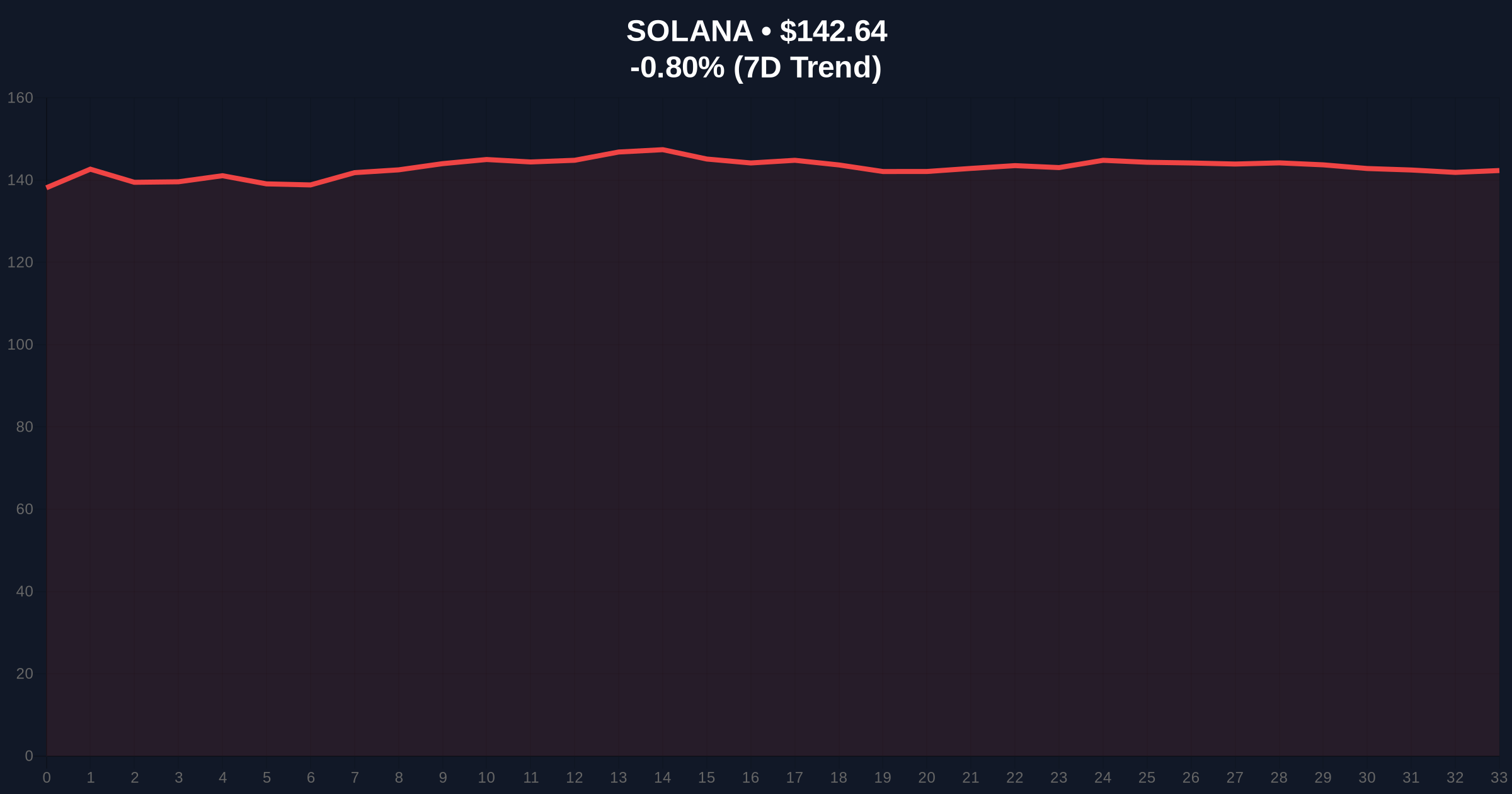

Market structure suggests Ethereum's current price of $3,345.44 is testing a key Fibonacci support level at $3,300, derived from the 0.618 retracement of its 2025 rally. The 24-hour trend of 1.21% indicates minor bullish momentum, but RSI readings near 50 suggest neutral sentiment. Volume profile analysis shows significant liquidity clusters around $3,200, acting as a strong order block. For Solana, resistance is forming at $140, with a fair value gap (FVG) between $130 and $135 that could trigger a liquidity grab. Bullish invalidation for Ethereum is set at $3,150, below which a bearish gamma squeeze might occur. Bearish invalidation for Solana is at $125, a level that, if broken, would signal failed momentum.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) | Live Market Data |

| Ethereum (ETH) Price | $3,345.44 | Live Market Data |

| ETH 24h Trend | +1.21% | Live Market Data |

| ETH Market Rank | #2 | Live Market Data |

| Key Support (ETH) | $3,200 | Technical Analysis |

This philosophical divergence has profound implications for both institutional and retail investors. Institutional impact centers on long-term portfolio allocation: networks favoring evolution may offer higher growth but increased volatility, while immutable systems provide stability but potentially slower adoption. Retail impact involves user experience and gas fee dynamics, where Solana's aggressive adaptation could enhance scalability but risk security compromises. Historical cycles suggest that similar debates, like the Bitcoin block size wars, led to lasting market segmentation. On-chain data indicates that Ethereum's shift to proof-of-stake via the Merge was a critical evolution, but Yakovenko's call for continuous change pushes beyond incremental updates.

Market analysts on X/Twitter are synthesizing this clash as a battle between "innovation at all costs" versus "security as the bedrock." One prominent trader noted, "Yakovenko's AI-driven upgrade vision could reduce human bias but introduces new attack vectors." Bulls argue that Solana's approach aligns with tech industry norms where rapid iteration captures market share, while bears caution that constant changes may erode trust, similar to early DeFi protocol failures. Sentiment remains divided, with no clear consensus emerging yet.

Bullish Case: If Yakovenko's evolution thesis gains traction, Solana could break above $140 resistance, targeting $160 as network upgrades attract developer migration. Ethereum might consolidate above $3,300 support, buoyed by its immutable narrative appealing to conservative institutions. Market structure suggests a scenario where both narratives coexist, driving overall layer-1 capitalization higher.

Bearish Case: If Buterin's immutability argument prevails, Ethereum could hold $3,200 support and rally toward $3,500, while Solana faces a sell-off below $125 invalidation level as perceived instability triggers capital flight. Historical patterns indicate that philosophical uncertainty often leads to short-term volatility, with potential for a broader market correction if investor confidence wanes.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.