Loading News...

Loading News...

VADODARA, January 22, 2026 — Solana co-founder Anatoly Yakovenko has outlined three principles for early-stage crypto projects to attract capital, but market structure suggests these guidelines face significant headwinds in the current Extreme Fear environment. This daily crypto analysis examines whether Yakovenko's framework aligns with on-chain liquidity realities or represents theoretical optimism disconnected from quantitative metrics.

According to the Crypto Fear & Greed Index, global crypto sentiment sits at 20/100, indicating Extreme Fear. This psychological backdrop creates a challenging environment for capital formation, where retail participation diminishes and institutional flows become more selective. Historical cycles suggest that during such periods, projects with aggressive token unlock schedules often face selling pressure as early investors seek liquidity exits. The current market structure mirrors aspects of the 2021-2022 correction, where high initial circulating supply correlated with prolonged drawdowns for many altcoins. Related developments in this environment include Sui's internship program launch and Hashed's KRW stablecoin blockchain initiative, both attempting to build during market stress.

In a post on X, Solana co-founder Anatoly Yakovenko outlined three specific principles for early-stage crypto projects seeking capital. According to the statement, projects should: 1) ensure staking is available for long-term holders, 2) unlock more than 20% of the token supply on launch day, and 3) fully vest investor allocations after one year. Yakovenko added that beyond these points, success depends on achieving product-market fit. The principles were presented without accompanying on-chain data validation from sources like Etherscan or Glassnode, raising questions about their empirical foundation.

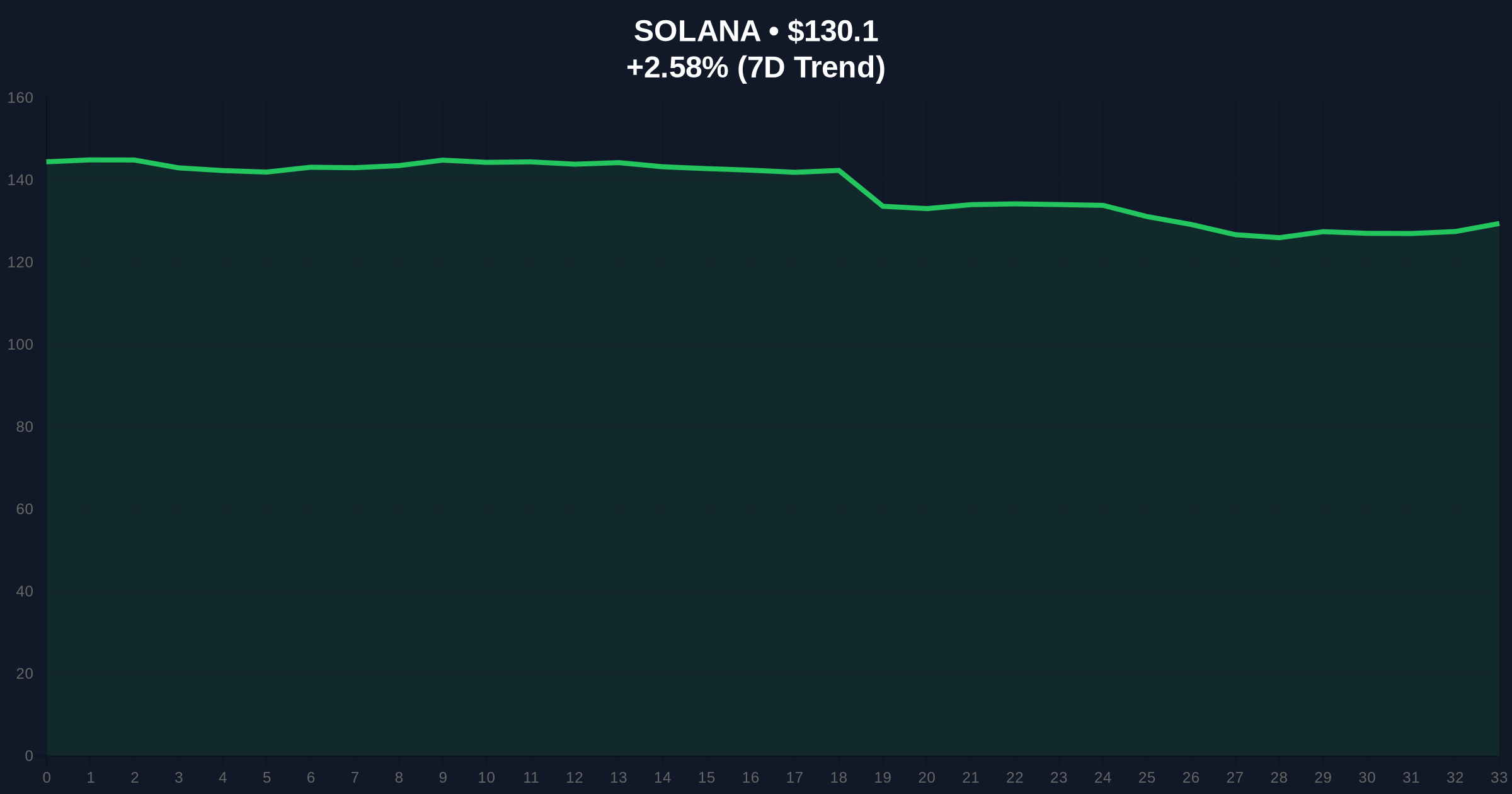

Solana (SOL) currently trades at $130.1, showing a 2.59% 24-hour gain against a broader Extreme Fear backdrop. Volume profile analysis indicates weak accumulation at current levels, with significant liquidity resting below the $125 support zone. The Relative Strength Index (RSI) sits at 48, suggesting neutral momentum with bearish divergence on higher timeframes. A critical Fibonacci retracement level at $115 (61.8% from recent swing high) represents a potential liquidity grab zone if current support fails. Market structure suggests the $125 level serves as Bearish Invalidation—a break below would invalidate the current consolidation pattern and target the $115 Fibonacci support. Bullish Invalidation rests at $142, where previous order block resistance has formed.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Alternative.me |

| Solana (SOL) Current Price | $130.1 | CoinMarketCap |

| SOL 24h Change | 2.59% | CoinMarketCap |

| SOL Market Rank | #7 | CoinMarketCap |

| Key Support Level | $125 (Bearish Invalidation) | Technical Analysis |

For institutional investors, Yakovenko's principles represent a framework for evaluating tokenomics, but the lack of historical backtesting raises concerns. The recommendation to unlock >20% of supply on day one could create immediate sell pressure if not paired with adequate demand-side mechanisms. For retail participants, these guidelines offer little protection against potential liquidity grabs by early investors during the one-year vesting period. The broader implication involves whether these principles align with regulatory expectations outlined in documents like the SEC's framework for digital assets, particularly regarding disclosure of unlock schedules and investor protections.

Market analysts on X have expressed mixed reactions to Yakovenko's principles. Some bulls argue that transparent unlock schedules reduce information asymmetry, while skeptics question whether day-one unlocks above 20% create inherent selling pressure that disadvantages later entrants. One quantitative analyst noted, "Without staking yields exceeding inflation rates, long-term holder incentives remain weak despite availability." This sentiment reflects broader concerns about tokenomics sustainability during bear market phases.

Bullish Case: If SOL holds the $125 support and breaks above the $142 order block resistance, a move toward $160 becomes probable. This scenario requires improved on-chain metrics, including increased active addresses and reduced exchange inflows according to Glassnode data.

Bearish Case: A break below $125 invalidates the current structure and targets the $115 Fibonacci support. Continued Extreme Fear sentiment could trigger a gamma squeeze downward as options markets reprice volatility expectations. This path would challenge Yakovenko's capital attraction principles by demonstrating how macro conditions override project-specific tokenomics.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.